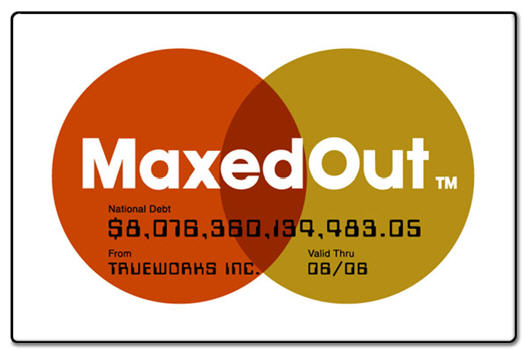

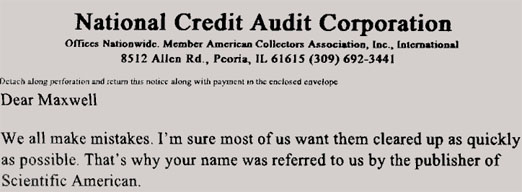

American Express truncated Ted’s address and sent his account to collections when he never received or paid his bill. The card in question was a backup card Ted used once in May 2006. He called Amex when he didn’t receive a bill in June. They told him a bill would only be issued if there were charges. He asked for one anyway, but they refused. Company policy.

Jump forward to December 27th. 8:30 AM. I get woken up by a collections agency telling me a) that I owe American Express for a charge from August, that b) I was obviously defrauding them, and that c) I was, to put it mildly, not being cooperative.

Ted never received a statement. Ted never received a late-notice. Ted never got a call from Amex. So why was a collections agency on the phone?