Based just on a name, and an address, crooks can purchase parts of a deceased person’s information from other crooks. This bits can be used to open up new bank accounts, credit cards, get a Social Security card, or used as a mask to conduct further crime.

identity theft

Checks Stolen? Maybe Leave The Account Open, Otherwise The Bank Won't Help You With The Hot Checks

Boom: they get angry and they sent many letters…

BoA Incompetence Helps Identity Thief Make Rachel Poor Broke

The Red Tape Chronicles has a story about an identity theft victim who allowed herself to be victimized over and over again. Rachel Poor (pictured) noticed some unauthorized spending on her account, reported it, but then continued to use the account and make deposits. Every time she put money end, the crook would overspend it. On top of that, she also got hit with 20 overdraft fees, and so forth. It got so bad that she had to beg her boss for a loan. The article’s author asks, “why a criminal was able to steal money from Poor’s account more than two weeks after she reported it as suspicious.”

Retailers Get Sued For Printing Too Many Credit Card Digits On Receipts

As of Dec 4th, 2006, it’s illegal for a retailer to print more than five digits of your credit card on your receipt. Retailers who persisted are getting hit in a recent whirlwind of class-action lawsuits.

Bank Of America Gets Verfication Data Wrong, Locks Customer's Account, Hangs Up On Him, Several Times

According to this reader complaint, to amass the personal information Bank of America uses to “verify your identity,” they employ a company that that trolls public records for your data. They look for things like employer, student loans held, what hotel you stayed in last year, etc.

Bank Midwest Let Someone Pilfer Our Safe Deposit Box For $92,000

Ken and Nina say that that $92,000 was stolen from their safe deposit box after Bank Midwest allowed someone else to access it.

Chase Puts Your Sensitive Documents On The Sidewalk

However, we never get an establishing shot of the trashcan, so it’s not totally clear whether they are actually discovering these bags on the sidewalk. After all, they are janitors and thus have access to the trash cans inside the bank, and being a union, they probably have an axe to grind (like applying pressure on Chase for higher wages and benefits for custodial staff).

Credit Cards To Feature Mutating Passcodes

A major bank will offer Credit cards with built-in, constantly shifting passwords starting in May.

Bankers Join The Class Action Fun Against TJX

TJX, the parent company of TJ Maxx and Marshall’s, is facing a class action lawsuit from the 45 million customers whose credit card data they lost; now, bankers associations representing 300 banks in Maine, Connecticut and Massachusetts have decided to file a class action suit of their own. From InfoWorld:

Banks — especially in states like Massachusetts — were also hard hit. Why? Because under current federal law, its banks, not merchants, who have to pay to make customers whole again: forgiving fraudulent purchases on credit and debit cards and, of course, cancelling compromised cards and bank accounts, then issuing new ones to their customers. Needless to say, that’s an expensive process, especially when you’ve got to repeat it 45 million times, as banks across the country will have to do in the wake of TJX. Not surprise, then, that banks aren’t taking this sitting down.

Banks are in the process of notifying consumers, some who did not think they were affected, that they will soon receive new debit and credit cards in the mail. — CAREY GREENBERG-BERGER

Bank Of America Let Conwoman Steal My Dead Aunt's Identity And Rob Her Safe Deposit Box

Ariel’s wealthy aunt died. When his mom went to open her safe deposit box, which was supposed to hold $300k in bonds and jewels, it was empty. The bank clerk said that it had been emptied that morning, by the aunt…

Sovereign Bank Branch Exposes You To Identity Theft As A Matter Of "Policy"

Concerned about identity theft, Seth had a fun time recently when he tried to get Sovereign bank to tell him why they need to record his driver’s license number when he withdrew $2.75. The teller kept saying, “It’s our policy,” but even when they finally showed the policy in writing, it only said “must record form of ID” and nothing about writing down license numbers.

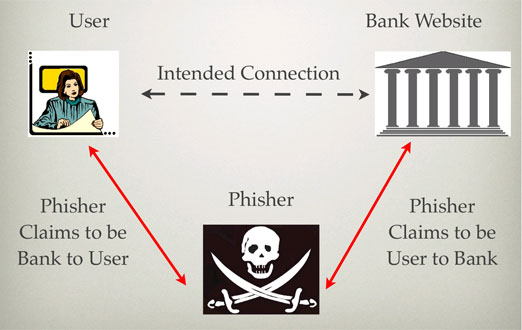

Bank of America's "Perfect" Security System Actually Vulnerable To Phishing

Bank of America has an online security measure called SiteKey and says, “[W]hen you see your SiteKey, you can be certain you’re at the valid Online Banking website at Bank of America, and not a fraudulent look-alike site.”

How Waiters Steal Your Credit Card

Unfortunately, there’s not much you can do except watch your credit card statement and report any suspicious transactions as soon as possible. — BEN POPKEN

Credit Report Nightmare: Damned By Apostrophe, Saved By The Letter M

This is the story of a girl named Corey O’Malley, and a boy named Corey O’Malley, who had their credit reports accidentally merged.