Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers. [More]

federal student loans

Not Too Late To Get Federal Loan Forgiveness, States Remind Corinthian Students

Earlier this week, Education Secretary Betsy DeVos rescinded relatively new federal guidelines intended to make the student loan repayment process more accurate and transparent. With the possibility that other federal student loan protections could face the same fate, the Attorneys General from dozens of states are reminding former students of defunct for-profit college chain Corinthian Colleges to apply for federal student loan discharges. [More]

Navient Claims It’s Under No Obligation To Help Student Loan Borrowers

Navient, the largest student loan servicer in the country, is here to simply collect your monthly education loan payments, not help you find ways to more easily afford those payments. [More]

When Education Dept. Said Your Student Loan Would Be Forgiven, It May Not Have Meant It

One way to erase federal student loan debt is to work for the government or at a non-profit for 10 years. However, thousands of people who received notices from the Department of Education that their federal student loans were going to be forgiven through this program may still be on the hook for this debt, as the Department now says these notices are not binding. [More]

Feds Will Forgive $30M In Federal Loans For Students Of Defunct American Career Institute

Under the “Borrower Defense” program, a student’s federal education loans can be forgiven if they can prove their college used deceptive practices to convince them to enroll. The Department of Education confirmed today that this program will be used to forgive $30 million in federal student loans for thousands of former students from the defunct American Career Institute. [More]

More Than A Year After Corinthian Collapse, Students Still Waiting For Financial Aid Help

Eighteen months after Corinthian Colleges Inc. completed its collapse – closing the remaining Heald College, Wyotech, and Everest University – tens of thousands of former students are still waiting to received some form of relief from the mountains of student loan debt they incurred to attend the defunct college. [More]

Nearly 200 Former ITT Students Refusing To Pay Student Loans, But Is That A Good Idea?

The abrupt closure of ITT Educational Services’ 130 ITT Tech campuses left tens of thousand of current students sitting in limbo with regard to both their education and all the student loan debt they had amassed. Likewise, a number of recent ITT grads are holding degrees they believe are now worthless. A group of nearly 200 stranded ITT students and graduates are the latest to join the ongoing “debt strike” started after the collapse of Corinthian Colleges.

[More]

Student Loan Borrowers Face Needless Hurdles When Trying To Reduce Payments

It’s a fact of life: if you take out thousands of dollars in federal student loans to attend college, you have to pay them back. While the government offers borrowers some relief through free income-based relief, a new report shows that getting that assistance is often a test of patience for consumers, with servicers providing incorrect information or creating difficult hurdles. [More]

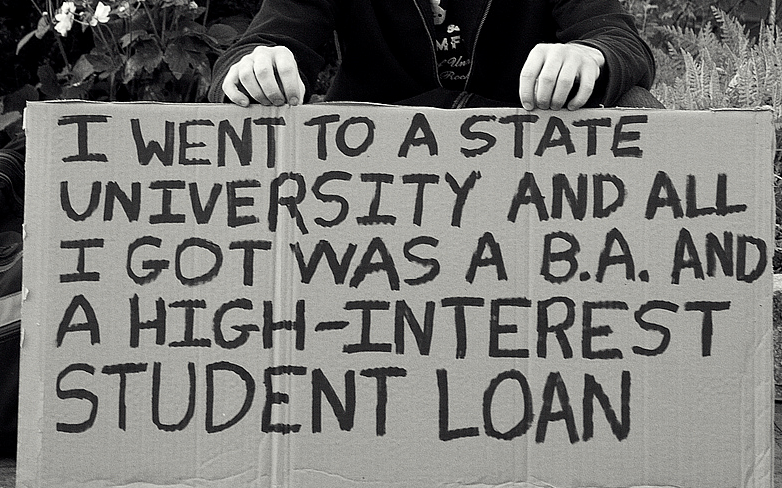

Know Before You Owe Mountains Of Student Loan Debt

Each year millions of students take out thousands upon thousands of dollars in student loans and other financial aid to help pay for a college education. But as we found out yesterday, many of these prospective students are woefully unprepared for the reality of student loan debt. From reading through piles of paperwork to making payments each month and keeping track of loan servicers, financing your education can be overwhelming, but that doesn’t mean you shouldn’t learn as much as possible before you end up under a mountain of loan debt. [More]

Feds Order Debt Relief Schemes To Cease Misleading Use Of Government Logos

Even though it’s incredibly easy to slap a government agency’s logo on your website, that doesn’t make it okay. Just ask the two debt relief companies that have been ordered to stop using Department of Education logos to mislead student loan borrowers. [More]

7 Things We Learned About Federal Student Loans & The Companies That Profit From Them

Fifty years ago, Congress created the federal loan program as a way to help Americans realize their dreams of a better life through higher education. While millions of students have no doubt benefited from the program, millions of others have found themselves burdened by mountains of debts, fielding calls from debt collectors and loan servicers, and watching as their paychecks are whittled down by garnishments. Today, seven million former college students are in default with a record $115 billion in federal loans. While those figures may be oppressing borrowers, it’s providing a stream of income – and profit – for companies contracted by the government to collect payments from debtors. [More]

New Test Program Lets You Use Federal Loans To Pay For Intensive Career & Coding Training

If you want to boost your resume by taking one of those intensive “bootcamp” training programs but don’t have the funds to pay for it, a new experimental offering from the Department of Education would allow you to use federal student loans to cover the cost. [More]

Borrowers With Federal Student Loans Made By Private Lenders At Greater Risk For Default

Consumers who took out federal student loans through private lenders are more likely to default on their debts than their counterparts who received federal loans through the Department of Education, in part because these borrowers have difficulty obtaining adequate information on repayment options. [More]

Are Student Loan Forgiveness Programs Just A Free Pass For Grad Students With More Than $100K In Debt?

Just two years ago, the Consumer Financial Protection Bureau estimated that nearly 33 million American workers eligible for student loan forgiveness weren’t taking advantage of the programs. Times have certainly changed, as the federal government earlier this year revealed that these program were now so popular they cost nearly $22 billion more than they anticipated. But it doesn’t appear the increase in use for such plans is by those who might benefit the most. [More]

Groups Say Proposed Student Loan Plan Doesn’t Provide Enough Assistance

The Dept. of Education recently proposed regulations intended to make the student loan repayment process less burdensome and drawn-out. Nearly two dozen consumer advocacy groups say that while these rules should help borrowers, more could be done to ensure that all students benefit. [More]

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

Corinthian Colleges Fined $30M Over Falsified Job Placement Rates At Heald College

The Department of Education continued its crackdown on deceptive for-profit college practices Tuesday by levying a $30 million fine against embattled Corinthian Colleges Inc. – operator of Everest University, Heald College and WyoTech – over the use of misstated and inaccurate job placement rates to recruit students. [More]