We understand why someone might opt for getting a payday loan online instead of doing it in person. It’s easier, faster, doesn’t require going to a shady-looking storefront operation where some trained fast-talking huckster might try to upsell you unnecessary add-ons or tack on illegal insurance policies. But the truth is that people who get their payday loans online often end up in a worse situation than they would have if they’d applied in person. [More]

ftc

Online Payday Loans Cost More, Result In More Complaints Than Loans From Sketchy Storefronts

Feds Warn Advertisers Against Trying To Hide The Truth

Most of us accept the fact that advertisers have to massage the truth to put their products in the best possible light. You’re likely to sell more widgets saying “The fastest widget on the market!” and doing your best to hide the disclosure that you really mean it’s the fastest widget you can buy at one particular market in rural Alberta. But some advertisers have apparently been getting too fine with their fine print and have been put on notice by federal regulators to just stop it already. [More]

Court Shuts Down Bitcoin Mining Business For Failing To Deliver Paid-For Computers

A federal court has temporarily shut down a Missouri-based business that sold computers specifically designed for aiding users in the generation, or “mining,” of the virtual currency Bitcoin, saying the company took — and spent — customers’ money but waited more than a year to make good on orders for one device and has failed to deliver on another. [More]

Court Shuts Down $11 Million High School Diploma Mill

Not everyone graduates from high school, but for nearly a decade, a company in Florida has been offering what it claims are “official” diplomas from “accredited” schools to consumers who took an online test (and paid betweeen $200 to $300). Except federal authorities say these diplomas are as bogus as they sound, and this company has allegedly scammed consumers for at least $11.1 million. [More]

Court Shuts Down Payday Lenders Who Made Millions Off “Loans” Borrowers Didn’t Ask For

Whether you think that payday loans are a necessary financial offering for people with bad credit to get low-value, short-term loans or a predatory product that only results in more debt for the nation’s poorest consumers, you’d agree that no loans should be doled out without the borrower’s approval. But one network is accused of putting unauthorized payday loans in consumers’ bank accounts so it can eventually siphon off even more money. [More]

Maker Of “Miracle” Green Coffee Weight-Loss Product To Pay $3.5M For Using Bogus Science To Sell Product

Months after going after online sellers for creating fake news sites, complete with a fake reporter, to push green coffee extract as a miracle weight loss drug, the Federal Trade Commission has settled its case against one Texas company that supplied the product while unsubstantiated scientific claims about the efficacy of the supplement. [More]

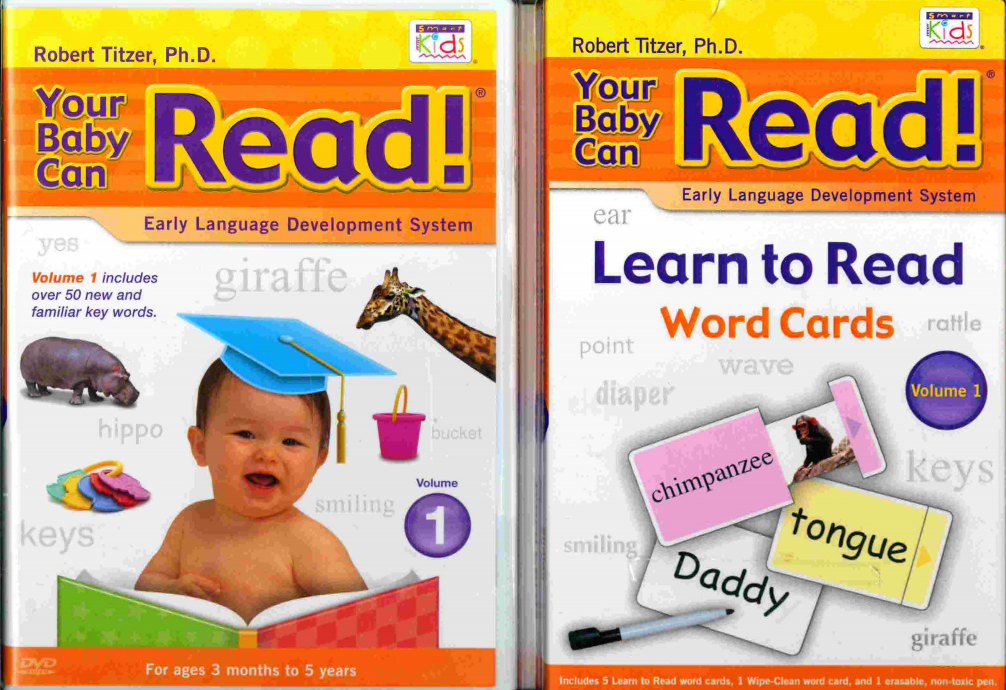

Creator Of “Your Baby Can Read” Program Settles False Advertising Charges

Almost exactly two years after the Federal Trade Commission accused the people behind the popular “Your Baby Can Read” training program of making deceptive advertising claims, the product’s creator has finally reached a deal to settle charges that he and his company made baseless pronouncements about the effectiveness of the program and that they misrepresented scientific studies to prove these bogus statements. [More]

