Bank of America has already agreed to mortgage meltdown-related settlements totaling more than $50 billion, so what’s another dozen or so billion dollars heaped on top of that pile? That’s the latest figure being thrown about in the seemingly never-ending series of complaints and settlements tied to the bank’s bad behavior in the home loan business. [More]

doj

Documents Show That Big Tobacco Has Been Interested In Pot For At Least 45 Years

With medical marijuana now legal in nearly half the country and pot now a legal retail item in Washington and Colorado, it would make sense that the nation’s tobacco companies would be seeing the potential for making green from green. And a new report uncovers documents showing that the tobacco industry has been thinking about marijuana long before most of the people who smoke it today were even born. [More]

GM Confirms It’s Being Probed On Multiple Fronts Over Ignition Recall

While there have been numerous reports of agencies poking their noses into General Motors’ long-delayed ignition-related recall tied to at least 13 deaths, today the car maker game some indication of just how many investigations it faces. [More]

Toyota Expected To Pay $1.2 Billion To Settle Unintended Acceleration Criminal Probe

An end to the four-year federal criminal investigation into claims of sudden unintended acceleration in Toyota vehicles may be coming to an end with news that the world’s largest carmaker has reached a deal with the Justice Dept. to pay $1.2 billion to close the case. [More]

Everyone At The FCC & DOJ Should Be Forced To Watch This “Comcast Doesn’t Give A F#!k” Video

In the debate over whether or not to approve the merger between Comcast and Time Warner Cable, there has been a lot of in-depth discussion of market share, divestments, fiber competition, and all sorts of other things the average cable subscriber doesn’t concern herself with because she has better things to do. What’s at risk of being overlooked is that Comcast is just a horrible company that really doesn’t care about its many millions of customers who have no other choice. [More]

Time Warner Cable Shareholder Sues To Block Comcast Merger

It’s not just consumers and advocacy groups that are worried about the pending sale of Time Warner Cable to Comcast for $45 billion. On Friday, a TWC shareholder has filed a lawsuit to block the merger, claiming that executives prioritized their own bank accounts over investors’ interests for a deal that will have a difficult time passing regulatory muster. [More]

Justice Dept. Sued Over Validity Of $13 Billion Chase Mortgage Settlement

Remember back in November when JPMorgan reached the massive $13 billion settlement with the Justice Dept. over allegations tied to toxic mortgage-backed securities sold to investors before the housing market went kerflumpp? A non-profit group filed suit today against the DOJ, challenging the validity of the deal and asking for a court to review it. [More]

DOJ’s Antitrust Chief: Decision To Block AT&T/T-Mobile Deal Has Helped Consumers

Not so many years ago, the folks at AT&T were so confident they could acquire the little pink wireless company called T-Mobile that they bet billions of dollars in cash and spectrum that the deal would go through. Then both the FCC and the Justice Dept. said they would fight the merger and AT&T ultimately left T-Mobile stranded at the altar. The head of the DOJ’s Antitrust division says that what has happened since that failed marriage is evidence that regulators did the right thing. [More]

U.S. Wants To Add $1.23 Billion To Bank Of America’s Tab For Countrywide Scam

Back in October, a federal jury found Bank of America liable for a Countrywide Financial program that deliberately sold piles of worthless loans to Fannie Mae and Freddie Mac before the housing bubble went kaflooey. At the time, prosecutors had only sought $864 million in penalties, but now the Justice Dept. claims that number should be $2.1 billion. [More]

Banks Say Target Hack Has Cost Them $153 Million In Replacement Cards

It’s not just Target’s sales figures that are feeling the sting of the massive data breach that affected more than 100 million customers at the height of the holiday shopping season. According to a group representing the nation’s retail banks, financial institutions have had to spend more than $153 million to replace credit and debit cards in the last six weeks. [More]

