Fashion Fever Shopping Boutique, the correctly named Barbie toy, features a built-in credit card swiper and a life-size credit card for young children to use when buying outfits for their dolls. According to the Amazon website, “Once the balance hits zero, it will reset so you can continue to shop.”

debt

Feeling Poor? Get Rid Of Clutter

If your empty wallet makes you feel the same, one way to boost your spirits is to get rid of crap around your house you don’t need, writes Debt-Proof Living.

2. CURB THE CLUTTER. I don’t care how clean your house may be, if you have clutter it’s pulling you down. Clear your closets, drawers, cupboards, garage and counters of everything that you do not need or brings beauty to your life. Clean open spaces, tranquility and simplicity chase away feelings of poverty. Clutter invites chaos which leads to depression and feelings of deprivation.

Toss it, garage sale it, give it away, burn it. Unnecessary objects steal energy and attention. Freeing up physical space frees up psychic space and boosts your mood, maybe even giving you enough energy to tackle a project that will more directly impact your bottom line, like figuring out a way to make more money, or reducing expenses.

Confessions Of A Campus Credit Card Pimp

Here are two of the things a former Citibank credit card pusher told college students to get them to sign up:

“Even if you apply, you can always cut up the card,” and “It’s easy to pay off your balance once you graduate and get a great job.”

The ex-app jockey even fell pray to his own patter. One signup shy of a cash bonus, he filled out one for himself. Five years later, he’s $13,000 in credit card debt. We encourage college kids who spot these hucksters, make like Jesus and overturn their tables.

6 Signs You've Got Too Much Credit Card Debt

Swiping the plastic so much your credit cards have skid marks? Via Kiplinger, here’s six warning signs to watch out for that might indicate you’re abusing your credit cards.

10 Ways To Break A Compulsive Spending Habit

“Addictive spending is often rooted in punishing feelings of low self-esteem and problems with impulse control,” says an addiction specialist in an MSNBC special report on compulsive spending. At its worst, it can wreak as much or more damage on your finances as any full-blown gambling, drinking, or drug addiction—and yet, a lot of people still consider it a moral failing that sheer will-power can prevent (just take a look at half the comment threads on this blog for evidence of that mindset). If you’re a compulsive spender, odds are you already know if you have a problem, even if you manage to hide it from everyone else. But here are ten ways to help get a grip on the situation.

With "Free Pita" Promise, Citi Lures Students Off-Campus To Skirt On-Campus Solicitation Ban

How does Citi get around Syracuse University’s ban against turning college kids into debt sharecroppers? Simple. Pass out flyers saying, “free pitas,” given away at a location just outside the campus boundaries…

../../../..//2007/09/24/how-one-blogger-paid-off/

How one blogger paid off $11,500 in 10 months using the “debt snowball” method. [No-Credit Needed]

Alumni Associations And Public Universities Profit By Selling Student Data To Bank Of America

We stumbled across a very interesting article in the Des Moines Register that discusses the methods public universities’ alumni associations (in this case, the University of Iowa and ISU) use to obtain and sell student data.

Borrowing From—And Loaning To—Friends And Family

Ah, what an awkward situation—over the phone, or whispered at your desk, or asked face to face over beers at your weekly hangout. What’s the best way to respond when someone you love (or at least like to some degree) wants to borrow money? And what if you’re the one in need? Betterbudgeting.com offers some advice on when to loan and when to figure out whether you’re just enabling a bad habit.

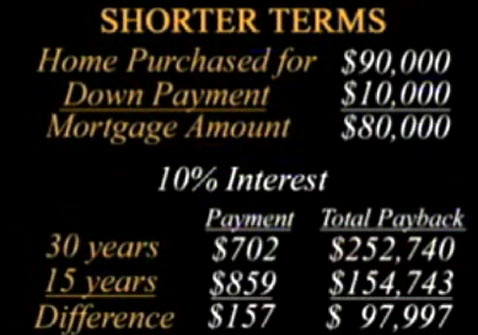

4 Strategies To Help You Live Debt Free

“Americans collectively spent more than we earned after taxes for the past two years in a row,” says SmartMoney in their latest cover story, “Live Debt-Free”. Their point: we spend a lot of time thinking about how to save and how to invest, but not enough time working out a healthy debt strategy that doesn’t eat away at our happiness, not to mention our retirement savings. They offer four different strategies for reducing your debt to little or nothing, so that you can apply your income to more worthwhile activities than fighting off your liability monster.

../../../..//2007/09/19/if-youre-upside-down-on/

If you’re upside down on your home mortgage, don’t be afraid of losing your house. It could be the best thing to happen to you. [Bankrate]

IRS Launches Special Website Section For People Facing Foreclosure

The IRS has launched a special section of its website aimed at helping people who are facing foreclosure navigate the tax issues that surround debt forgiveness.

One Unpaid Bill Is Not Going To Ruin Your Credit Score

We get many tales of consumer disputes and a common situation we hear of us is where customers are dissatisfied with a product or service, refuse to pay until its fixed, and the business, usually a small business, threatens to “ruin” the customer’s credit score over the item. (For some reason, the word “ruin” is always used).

Sample Letter For Telling A Debt Collector To Drop Dead

Is a debt collector calling and calling or sending you letter after letter? Clark Howard has a quick and easy sample letter on his site you can use to tell them to swallow a fork. [More]

../../../..//2007/09/14/my-company-was-deliberately-targeting/

“My company was deliberately targeting minority people for a continuous loan process that they would never, ever get out of. ” – Bill Harrod, Former Payday Loan Manager. [NBC4]

Verizon Sold 1,000,000 Old Accounts To AFNI, Who Then Fraudulently Tried To Collect Debts

A reader whose wife received a debt-collection notice from AFNI regarding a seven-year old Verizon account was actually just one of over a million consumers getting a similar letter, WSYR reports.

Caution Advised Before Paying Medical Bills By Credit Card

Thanks to universal default, in which one credit card issuer can elect to raise your interest rate if you fall behind on the payments on another credit card, consumer advocates urge extra carefulness when paying large medical bills by credit card. Instead, first try working out an extended payment plan with the care provider.