Many of you know that if you’re late on your credit card bill payments they can raise your rates as high as 29.99%, but that’s just for scalawags, right? Nope. JLP at All Financial Matter’s brother was late twice on his Bank of America bill, once by three days, and once by one day. That was enough to make Bank of America say, OMG, this guy is way too risky and we need to penalize him and send his rates as high as they can legally go!

interest rates

Meet Leverage Connections, King Of The Robocallers

Last week we reported that some types of unwanted robocall telemarketing will soon be banned. If you’re on the receiving end of Leverage Connections’ prerecorded harassment—they frequently operate under the generic names “Consumer Services” or “Credit Card Services”—you’ll finally have a way to formally complain to the FTC about them. Why would you want to complain? Because they’re the scammiest, most obnoxious robocall telemarketing company we’ve seen so far—even though what they do is apparently legal.

Don't Let Your Credit Card Rate Get Spiked

Credit card companies are raising interest rates and canceling cards left and right. Bankrate has seven ways to avoid getting caught up in the “risk repricing” spree. It all comes down to keeping everything looking normal.

HSBC Extends 3.5% APY Online Savings To Sept 15

HSBC sent around a big cheery email to let everyone know that they’ve extended the promotional 3.5% rate on their online savings account until September 15th.

How To Report Do Not Call List Scofflaws To The Proper Authorities

Reader Brian says that he’s getting weird scammy calls about “lowering his interest rates” and would like to know what he should do about it.

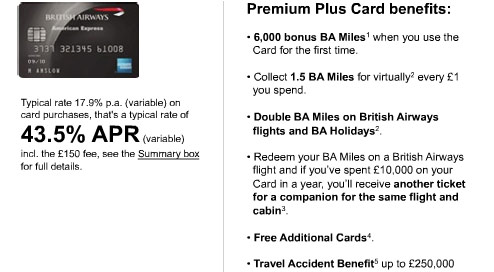

The 43.5% APR Credit Card

Perhaps this British Airways American Express Premium Plus Card’s interest rate is in “metric” APR, but if not, no matter what side of the pond you’re on on, or road you drive on, you must agree that a 43.5% variable interest rate is bollocks. Who cares how many bonus miles you get, they’re just going to get devalued anyway.

Citigroup May Reinstate Universal Default

Last year Citigroup pledged to abandon the customer-screwing policy of universal default, where an unrelated late payment or credit score change can trigger an interest rate increase on your Citibank card. They even used a marketing phrase to promote their promise: “a deal is a deal.” According to the New York Times, Citigroup is “quietly reconsidering its pledge” and may decide to reinstate universal default as early as this week.

We're Not Kidding, BoA Really Closes Your Account Just For Asking About Your Interest Rate

Reader Todd decided to call Bank of America up to test whether our story “BoA Closes Your Credit Cards If You Ask Why They Increased Your APR” was really true or not. Turns out, it is.

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.

../../../..//2008/05/14/inflation-rose-far-less-than/

Inflation rose far less than expected in April, mitigating fears that the Feds would have to grapple with both trying to loosen credit and fight off rising prices. [AP]

../../../..//2008/04/30/as-predicted-the-feds-cut/

As predicted, the Feds cut interest rates a quarter of a point to 2%. [NYT]

../../../..//2008/04/28/the-fed-is-widely-expected/

The Fed is widely expected to cut interest rates for the 7th time this Wednesday, from 2.25% to 2%. Slightly cheaper loans for everyone! [

Watch Out For High Interest Rates On Store Credit Cards

Seems whenever you check out at a store these days the clerk is always asking if you want to sign up for the store credit card. They’ll tell you that you can save 15% today, but what they’re not telling you is how high the interest rate is: an average of 21.96% and in some cases, as high as 23.99%, says a survey by Congressman Anthony Weiner. That’s almost as high as the default rate you would pay on a normal credit card. Before biting, make sure you read the disclosure agreement in full to find out the APR. If you end up not paying off that balance in full, that one day of savings could eventually be erased by compounding interest. Inside, the interest rates and grace periods for the in-store credit cards of 35 top retailers…

../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]

Bank of America Angers More Customers With Unjustified Rate Hikes

More about Bank of America’s inexplicable rate hikes against good customers who never pay late: the Charlotte Observer talks to some recent recipients of BoA’s infamous rate-increase letters from the past few weeks. The first person they talk to is a 60-year-old woman who “had never been late on a credit card payment, just refinanced her home at a lower interest rate, and just been rewarded by her credit union with a lower rate on her credit card there.” Bank of America just raised her card from 13% to 24.99%.