Minnesota retailers will soon be required by law to purge PIN numbers and credit card information after 48 hours. The new law, the the Plastic Card Safety Act, takes effect on Wednesday; beginning next year, the act will empower banks to sue retailers whose data-retention practices lead to a security breach. From the Star-Tribune:

identity theft

../../../..//2007/07/27/identity-thieves-chameleon-ftc-irs/

identity thieves chameleon FTC, IRS, and Justice Department in recent phishing attempts. [Seattle P-I]

ExxonMobil Mails Customer 2,000 Credit Cards

ExxonMobil sent a box containing 1,000 credit cards to Frank Van Buren, who had requested two (2) new cards to replace one that was about to expire. The cards contained Frank’s name and account number, and would have worked right out of the box since ExxonMobil saw activation stickers as an unnecessary extravagance. Frank saved the two cards he had requested, and spent three hours shredding the remaining 1,000.

He thought that was that. Until another box arrived this week.

Restaurants May Use Portable Credit Card Readers To Prevent Identity Theft

Portable credit card readers have the potential to make your dining experience safer and faster. The portable readers make it unnecessary for customers to hand over their credit cards, preventing waiters from stealing personal information with skimming devices. Up to 70% of skimming scams take place in restaurants.

Pay-at-the-table systems are popular in Europe and other parts of the world, but they haven’t yet caught on in the U.S., largely because equipment makers have been unable to point to a reason restaurateurs should invest in the gear.

../../../..//2007/07/12/hot-on-the-heels-of/

Hot on the heels of Texas Attorney General Greg Abbott’s announcement that consumers are now much safer from identity thieves because they’re making stores shred instead of merely toss customer records out the back door, id theft watchdog Steven Peisner showed how easy it was to steal Abott’s identity through the incredibly insecure Secretary of State Online Access database. [Freakonomics]

../../../..//2007/07/08/the-investigative-arm-of-congress/

The investigative arm of Congress believes that few cases of identity theft can be tied to security breaches. “The Government Accountability Office said it is not because it doesn’t happen, but rather that the links are so hard to find.” Good work, GAO.

How Frank Abagnale Protects Himself From Identity Theft

How does Frank Abagnale, an infamous check forger in the 60’s, protect himself from modern day identity thieves?

../../../..//2007/07/01/a-report-from-anti-virus-company/

A report from anti-virus company McAfee warns that criminals are joining MySpace and Facebook to steal your identity.

Laptop Containing Personal Data Of All 64,000 Ohio State Employees Stolen

A laptop containing the personal information of all 64,000 Ohio state employees and their dependents has been stolen from an employee’s car. Ironically, the laptop was taken home by the employee “as part of a security procedure.” Governor Ted Strickland is not taking the matter lightly. He has already issued Executive Order 013S, giving Ohio’s Chief Privacy Officer 75 days to develop an impressive-sounding “privacy impact assessment protocol.”

“As we are continuing an ongoing review of the data contained in the stolen device, we have determined that information pertaining to participants in the state’s pharmacy benefits management program, including information such as names, social security numbers, addresses and phone numbers of the employees and the names and social security numbers of their dependents, may be contained in the device,” Strickland said.

Strickland’s office has set up a site for Ohioans concerned about their data. The state will provide affected employees free credit monitoring for one year. — CAREY GREENBERG-BERGER

Success Story: Woman Captures Her Own Identity Thief

Readers alerted us to a great story in today’s San Francisco Chronicle. A woman who lost $30,000 in business and six months of her life to a local identity thief captured her tormentor… on foot.

Yes Virginia, Scammers DO Use Stolen Credit Cards To Buy Airline Tickets

After reading some of the incredulous comments on, “Easy For Fraudsters To Fool E-Ticket Kiosks,” we asked a former identity thief whether fraudsters ever actually used stolen credit cards for airline tickets. He said:

Yes, people card them and yes its very risky, however people have made a killing doing it.

— BEN POPKEN

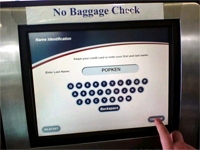

Easy For Fraudsters To Fool E-Ticket Kiosks

It would be really easy for someone to steal your credit card and buy and use an airplane ticket.

Identity Theft: You Can't Really Do Much About It (But Here's What You Can Do)

You can’t really stop identity theft from happening. So many entities have your credit card numbers, social security numbers, date of birth, and address, that it is more or less inevitable that we will all have our identities stolen at some point. If you are lucky, you will just get a credit card cloned. If you aren’t so lucky–like many people I see in my line of work–someone will start opening accounts, buying houses, or doing other nasty things in your name.

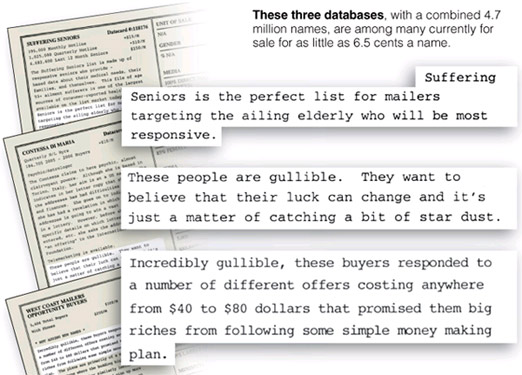

infoUSA Calls "Unfair" NYT Article About How It Marketed Lists Of "Gullible" Seniors To Known Scammers,

Instead of atoning for their sins and begging for forgiveness, infoUSA, the firm that knowingly marketed lists of “gullible” seniors to known scammers, opted for a path of childish and defensive rebuttals:

infoUSA Marketed Lists Of "Gullible" Seniors To Known Scammers, Wachvoia Processed The Unsigned Checks

Global rings of crooks are stealing the bank accounts of thousands of the elderly, using lists of names and phone numbers sold to them by corporate America, NYT reports.

Oh, Your Mom Might Know Your PIN? Then You're Not Getting Your $300 Back

Samantha, pictured holding a log more customer friendly than Capital One, had $300 stolen from her Capital One account, even though her debit card was still in her pocket. When she filed a claim with CapOne, not only did it take numerous contradictory phone calls with employees not knowing their ass from their elbow, her claim was denied. Why? Because she said on her claim form that her mother might know her PIN. Oops.

Beware Address Fraud

Identity thieves can take over your accounts, just by swapping their address for yours with your financial institutions. Banknet360 elucidates how this works: