The Department of Education has told federal student loan debt collectors that they are to ignore previous guidance that restricted the fees they could charge to borrowers who defaulted on their loans — even if they immediately enter into repayment programs. [More]

et cetera

Which Cities Have The Highest/Lowest Credit Card Debt Burden?

The average amount of credit card debt varies quite a bit from city to city, as does the ability of consumers to pay down that debt in a timely manner. A new study claims to show that the cities with the least amount of credit card debt burden aren’t necessarily the cities with the least amount of debt. [More]

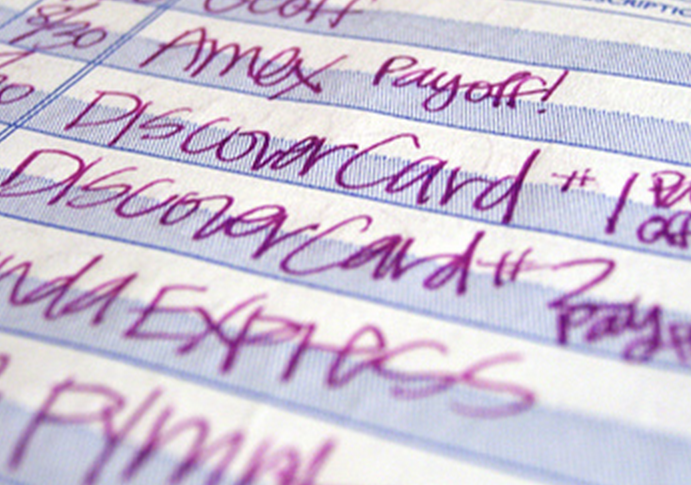

The 5 States (Plus D.C.) With The Highest Levels Of Credit Card Debt

If you were asked to guess which states had the highest average credit card debt, you might assume it would be dominated by places with high real estate costs, where consumers need to spread out their other purchases in order to make the rent or mortgage every month. Or you might go the other way and guess that states with low costs of living but high unemployment rates would top that list. But a new analysis of credit card data paints a different picture than either of these assumptions. [More]

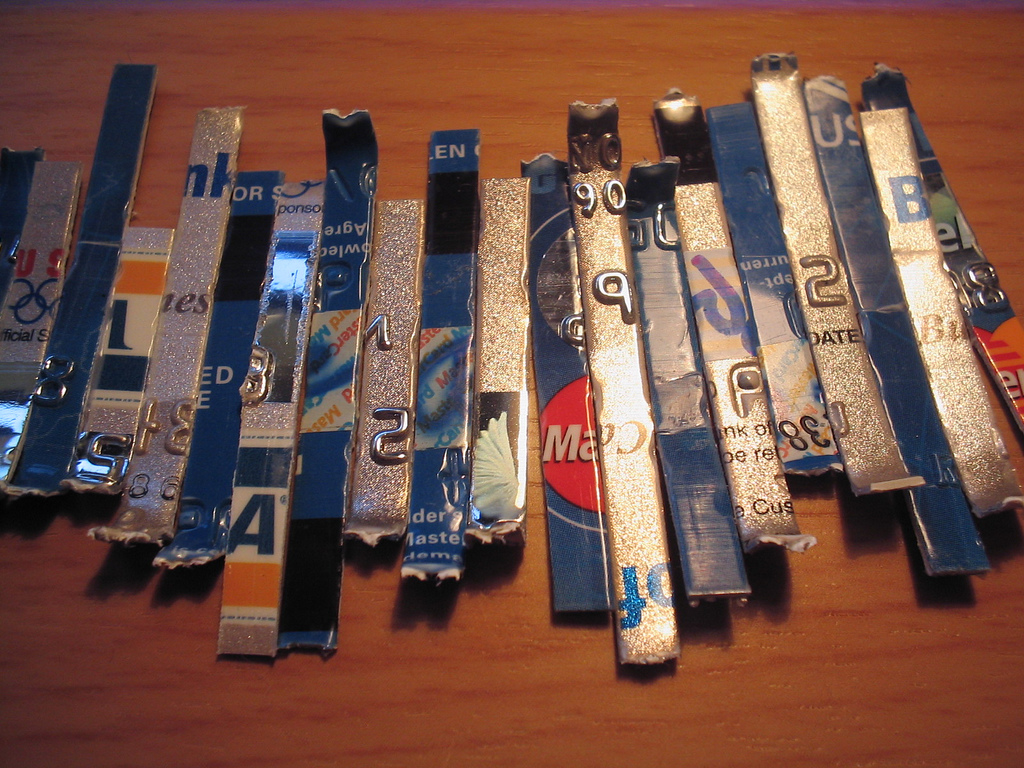

How Does A $1,000 Loan Blow Up Into $40,000 Of Debt?

We’ll never advise that anyone take out a payday or installment loan with an interest rate of 240%, but if you do find yourself taking out one of these ridiculously high-interest loans, know that defaulting on the payments can land you in the courthouse, where you could end up buried beneath a mountain of debt from which you’ll never dig out. [More]

How Long Should Paid-Off Medical Debt Be Part Of Your Credit Report?

Right now, any medical debt that gets sent to a collections agency can remain on your credit report for up to seven years, even after it’s been paid off. This ding on your credit score can be the difference between qualifying for a loan or being denied. That’s why the House Committee on Financial Services is looking at a bill that would erase some paid medical debts from folks’ credit reports. [More]

GAO: Consumers Only Getting $.21 On The Dollar Out Of Credit Card Debt Protection Fees

In 2009, U.S. consumers spent at least $2.4 billion in fees for credit card debt protection products that provide them with the ability to suspend or cancel a part of their debt obligations as a result of things like disability and involuntary unemployment. However, a new Government Accountability Office report finds that the credit card companies are making a substantial profit from these fees. [More]