The wife of a Vietnam War vet with multiple myeloma accidentally typed a “7” instead a “9” when she made a payment to Ceridian, the company that administers his COBRA benefits, meaning the $328.69 payment was short by two cents. And as the couple learned, being .006% in arrears is enough to have one’s health coverage canceled. [More]

insurance

Only 56% Of Dialysis Technicians Pass New Skills Test

Almost half of the dialysis technicians in California are failing a new Federally-mandated skills test, throwing the industry’s tarnished reputation under the magnifying glass once again. [More]

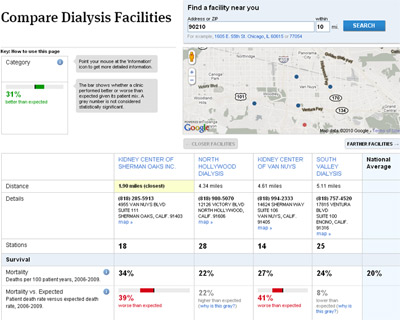

Database Shows How Likely It Is You Will Die At A Dialysis Clinic

For the first time ever, patients can have access to previously secret government information about survival rates at specific dialysis clinics. ProPublica got the info through a Freedom of Information Act request and has put it together in an easily searchable database. This is important because some of these places, especially if they’re for-profit, have pretty bad track records at keeping their patients alive. [More]

FDNY To Begin Charging Motorists In Car Crashes

The Fire Department in New York City thinks the taxpayers should no longer be the only ones paying when firefighters are called to the scene of a car crash. Starting next summer, the FDNY will begin billing their time to the motorists involved in the incidents. [More]

State Farm Uses Mutilated Monkeys To Sell Insurance To College Kids

State Farm didn’t win too many people over with its Worst Ad In America-nominated spokesman, so now the company is trying a very different approach by courting college students with mutilated monkey keychains. [More]

For-Profit Dialysis Centers Have Higher Mortality Rates, Up To 24%

If you’re a patient at the largest for-profit dialysis chain in America, you’re 19% more likely to end up dying than if you went to a non-profit chain. If you’re at the second-largest for-profit chain, you’re 24% more likely to die. These disturbing results were released in a new study in the Health Services Research journal. Guess if you’re going in for dialsysis, you’ll want to think carefully about your choice of treatment options and don’t forget to include a non-profit center in your selection process. [More]

Insurance Companies Data Mine Your Death

Everything from what magazines you buy to how much television you watch could be used by insurance companies to determine whether you’re a risky client or not, and when you might die. [More]

Beware Of "Windshield Bullies"

Police are issuing renewed warnings about “windshield bullies.” In some of the worst cases, they’ll damage your windshield and then ring your doorbell offering their windshield replacement services. [More]

An Executive Email Carpet Bomb Saved Me From Insurance Hell

Daryl’s insurance company charged a closed checking account for a premium on a policy he’d already canceled, then tried to stick him with the bounced check fee. [More]

Why Does US Have Worst Fatality Rate From Kidney Dialysis?

Just about anyone diagnosed with kidney failure can get their kidney dialysis fully covered under Medicare. So why are taxpayers paying $20 billion a year for a program that lets 25% of the patients die within a year, the worst fatality rate of the first world? Why do only two chains run 2/3 of all clinics? And why won’t the government release important data that could improve the quality of care? An investigation in The Atlantic probes this issue in depth. [More]

Insurance Agency Stops Me From Saving Money On My Windshield Deductible

Guy’s windshield lost a battle with a flying rock, and his insurance company gave him a similar cold-cocking when he tried to find a way to save some money on his deductible. His Sate Farm insurance agent said he wasn’t allowed to repair the windshield through a company that promised him $50 off his upfront costs. [More]

Don't Shop At Target When It's Raining If You Don't Want Your Car To Get Crushed

A few weeks ago, as Tropical Storm Hermine breezed through Texas, a pregnant mother of two exited a San Antonio Target store to find her car crushed beneath a fallen parking lot light pole. And now, she says, the retail chain has left her to foot the $10,000 repair bill herself. [More]

Health Insurance Companies Really Hate Your Sick Children

The health insurance industry is generally known for its efficiency, generosity and — of course — for its customer-first attitude. That’s why it comes as such a shock that several of the more beloved insurance institutions like Wellpoint, Aetna, Cigna and United Healthcare have decided to stop selling you insurance policies for your sick children. [More]

How Is A Dump Truck Crashing Into My Parked Car My Fault?

Somewhere in upstate New York, a mysterious dump truck rolled down a hill, hitting Jennifer’s partner’s vehicle and one other car. While it’s wonderful that no one was hurt, now the incident has turned into a consumer issue. The truck owner’s insurance company doesn’t want to accept fault for the incident, leaving Jennifer’s partner to file a claim against his own meager insurance. How, she wonders, can they fight back? [More]

USAA And Mastercard Turn Celebrity Librarian Into Unwitting Consumer Scofflaw

K.G. writes that she used her Mastercard to pay for a car rental from Avis. The card issuer, Consumerist darling USAA, assured her that the card provided insurance coverage for rental cars. Good to know! Except for how the insurance claim was denied, possibly because she used a coupon for the car rental. No one is entirely sure. The bill went straight to a collection agency without ever giving K.G. an opportunity to, um, actually pay it. Now she’s being penalized for ducking a bill she was never sent, and still can’t get a straight answer out of any of the companies involved. [More]

Lloyd's Of London Hopes Troy Polamalu Doesn't Get Male Pattern Baldness

Head and Shoulders pitchman/Pittsburgh Steelers linebacker/ thief of Arizona Cardinals’ fans dreams Troy Polamalu is known for his flowing black locks that cover the last name on his jersey. The shampoo ad guys want to make sure things stay that way and thus have taken out a $1 million insurance policy through wacky British insurers Lloyd’s of London, the AP reports. [More]

Do I Really Need A Deep Teeth Cleaning?

One of our readers just tried to take advantage of a $50 teeth cleaning offer from a local dentist, but once he got there he was quoted a new price of $1,136 for what they described as a “deep cleaning.” Was their revised offer legit? [More]