While it seems like the major players in the travel industry are constantly coming up with new ways to charge customers more money, travelers flying on United Airlines can say good-bye to at least one fee: the carrier announced it’ll no longer charge a hardship refund fee of $50. [More]

fees

Verizon Adds Yet Another Activation Fee For New Wireless Customers Because They Can

You know what the best thing is about mobile phones? Countless fees! Wait, no, that’s the worst thing, sorry. My mistake. But Verizon seems to have the same confusion, because the nation’s largest-by-far wireless provider is now adding even more fees onto their customers’ bills, because they can. [More]

Lawmaker Urges Airlines To Drop Holiday Baggage Surcharges

With two airlines set to show their bah humbug by increasing baggage fees just in time for the holidays, one lawmaker is asking them to rethink that plan, you know, in the spirit of the season and all. [More]

Airlines Once Again Introducing Baggage Surcharges For Holiday Travelers

Last year, Spirit Airlines showed passengers that it didn’t quite get the concept that holidays – especially those that fall in late December and early January – are meant to spread cheer and goodwill toward fellow humans, by increasing baggage fees for merry travelers. This year, the budget airline is once again utilizing those surcharges, and this time, it has company in Frontier Airlines. [More]

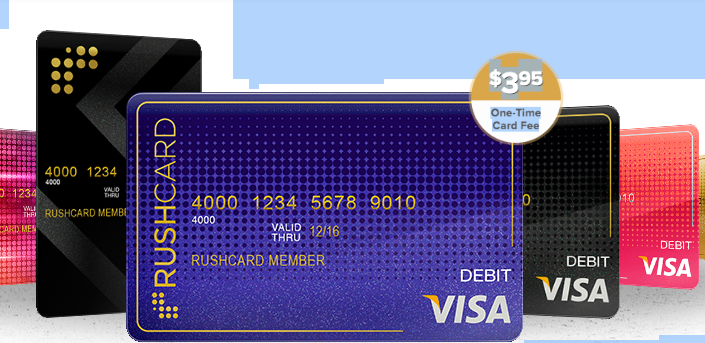

RushCard To Create Reimbursement Fund For Customers Unable To Access Money

The thousands of unbanked consumers who rely on prepaid RushCards but have been unable to access their funds because of a technical glitch, may receive compensation for the issue. [More]

After RushCard Fiasco, Consumer Advocates Urge More Oversight Of Prepaid Cards

For the better part of two weeks, thousands of unbanked consumers who rely on prepaid RushCards have been unable to access their funds because of a technical glitch. While the company run by Russell Simmons continues to fix the issue, consumer advocates are pointing at the incident as evidence that federal regulators need to do more to protect prepaid cardholders. [More]

UPS Agrees To Pay $4.2M To Resolve False Delivery Claims With 17 States

We’ve all been there: you’re waiting for a package, you check the tracking, and it says they tried to deliver. Except you’ve been paying attention the whole time, and no knock has ever come. When it’s just one resident, that really stinks. When it’s a whole bunch of packages being delivered on government contracts, though, it’s lawsuit time. [More]

Technical Glitch Locked Customers Out Of Prepaid RushCard System For The Past Week

While prepaid credit cards can serve as a lifeline for millions of unbanked Americans in need of an alternative to traditional banking, Russell Simmons’ RushCard recently left thousands of consumers stranded without their funds because of a technical glitch. [More]

Uber’s “Safe Rides” Fee Now Varies Depending On Where You Live

Since April 2014, Uber passengers taking rides in the U.S. and Canada have paid a flat $1 “Safe Rides” fee, something the company said would go toward funding background checks, regular motor vehicle checks, driver safety education, and insurance. Depending on where you live, however, that fee could increase soon. [More]

