Once again, federal regulators are cracking down on companies running “phantom” debt collection schemes that go after individuals for money they did not actually owe. This time, the Federal Trade Commission shut down an operation that collected more than $690,000 in fake debts by threatening consumers with lawsuits or arrests. [More]

fair debt collection practices act

Debt Collector Allegedly Threatened Lawsuits, Arrests Against People Who Didn’t Owe Anything

Supreme Court: Protections Against Debt Collectors Don’t Apply To Banks That Purchase Defaulted Loans

The Fair Debt Collection Practices Act prohibits debt collectors from a number of annoying and aggressive practices, like calling late at night to hassle folks about their debt or publicly outing people as debtors. However, this morning — in Justice Neil Gorsuch’s first opinion — the U.S. Supreme Court ruled that this law doesn’t apply to banks that purchase defaulted loans with the intention of collecting on them. [More]

Medical Debt Collection Firms Must Refund $577K For Threatening Consumers

In this latest episode of Debt Collectors Behaving Badly, we bring you the tale of two medical debt collection law firms who must now refund hundreds of thousands of dollars after they were caught falsely claiming that attorneys were involved in collection actions. [More]

Jury Hits Debt Collector With $83 Million Verdict Over Bogus $1,130 Debt

A jury in Missouri recently awarded $251,000 in damages to a local woman who was wrongfully sued by a debt collector — more than 222 times the amount she’d been sued over — but that’s nothing compared to the additional $82.99 million in punitive damages assessed against the collection company. [More]

5 Sample Letters That Get Debt Collectors Out Of Your Face

Calls from debt collectors can make your life miserable when you’re already pretty miserable from being in so much debt. It’s even worse when you already paid the debt, or it wasn’t yours to begin with–what should you do next? That’s why sample letters can be a good starting point, or you can just send them as is. [More]

Disabled Janitor's $311,000 Victory Against Abusive Firm Trying To Collect $3,800 Debt

They just wouldn’t stop calling, and now they have to pay. The 9th U.S. Circuit Court of Appeals has upheld a ruling that a debt collection firm will have to pay a former janitor suffering from a head injury $311,000. Quite a turn of events, considering the debt they were hounding him on was only about $3,800. [More]

Video Of Bully Debt Collector Crumbling

Here are two videos, the first of debt collector threatening this man’s wife and kids over a debt he had already repaid, and the second of when he calls them back and takes them to task. The debt collector says he’s an “officer” with the “ULPD,” which is the “United Legal Processing Division” but the name sounds like it was chosen to make it sounds like law enforcement. Note how quickly they fold once he starts asking questions like “Who are you,” “who do you work for,” and “what proof do you have.” Then think about how if that’s all it takes to get them to back off and move on to the next soft target, how these bullying tactics must be working for them. [More]

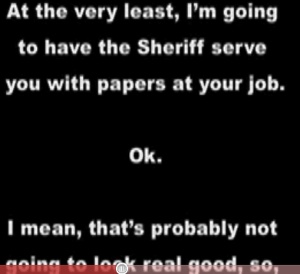

Zombie Debt Collector Threatens To Send Sheriff To Man's Work

“I’ll go through any lengths I have to in order to embarrass you,” says one of the many debt collector chicks who keep calling this guy up at work, trying to get him to pay for a credit card debt from 1998 that he doesn’t remember and for which they refuse to provide verification. [More]

Bank Of America Won't Stop Calling Looking For "Zoran"

Hey, um, “Zoran,” if you owe money to Bank of America, can you give them a call because they seem to think you live at reader Kimber’s house and they are just not willing to accept that you don’t. Kimber says they call the house at “all hours of the day, during meal times and weekends” looking for you. [More]

Debt Collector On Tape: "I'm Gonna F**** You Up"

“When I see you, I’m gonna f*** you up,” says debt collector “Mickey,” pictured at left, on the answering machine of a guy who bounced a check. WTSP obtained the messages, some of the worst debt collector recordings I’ve ever heard, and you can listen to them here.

Exclusive: AOL's Collections Guide Encourages Agents To Lie And Deceive

An anonymous tipster sent us AOL’s 153 page internal collections guidebook for prying money out of delinquent account holders. The guide shows that AOL is following some of the debt industry’s most egregious collection tactics by encouraging agents to deceive and lie to customers. After the jump we present AOL’s scare tactics, tricks to negotiating a substantial discount, and the full collections guide.

Consumers Reported 69,204 Fair Debt Collection Practices Act Violations. FTC Responds With One (1) Lawsuit

Consumers have filed over 69,000 complaints against scummy debt collectors for violating the Fair Debt Collection Practices Act, prompting the FTC to rush to our collective defense by taking action against three debt collectors who showed a “culture of harassing the debtors from which they collect.” Two debt collectors settled and one went to court. Still, when you receive over 69,000 complaints—and these are from the people who know to complain to the FTC—it’s reasonable to assume that more than three collectors encourage a culture of harassment. More harrowing revelations from the FTC’s annual report to Congress, after the jump.

The Midlothian Police Department Should Not Collect Private Debts

The Midlothian, IL Chief of Police thinks it’s appropriate for his officers to help local businesses collect private debts. Midlothian’s local mechanic, Merlin’s Muffler and Brake, performed $500 of work for Angela Proctor, who paid back all but $108 before falling into financial trouble. From The Star:

UPDATE: Acquiesce to the Zombie Debt Collectors

Relevant to our earlier post about Chris getting call after call from his debt collectors and wanting to stop their zombie madness, and T-Mobile and Catherine Zeta Jones’ inability to do anything about it, reader Erik found the Federal “Fair Debt Collection Practices Act” from Title 15 of the United States Code.