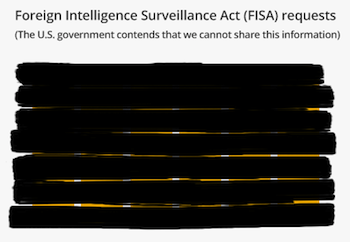

Feds To Allow Tech Companies To Provide More Transparent Info On Data Requests

While a number of the largest websites and telecom companies have recently published transparency data detailing the number of data requests made about consumers, these companies have been very limited with regard to what they could say about federal requests that fall under the header of national security. In response to a call for more transparency from several major Internet businesses, the government is changing its restrictions. [More]

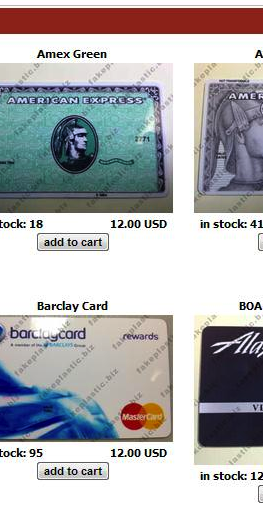

Trio Charged With Running “One-Stop Shop” For Blank Bogus Credit Cards, Holographic Overlays

All that credit and debit card information that gets stolen when criminals hack places like Target and Neiman Marcus is only worth so much to an ID thief. Sure, one could use that info to place online orders, but you’re just asking to be tracked down and caught that way. The real prize comes when you take that information and create real-looking credit cards with it. [More]

Ally Bank To Pay $98 Million For Charging Higher Interest To Non-White Borrowers

Earlier today, the Justice Dept. and the Consumer Financial Protection Bureau announced the largest auto loan discrimination settlement in U.S. history with the news that Ally Bank has agreed to pay $98 million, including $80 million in refunds to settle allegations that it has been charging higher interest rates to minority borrowers of car loans. [More]

Odds Of Comcast/Time Warner Cable Merger Are Pretty Slim

Given a shared history of treating subscribers like ATMs and of taking the “do the least” approach to customer service, it almost made sense last month when the merger rumor mill went into overdrive with reports that Comcast was looking to acquire Time Warner Cable. But the odds of this marriage being blessed by regulators seem pretty slim. [More]

Bank Of America Found Liable For Countrywide’s “Hustle” Scam

A federal jury has found Bank of America (and a current JPMorgan executive) liable for a Countrywide Financial program that knowingly sold piles of cruddy home loans to Fannie Mae and Freddie Mac, meaning the bank could face nearly $850 million more in penalties added to the $40 billion-plus court tab it has tallied since acquiring the cratering mortgage-lender in 2008. [More]

Mayors Beg DOJ To Pretty Please Let US Airways/American Airlines Merger Happen

While US Airways and American Airlines have had to indefinitely postpone their nuptials because the Justice Dept. decided the union might result in problems for consumers and the airline industry, the mayors of those cities that would be most positively affected by the merger are now pleading with Attorney General Eric Holder to see that these two companies obviously love each other and should be allowed to be together. [More]

Apple Makes Good On Pledge To Appeal E-Book Price-Fixing Ruling

Nearly three months after a federal court ruled that Apple had indeed conspired with the nation’s largest book publishers to anticompetively fix prices in the e-book market, the company has filed a notice of appeal with the U.S. Court of Appeals for the Second Circuit, possibly alleging that the court excluded important testimony that would have helped Apple’s defense. [via CNET] [More]

Shutdown Forces Justice Dept. To Press Pause On Attempt To Block US Airways & American Merger

It’s been more than six weeks since the Justice Dept. rained on the planned wedding between US Airways and American Airlines, and it looks like the fate of the two carriers may be further delayed by the current shutdown of the federal government. Earlier today, lawyers for the DOJ filed a motion for a stay in its lawsuit to block the merger because the shutdown is “creating difficulties for the Department to perform the functions necessary to support its litigation efforts.” [via Reuters] [More]