Do you have so many credit cards that you could sew a pair of pants from them? Confused as how to get rid of them? Try this handy Excel spreadsheet to generate a custom strategy for becoming debt-free.

debt

Fake Debt Collectors Are Trying To Intimidate You Out Of Your Money

ABCNews says that the West Virginia Attorney General is warning people about fake debt collectors who will call you repeatedly at home and at work, threatening you with arrest for not paying a debt… that doesn’t even exist.

Will Uno Chicago Grill Be The Next Restaurant Chain To File For Bankruptcy?

At the risk of inviting another pointless “this pizza is better than that pizza” debate in the comments, we feel it is necessary to inform you that Uno has run into some nasty looking debt problems and some people are speculating that they may be the next restaurant chain to go under.

Man Sets Himself On Fire At Rent-A-Center After Receiving Too Many Late Payment Notices

There are lots of good ways to escalate your complaints. Going to the store, dousing yourself with lighter fluid and setting yourself on fire is not one of them. Unfortunately, that’s exactly what one Newark, NJ man did after becoming frustrated with the amount of late payment notices and collection calls he was receiving from Rent-A-Center.

Debt Slavery: Why Are Americans So Willing To Dig Themselves Deep Into Debt?

The New York Times has an article that tells the unfortunate tale of Diane McLeod and her love affair with debt. She started out “debt free” when she got married, but after a divorce she’d managed to accrue $25,000 in credit card debt. Despite not having a down payment or any assets, Diane was given a $135,000 mortgage. Over the next few years, illness, underemployment, and shockingly irresponsible spending combined disastrously with the bank’s willingness to refinance her loan as her home appreciated (for a fee, of course). 5 years later, Diane owes $237,000 on her mortgage. She’s in foreclosure now, and a recent sheriff’s auction of the home did not draw a single bidder. A similar house down the street recently sold for $84,000 less than she owes on her home.

How To Protect Yourself Against Aggressive Debt Collectors

Millions of Americans are in debt, so it stands to reason that there are over 6,500 collection agencies in the U.S.. Most of these agencies operate under the law but a growing number of them do not. According to statistics from the Better Business Bureau, complaints filed against debt collectors rose 27% in 2007. Even if you legitimately owe the debt, you should know there are laws that protect you against harassment and the unfair practices often employed by these rogue debt collectors. CNN Money discusses the Fair Debt Collection Practices Act and laws which protect the consumer. Details, inside… [More]

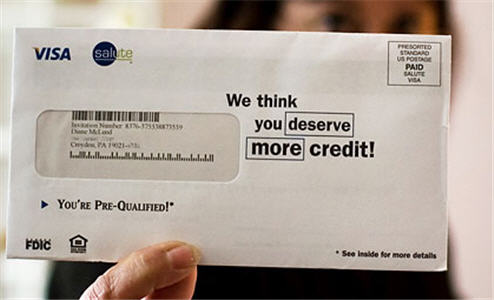

A Debt Collector Offers You A Credit Card, What's Wrong With This Picture?

Like countless others, reader Ryan is in debt. His debt is to the tune of $1,364. He received an interesting offer from the debt collector who is offering “debt reduction” in the form of a pre-approved Visa card in which his $1,364 debt would be reduced to a $1,200 balance if he accepts the card. He would need only to to pay off the balance under the terms of the credit card to eliminate his debt. Ryan wisely wrote to us to ask if this is a good idea. Actually Ryan, it’s a really really really bad idea. His letter and our advice, inside…

Succeed Through Self-Undermining!

Our post on freezing your credit cards in a block of ice got me thinking. Anything that slows, stops, or impedes making transactions can be used as a technique for limiting your spending. Whatever it may be, cutting up your credit cards, locking up most of your money in an account it takes 3 days to transfer from, giving yourself an allowance, it will be a variation on a single principle: It’s easier to put a hard limit on the future then to make the right decision in the impulsive moment. Installing some kind of an automatic hiccup can help break you out of your desire-driven action and give you the breathing room to step back and make the right choice. So if you have trouble with overspending (or overeating or any kind of bad habit) and your sheer willpower is sometimes lacking, aka, you’re human, try brainstorming ways you can trip yourself up. The world is full of obstacles, it shouldn’t be too hard to find one.

8 Rules For Smart Borrowing

Even people who are financially well off can be at risk of slipping into debt, especially in a staggering economy. There are plenty of doctors, lawyers and stock brokers who are currently on debt-management plans, according to David Jones, president of the Association of Independent Consumer Credit Counseling Agencies. Some of the warning signs of excess debt include: relying on home-equity credit lines or credit cards for everyday purchases, making only minimum payments on extended lines of credit and taking cash advances from one source of credit to pay another. To help save you from a downward-spiral into debt, Consumer Reports has put together a handy list of rules for smart borrowing. Here’s one of our favorites…

../../../..//2008/06/03/maybe-a-whole-generation-will/

“Maybe a whole generation will wake up and realize that collecting points on your Discover card doesn’t make you rich.” – Dave Ramsey. [TIME]

Bloomingdale's Sends You To A "Collection Agency" Over $5.00

Reader Haven accidentally underpaid a Bloomingdale’s credit card bill by $5, and so it was off to the collection agency…

Woman Loses Home Over $68 Dental Bill

Maybe there are no more debtors’ prisons, but that doesn’t mean your life can’t be screwed up by unscrupulous collection agencies.

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.

Consumer Bankruptcies Up Nearly 50% From A Year Ago

The number of people filing for bankruptcy continues to increase, as bad mortgages and the rising price of [insert noun here] squeezes every last penny out of debt-laden consumers. The American Bankruptcy Institute says the number of filings was up 47.7% in April from a year ago, and up 7.1% from March ’08.

../../../..//2008/05/01/people-are-not-willing-to/

“People are not willing to modify their lifestyle in order to live on what they earn – that is the real problem.” Larry Winget, author of “You’re Broke Because You Want To Be” on the root cause of the current economic crisis. [AllFinancialMatters]