You Can’t Sell “Made In The USA” Seals Without Checking That Products Live Up To That Label

As we’ve talked about in previous stories, while there are federal guidelines about what constitutes a “Made In America” product, manufacturers are operating on an honor system because it would be too onerous a task for the government to actually investigate every product claiming to be American-made. But if a company charges thousands of dollars for seals that indicate that a product’s Made In USA bona fides have been verified, it should actually be doing something to check those claims. [More]

$9.3M In Refunds Going Out To People Who Bought Ab Circle Pro

We’ve covered so many sketchy fitness devices over the years that when we recently mocked the Ab Circle Pro for its obvious before/after Photoshop hackery, we’d forgotten that the marketers of this device were hit with a massive settlement in 2012 for falsely claiming that it could give you rock-hard abs if you used it for only three minutes a day. Well, we’re remembering now, because the Federal Trade Commission is currently sending out $9.3 million in refunds to Ab Circle Pro owners. [More]

Even Scofflaws With $270K In Debt Have The Right To Not Be Cyberstalked By Collectors

We recently told you about the woman who admitted she indeed owed Kohl’s $20, but sued the retailer for being over-eager about collecting on the debt. But does a debt collector have more leeway to be a pest when the debt is 13,500 times that amount? [More]

3 Scams Targeted At Hotel Guests

Between all the fees and add-on charges that can come with a hotel reservation, just booking a room for the night can make you feel like you’ve been taken for a ride. But even when the hotel isn’t trying to nickel-and-dime you, there are scammers out there ready to steal your money by preying on common assumptions made by hotel guests. [More]

Phony Payday Loan Brokers Must Turn Over Rolls Royce, Maserati, Ferrari To Feds

When someone goes hunting for a payday loan — just looking to get their hands on a small amount of cash to tide them over until the next paycheck — it’s bad enough that they can end up trapped in a hellish debt cycle that sees them taking out loan after loan. But the FTC says a Tampa-based operation preyed upon these already-desperate victims by tricking them into applying for payday loans, only to steal their info and what little money they had. [More]

Amazon Sued By Feds Over In-App Purchases

Last week, Amazon made it clear to the Federal Trade Commission that it wasn’t going to fork over a ton of cash to close an investigation into the e-tailer’s in-app purchase policy. And today the FTC made it clear that it intends to pursue its complaint against Amazon, suing the company in federal court. [More]

Amazon Willing To Pick Fight With Feds On In-App Purchases

Earlier this year, Apple agreed to refund $32.5 million to customers of its App Store in order to settle charges from the Federal Trade Commission that the computer company did little to protect users from inadvertent in-app purchases. The FTC is looking to reach a similar deal with Amazon over its app store, but the online giant has said the government will probably have to make its case in court. [More]

