In 2004, a hospital staffer accidentally checked off “deceased” on a heart surgery patient’s discharge papers. That one little tick mark on one document resulted in years of headaches for that woman, as she has attempted time and again to prove to the three credit bureaus that she is not a zombie. [More]

experian

Cordray: Credit Bureaus Are A "Murky Unknown" To Consumers

Last week, the Consumer Financial Protection Bureau announced it was drafting new regulations that would allow for the oversight of the largest credit reporting bureaus and debt collection companies. The reason, explains CFPB head Richard Cordray is that many consumers are in the dark about these businesses and feel somewhat helpless when it comes to dealing with them. [More]

The Ins & Outs Of Getting And Using Your Free Credit Report

Regular readers of Consumerist know full well that those websites like FreeCreditReport.com and FreeScore.com (you’ll forgive us for not actually linking to them) are not exactly what their names might have you believe. But there are new consumers born every day, so it doesn’t hurt clarifying once again that there is only one place to score your credit reports with no strings attached. [More]

Someone Steals My Credit Card Number So They Can Buy Credit Protection From Experian

Credit protection programs often cost money. So what’s a someone who can’t get the credit to buy such a program supposed to do? Well, in this case the answer was apparently “steal someone else’s credit card number.”

How Lower Credit Scores Cost You More Money

People talk a lot about credit scores. Bands play songs about them in TV ads that try to sell you credit reports. It’s generally known that a higher score is better than a lower score. But what really is the difference between a person with a 820 and one with a 620? Is one a better person than the other? Not necessarily, but the person with the 620 score can expect to pay $227 more a month on a $216,000 30-year fixed rate mortgage. Here’s the breakdown. [More]

Freeze Your Credit Report

One way to protect yourself from identity theft is to “freeze” your credit report. This means that no new lines of credit can be opened in your name because lenders are prevented from taking a look at your credit report. This stops identity thieves from opening credit cards under your name and going on spending sprees. It also means extra hassle for you when you want to legitimately open credit. There’s always a tradeoff between security and convenience. Here’s how to do it. [More]

The Four Most Interesting Finance Sites At Finovate

This week there was a finance technology conference in New York called Finovate. I was able to slip in incognito because my press pass had been printed out as, “Ben Popken, Managing Editor, The Consumer Blog.” Freed from the shackles of people knowing who I was and thereby trying to influence my reportage, I was able to survey the scene with a clear and penetrating gaze. Here are four of the new sites that sounded the most interesting. [More]

5 Myths About Your Credit Score

How one’s credit score is computed is to most people a complete mystery, akin to figuring out a quarterback’s passer rating. Thus, there are numerous myths and half-truths that have attached themselves to credit scores, some of them having at least a partial basis in fact. [More]

How Long Should Paid-Off Medical Debt Be Part Of Your Credit Report?

Right now, any medical debt that gets sent to a collections agency can remain on your credit report for up to seven years, even after it’s been paid off. This ding on your credit score can be the difference between qualifying for a loan or being denied. That’s why the House Committee on Financial Services is looking at a bill that would erase some paid medical debts from folks’ credit reports. [More]

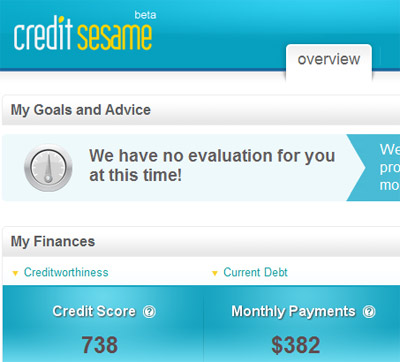

Get A Free FICO-esque Score From Credit Sesame

Credit Sesame is an advertising-supported service that gets you your credit score for free. No hidden fees, singers in Renaissance garb or gotchas. It’s not quite your FICO, but it’s close. [More]

Do VIP's Get Privileged Treatment From Credit Bureaus?

NYT reports that the three major credit bureaus each keep a special VIP list of important people who are given preferential treatment when fixing their credit reports. The list has the names of celebrities, politicians, judges and others on it. When they have errors on their reports, they are fixed by employees who work in America, and fixed swiftly. The rest of us get our requests shunted overseas to be dealt with in a cursory manner. [More]

Trying To Ruin Your Ex's Credit Score Is Not A Good Way Of Getting Revenge

When a romance goes south, it’s not unheard of for at least one of the parties involved to begin dreaming up clever ways to continue making the other person’s life hell. And one thing you definitely don’t want to do is try to screw with your ex’s credit score. [More]

Someone Explain To Experian How American Express Cards Work

How does American Express work? Michael writes that Experian doesn’t seem to understand how the company’s credit limits work. His card technically has no limit, and this confuses Experian. They coped with the confusion by showing that instead of having theoretically infinite available credit, he had $0, making his pristine record look pretty bad to potential lenders. [More]

Experian Adds Rent Payments To Credit Reports

In what could be a boon to renters looking to build a credit history (or bad news if you have a roommate who always delays your rent), credit reporting agency Experian has begun incorporating data on rental payments into its reports. [More]

Convincing The Credit Bureaus I Wasn't Dead

A writer for Slate shares the tell of her trying to convince Experian and Transunion that she is not deceased, as being dead is a bit of a problem when you’re trying to buy an apartment. Transunion only took one phone call and one fax to Lazarus her, but Experian was an abyss of despair, until, out of the darkness, a ray of hope emerged… [More]

Letting Mortgage Go Delinquent To Qualify For Short Sale Damages Credit

In order to qualify for a “short sale,” in which the lender agrees for the house to be sold for less than the remaining amount owed and takes a loss, the lender sometimes requires the homeowner to be several months delinquent on their mortgage payments. But while getting out of a house you can’t afford can be a good idea, bear in mind that the delinquency will stain your credit report. [More]