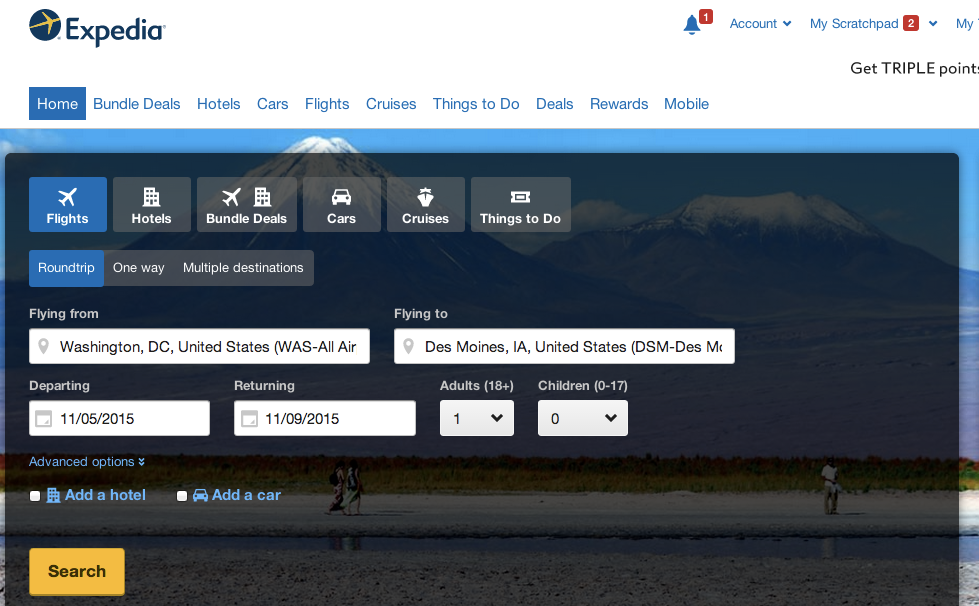

Federal Advisory Panel Recommends Clearer Disclosure Of Airline, Hotel Resort Fees

It’s no secret that airlines have increased their fees and shrunk the size of their seats over the years in an attempt to maximize revenue. While those extra costs and seat sizes are generally available through the carrier’s website, a federal panel thinks that information would better serve passengers if it were readily available during the ticket purchasing process. [More]

College-Bound Students Should Shop Around For Bank Accounts

With millions of young adults heading off to college this month, federal regulators are reminding those consumers to do their homework. Okay, not that homework, but the kind related to researching college-sponsored bank accounts. [More]

Regulators Sue Pension Advance Companies Over Deceptive Marketing Of Loans

Five months after the Consumer Financial Protection Bureau warned that pension advance loans could be the new payday loan – leaving consumers who are already struggling to make ends meet in dire financial situations – the agency announced it had teamed up with the state of New York to shut down two companies that allegedly deceived retirees about the risks and costs associated with the loan products. [More]

Citi To Return Additional $4.5M In Overcharged Fees To 15,000 Investment Account Holders

Last October, Citigroup agreed to return a total of $16 million to nearly 30,000 customers after an investigation by the state of New York found the company overcharged some customers advisory fees on their investment accounts. While that redress seems pretty hefty, it wasn’t enough, with the financial institution now agreeing to pay an additional $4.5 million to another 15,000 account holders. [More]

Frontier Airlines Offering Packages That Bundle A La Carte Extras For One Price

Though Frontier Airlines might be known for unbundled flight fares, instead choosing to offer a la carte options like checked and carry-on bags and seats with more legroom as add-ons, the airline is jumping back into the bundling arena with a new option that charges a flat fee for certain extras. [More]

United Airlines CEO: Checked Bag Fees Are Here To Stay, Just Part Of Doing Business

Despite Southwest Airlines’ recent admission that charging for bags would be a financially irresponsible policy change, it doesn’t appear that other airlines feel the same way. [More]

Southwest Airlines Has No Plans To Start Charging For Checked Bags

Less than a month after JetBlue said goodbye to free checked bags, Southwest Airlines has made it clear it won’t be going down the same path. [More]