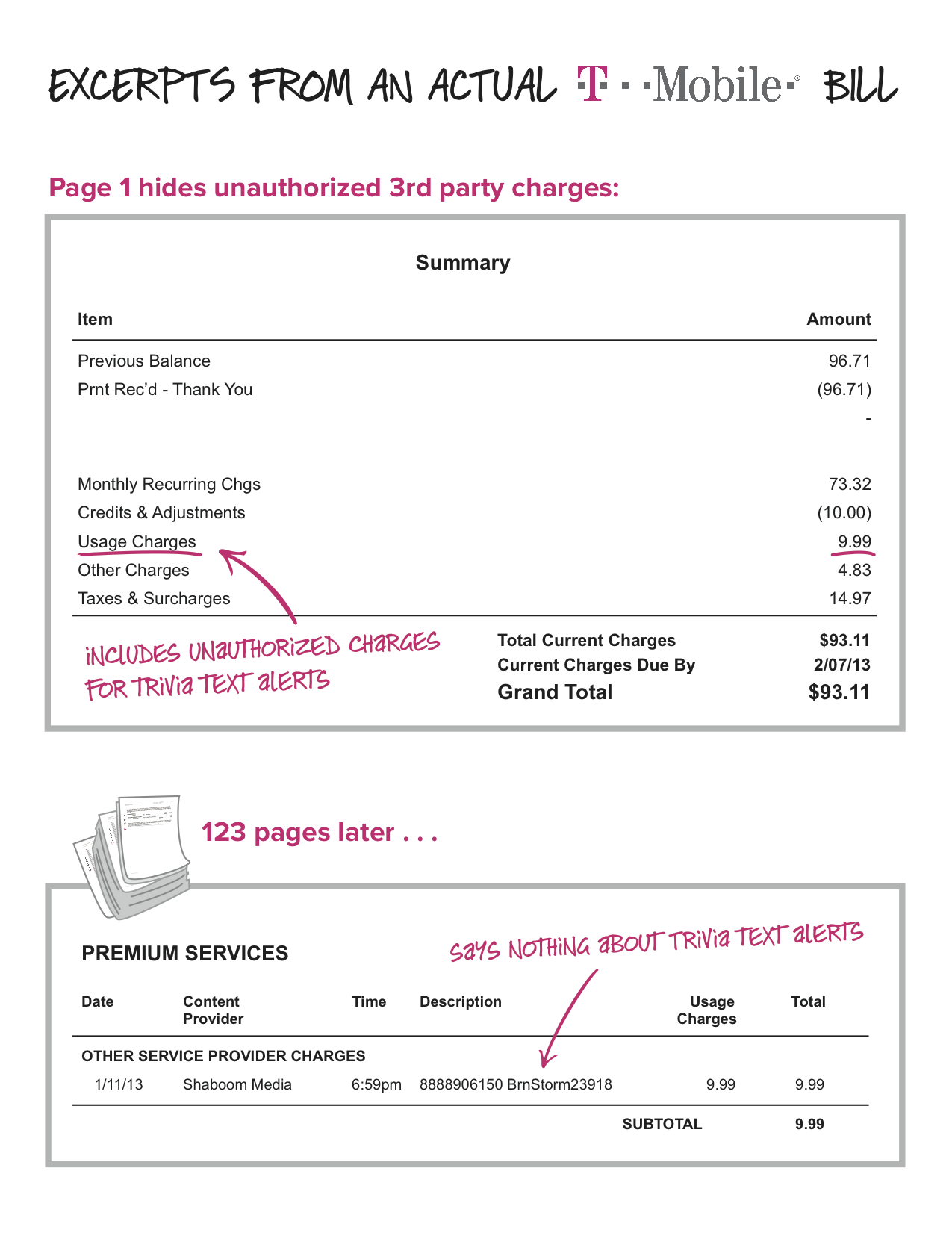

T-Mobile: We Shouldn’t Be Sued Over Bill-Cramming Because We’re Not Doing It Anymore & We’re Super-Sorry

Earlier this afternoon, the Federal Trade Commission filed a complaint against T-Mobile, alleging the wireless carrier made hundreds of millions of dollars off of bogus premium text-messaging charges “crammed” onto customers’ bills. The response from T-Mobile CEO John Legere isn’t exactly what you would describe as contrite. [More]

T-Mobile Accused Of Making A Ton Of Cash From Bogus Charges On Phone Bills

T-Mobile, a company that has tried to position itself as being consumer-friendly, has been accused by federal regulators of being anything but friendly. The self-described “Un-carrier” has been accused in federal court of making hundreds of millions of dollars off of so-called “premium” text-messaging subscriptions that were often never requested by subscribers. [More]

Feds Warn Consumers Against Taking Pension Advances

Unfortunately, not everyone currently in retirement has enough cash on hand to stay afloat, even those fortunate enough to receive a pension from their former employer. That’s why it might be tempting to solve a short-term money problem by taking out a pension advance, which pays you a lump sum now for signing over your pension payments to the lender for anywhere from a few years to a decade. Today, the Federal Trade Commission warned consumers to think twice before agreeing to one of these loans. [More]

Debt Collection Scammers Calling Victims’ Family & Co-Workers To Squeeze Money From People

A debt collection scam operates on two principles: That lots of us have debt, and that the con artist is good enough at his art to trick some of us into believing we have to pay immediately. But some scammers are bringing outside parties into their grift, contacting victims’ families and co-workers in the hopes that this will result in pressure to pay up on the bogus debt. [More]