Following the revelation that Wells Fargo employees created more than two million unauthorized accounts in customers’ names to meet the bank’s high-pressure sales goals, the bank’s board has decided to claw back $41 million from CEO John Stumpf’s compensation package, and $19 million from Carrie Tolstedt, the former head of retail banking who failed to stop the chicanery. [More]

fake account fiasco

Former Wells Fargo Employees Sue Bank For $2.6B, Claiming Wrongful Termination

Days after lawmakers urged the Department of Labor to investigate Wells Fargo’s actions against employees after workers of the banking giant claimed they were fired and otherwise mistreated if they failed to meet strict sales quotas that ultimately resulted in the opening and closing of two million unauthorized consumer accounts, some former employees have come together to file a class action lawsuit against the company. [More]

Senators To Wells Fargo CEO: Don’t Strip Wronged Customers Of Their Day In Court

Now that Wells Fargo is in the hot seat for allegedly pushing its employees to meet sales goals and quotas by opening millions of bogus accounts in customers’ names, will the bank use the anti-consumer terms of its customer contracts to get out of the inevitable class action lawsuits? A coalition of U.S. senators have written the bank’s CEO asking him to please not strip customers’ of their day in court. [More]

Senators Ask For Investigation Into Possible Wage, Hour Violations By Wells Fargo

To say that Wells Fargo has been having a bad few weeks might be an understatement: from being ordered to pay $185 million for the opening and closing of two million unauthorized consumer accounts to being party to federal investigations and being grilled on Capitol Hill. But it doesn’t look like things are going to get any easier for the company, as lawmakers are now urging a probe into whether it violated labor laws. [More]

4 Things Former Wells Fargo Workers Revealed About Pressure To Meet Sales Goals

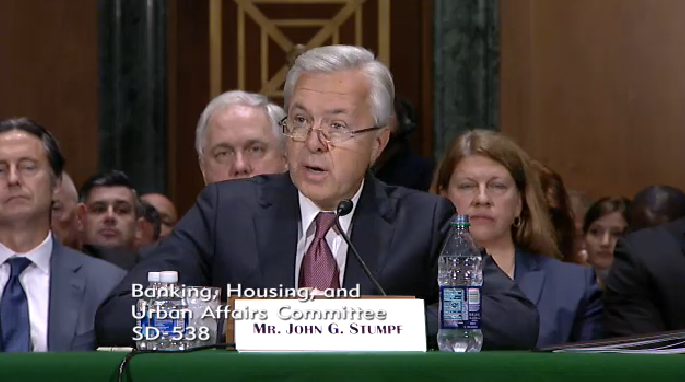

On Tuesday morning, Wells Fargo CEO John Stumpf will face the Senate Banking Committee to answer questions about how the bank’s high-pressure sales goals led a number of employees to fraudulently open up millions of unauthorized accounts. In advance of that hearing, a group of former Wells employees shared their insider views on this scandal. [More]

Wells Fargo Customers Accuse Bank Of Fraud, Negligence After Employees Open Fake Accounts

Now that Wells Fargo has admitted bank employees opened up more than two million unauthorized accounts, it’s no surprise that customers who may have been hit with fees and charges because of these bogus accounts are firing back at the bank with a lawsuit, but they might never get their day in court. [More]

U.S. Bank CEO Warns Employees: Make Fun Of Wells Fargo And You’re Fired

It’s been a (deservedly) bad month for Wells Fargo, what with the bank being ordered to pay $185 million in penalties because employees opened millions of bogus accounts, not to mention the ongoing Justice Department investigation. It would seem like a prime time for the competition to pile on the misery and steal away customers, but the CEO of U.S. Bank is demanding his staff not give into that temptation. [More]

Feds Investigating Wells Fargo After Employees Open 2 Million Fake Accounts

Financial regulators recently ordered Wells Fargo to pay $185 million to resolve allegations that the bank’s sales quotas and incentives pushed employees to open millions of unauthorized accounts, but that my not be the end of Wells’ troubles, with the U.S. Department of Justice now looking into the matter. [More]

Wells Fargo’s High-Pressure Sales Strategy Probed By Federal Regulators

Six months after the Los Angeles City Attorney filed a lawsuit accusing Wells Fargo of a slew of unfair practices — like encouraging employees to open unauthorized consumer accounts and then charging those accounts phony fees to meet sales expectations — two other regulatory agencies have opened investigations into the bank’s behavior. [More]

Class Action Suit Filed In California Over Wells Fargo’s Alleged Customer Account Abuses

A lawsuit filed earlier this month by the city of Los Angeles accuses Wells Fargo of pushing employees to engage in fraudulent conduct with regard to consumer accounts in order to meet the bank’s sales quotas. Now, one of those customers has filed his own lawsuit against the San Francisco-based bank alleging the same misconduct deceived and defrauded consumers across the country. [More]

Los Angeles Sues Wells Fargo Over Unfair Customer Account Conduct

The City of Los Angeles has filed a lawsuit against the largest bank based in the state, accusing Wells Fargo of a plethora of unfair practices including encouraging employees to open unauthorized consumer accounts and then charging those accounts phony fees. [More]