We’ve brought you several stories about so-called modern day debtor’s prisons that have starting rising across America as shady debt collectors pervert the power of the courts to their own end. They’re basically deputizing the local police to do their debt collecting for them. Now a Washington lawmaker has put forward a new bill to try to put a stop to the practice. [More]

debt

You Can Donate Money Toward The National Debt

Are you outraged at recently proposed federal budget cuts, and dismayed that you just aren’t contributing enough in taxes to help pay off the national debt? Good news! The Treasury Department has a program in place to donate toward the national debt. The program began in 1996, and has collected more than $406,000 so far this year. [More]

Delawareans Racked Up Most Debt

Delawareans lead the nation in average consumer debt, according to a new report. Misplaced sense of state pride? (A lot of credit card companies are headquartered in Delaware because of the state’s relaxed attitude towards usury and their low taxes). Whatever the reason, $20,233 is the average per-person consumer debt load in Delaware, and the next 9 states aren’t that far behind: [More]

Win $1000 For Making A Picture About The Dangers Of Debt

Make a picture illustrating “The Dangers of Being in Debt” and you could win $1,000 in our publisher Consumers Union’s new contest. Simply submit your Photoshop, drawing of a spider, collage or what have you on this Facebook page. Get people to vote for you and the image with the most votes wins. Then you can use your cash prize to pay down your credit card debit. See, it all circles back… [More]

Reasons It's Not So Great To Own A Home Free And Clear

If you’ve signed your life away on a mortgage, you’ve probably dreamed of tossing that paperwork into the shredder after you’ve made the final payment. But outright ownership isn’t all positive. [More]

First Step To Reducing Credit Card Debt Is To Stop Using Your Card

It sounds obvious but judging how many people (ab)use their credit cards they seem to forget it: to get out of debt you need to stop getting into more debt. That means putting your credit card on lockdown. [More]

How Do I Record An Illegal Debt Collector?

Shannon keeps getting calls from a debt collector that violate the law so she wants to catch them in the act. The collector calls herself “Investigator” and claims that Shannon is part of a “serious investigation” and has threatened her with jail time if she doesn’t pay up. The “Investigator” keeps calling her at work and has also called up her coworkers and told them that Shannon is part of an investigation. Shannon needs help figuring out how to record these calls. [More]

Overcome Personal Finance Procrastination

The number one cause of personal finance ruin is procrastination, and the number one cause of procrastination is fear of failure. So if you find yourself watching Brideplasty instead of balancing your checkbook, deciding which expenses to cut, or updating your retirement savings plan, here are some tips for making those tasks less daunting. [More]

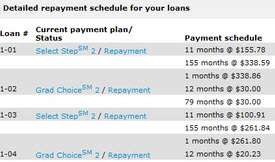

I've Got $555,000 In Student Loans

Think $200,000 in student loans is bad? Try $555,000. [WSJ] [More]

Debt Collectors Have Been Using Robo-Signers For Years

For all the attention being paid robo-signing foreclosure mills, you’d think people would be more interested in the guys who basically invented the business of mass-production affidavits: debt collectors. [More]

Capital One "No Hassles" Card Actually Kind Of A Hassle

Reader Neurocat says he loves the rewards on his Capital One “No Hassles” Visa card. Cashing in points for $100 gift cards to Home Depot, Sears and the like is handy when you’ve just bought your first fixer-upper house. Then he was slightly late on two of his payments and the honeymoon was over. [More]

Old-School Personal Loans Make A Comeback

Out of the soil of the post-apocalyptic credit graveyard shoots the skeletal hand of a forgotten lending practice. Banks are once again busting out “personal loans” to help finance what might otherwise be just out of reach for consumers. Here’s how they work: [More]

Corps. Gobbling Up Cheap Debt Instead Of Hiring

You can’t get a loan but Microsoft sure can, and it’s taking advantage of uber-low interest rates to raise billions by selling bonds. Why? “Because they can,” writes NYT. They’re not alone, across the board companies are plumping up their cash reserves so they can take advantage when the economy turns around, but it’s unlikely to anytime soon if companies keep saving instead of creating jobs. What came first, the chicken or the nest egg? [More]

College Kids Buying Credit Card Cosignatures

Tell a college student they can’t do something and someone will figure out a way to monetize it. Thanks to the CARD Act, makers of fake ID’s on campuses may now have a new sideline business: selling real credit card cosigner signatures. [More]

Collectors, Stop Harrassing Me About Mom's Debt

Michele keeps getting nasty letters and phone calls from debt collectors trying to get her to pay for her mother’s debt. One of them told her the local police had said she “should be arrested” and another pretended to be from the U.S. Department of Education. How does she get them to stop? [More]

Turn Store Financing Offers Into Interest-Earning Free Loans

Store financing offers like 0% down, pay nothing for 6 months, etc, can be a way to lure those who really shouldn’t be buying stuff into purchasing, but if you actually have the cash in hand already, you can leverage them into the equivalent of an interest-earning free loan. [More]

Love In The Time Of Soul-Crushing Student Loan Debt

What kind of lies about money would cause you to end a romantic relationship? What is more important–debt or money problems themselves, or if your significant other lies about them? As young Americans begin their adult lives with unprecedented amounts of student loan debt, it’s important to confront debt and be honest with oneself and before pursuing a serious relationship. Just ask the California woman whose fiancé broke their engagement after learning that her student loan debts were significantly higher than she had previously disclosed. [More]