Man fakes death for three years to avoid debt collectors. Hides in in house and flees via secret compartments whenever guests are over. When he finally resurfaced, he did it by walking into a police station and claiming to be suffering from amnesia. He was arrested on suspicion of fraud. Debt makes people do crazy things. That’s why we’re allergic to it when it comes to buying depreciating assets (unless they’re needed to make more money.

debt

"Why I Never Want Anything To Do With Verizon Ever Ever Again"

Verizon is finally installing FiOS in my area. But I’ll never use it. I’ll never sign up for another Verizon account in my life, and I’m encouraging my parents to change to a different service when their Verizon cell contracts end soon. Over the course of eight months, I’ve become completely appalled at the horrible customer service I’ve gotten from that company.

Credit Cards Ensnare Naive College Freshmen

Eager young college students are ripe targets for the hordes of credit card marketers that blanket campuses every year. But they’re adults, right? They can make rational personal financial decisions themselves and in the absence of any education about how the credit system works, right? Survey results tell a different story:

../../../..//2007/12/05/hey-everyone-is-getting-debt/

Hey, everyone is getting debt free! “No debt” is the new “debt!” Thrill as Leo from Zen Habits pays off his car loans. Lots of good tips on how to get out of debt. [Zen Habits]

How To Pay Off $35,000 In Consumer Debt In 3 Years

J.D. at Get Rich Slowly has made his final payment and is now free of consumer debt. He still has a mortgage, but has eliminated $35,000 of consumer debt that began with a $500-limit department store credit card.

Couple Shreds Credit Cards, Spells "No New Debt"

Robert and Helena shredded all their credit cards and arranged them to spell out “NO NEW DEBT” to cement their commitment to getting out of credit and living a debt-free life. According to the blog post over at JosephSangll where this picture appeared, the couple haven’t incurred any new debt in the two months since taking the picture. For some people it just takes a little ritualistic madness to break the cycle of debt dependency.

../../../..//2007/11/26/woman-pays-debt-on-foreclosed/

Woman pays debt on foreclosed home, only to have it sold out from under her anyway. [Newsday]

10 Best And 10 Worst Housing Markets

Forbes has put together a list of the best and worst housing markets in the U.S. Think every market is dropping? Apparently not. Salt Lake City, you’re doing just fine. So far. Overall, the picture isn’t as rosy:

Mortgage Related Losses Could Reach $300 Billion

The Organization for Economic Cooperation and Development is predicting that mortgage-related write-offs could reach $300 billion, says the New York Times. Although major U.S. financial institutions have placed their estimates at around $50 billion, the OECD says that “a rougher period may yet await financial markets.”

Helpful Website For Student Loan Borrowers

The National Consumer Law Center and the Project on Student Debt have launched a joint website that offerers information for student borrowers who are behind on their loans, or those who just want to learn more about their options.

ABCDEs Of Cutting Down Debt

No Credit Needed offers these “ABCDEs” for getting yourself out of debt.

"We've Built This Latest Economic Boom On Borrowed Money"

Elizabeth Warren of Harvard Law, our very favorite consumer debt expert, gave an interview to Marketplace this morning in which she talked about the rising cost of so-called “fixed expenses” and their affect on the American consumer.

Harvard Professor Elizabeth Warren has spent a career looking at personal debt. I asked her if consumers can sustain the engine of our economy much longer.

Zombie Debt: How Credit Card Companies Illegally Reanimate Your Old Debt

In what BusinessWeek calls “financial Night of the Living Dead” credit card companies are refusing to stop reporting legally discharged debt to credit reporting agencies—illegally forcing consumers to pay debts that they no longer owe in order to get approved for mortgages.

5 Expenses You Can't Afford If You Have Credit Card Debt

5) Cable. Your Excuse: “But, but, but I need cable! I get a good deal! It’s only $100 a month! I use it a lot! It’s bundled with my phone and my internet. I’ll only save $30 a month if I cancel it.”

The Mom With $135,000 In Credit Card Debt Who Spends $400 A Month On Starbucks

“I love new clothes. However, I like getting rid of the clothes just as quickly to go buy new ones.”

Virgin Money USA Helps Americans Lend To Family & Friends

VirginMoneyUSA, which launches today, is a lending service designed to manage personal loans between friends and family, by taking care of documentation, repayment schedules, and reminders. At first glance, the service sounds like an intrusive middle-man; however, anyone who’s ever been on either side of a personal loan knows how delicate the situation can be, so we can understand the appeal of putting some distance between the personal relationship and the fiscal one.

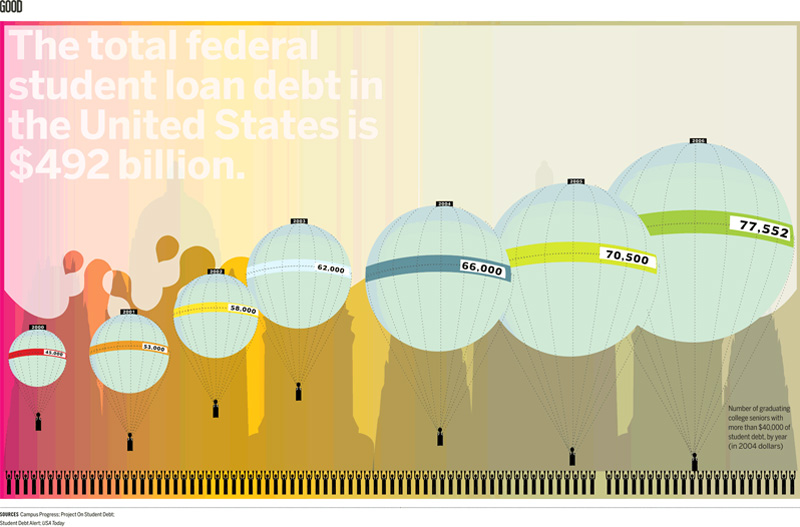

77,552 Of Graduating College Seniors Have $40,000+ In Student Debt

This graph from GOOD and FutureFarmers shows the number of graduating seniors with more than 40,000 in student debt by 2004.

No More Home Equity? Bust Out The Credit Card, Consumer Borrowing Is Up

With home equity harder to find these days, one might suspect that there would be a drop in consumer borrowing. Nope.