Cable and telecom companies love to sell you on the convenience and affordability of bundles combining phone, TV and Internet service onto one bill. But what they don’t tell you is that shedding that bundle could end up in a billing nightmare. [More]

debt collections

Some Moron Just Paid $5K To Buy A 12-Year-Old $1,600 Judgement Against Kim Kardashian

It’s a common practice for businesses to sell off uncollected bills and judgements to collections agencies, but those collectors usually only pay a fraction of the face value of the debt, knowing they are taking on the risk that it may never be paid or only partially paid. But slap a sorta-celebrity’s name on that debt and you’ll apparently attract a different type of debt collector. [More]

Advocates Call On Senate To Remove Paid Medical Debt From Credit Reports

Medical bills can be outrageously high, and usually there’s a direct relationship between the unexpectedness of a procedure and its cost. Sometimes, no financial planning in the world can forestall unforeseen medical expenses. Yet if any medical debt ends up on your credit report, it can remain there for up to seven years — even after you’ve paid it in full. That’s why a large coalition of advocacy groups have written Senate leadership asking them to consider the Medical Debt Relief Act. [More]

Hospital Sends Patient To Collections For Bill His Insurance Company Had Already Paid

We understand that hospitals often get patients using the emergency room as a “free” clinic, and that it may be less of a headache to turn unpaid bills over to a collections agency than it is to chase down debtors on your own. But hospitals shouldn’t be tossing patients to the collections lions if the patients’ insurance provider has already paid the bill. [More]

Senators Take Another Stab At Eliminating Paid Medical Debt From Credit Reports

This happens all too frequently: Someone with good credit suddenly incurs a large number of medical bills. Sometimes it’s too much money for the person to pay off in time, sometimes one bill will get overlooked and the debt is sent to collections. That person’s credit will now carry that stain for up to seven years. [More]

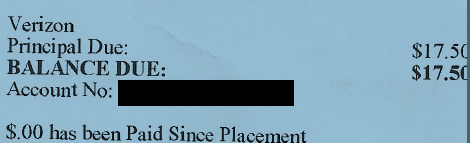

Verizon Sends Me To Collections Over Fees It Shouldn’t Have Charged Me In The First Place

After several months of being lied to by Verizon customer service about his bill, it looks like a customer finally got the company to realize its error and zero out his account — except for the $17.50 in fees that shouldn’t have been assessed in the first place, and which has the customer fending off a collections agency. [More]

T-Mobile Assumes I Owe Them Money Just Because Of My Name

If you work in the collections department for a wireless company and you’re trying to contact a delinquent customer but don’t have a home phone number for him. What to do? If you’re T-Mobile, apparently you just find someone else with the same name and assume he’s the guy. [More]

Comcast's Inept Collections Practice Is Putting My Mortgage Application At Risk

The home-buying process can be stressful enough without questionable debt from the past rearing its ugly head just as you’re applying for a mortgage. And if you deal with that debt right away, you don’t expect it to linger — and you certainly don’t expect the company you owed money to will suddenly lose all record of your account. [More]

Capital One Admits It Wrongly Tried To Collect On Credit Card, Then Continues Trying To Collect Anyway

Earlier this year, a woman in Chicago won what she likely thought was a small victory. She and her lawyer were able to convince Capital One that she had never had a credit card from the bank, and thus does not owe the $1867.18 Cap One had sued her for. But rather than remedy the situation, the woman says Capital One just made it worse. [More]

HSBC Really Wants Your Cellphone Number To Alert You To Suspicious Activity (Oh, And Also To Make Collections Calls)

According to this post from yesterday, the folks at HSBC’s collections dept. have such a trigger finger on the redial button that they made a list of most-blocked phone numbers. And now we have a pretty good idea where HSBC is getting permission to call up customers’ cellphones. [More]

Debt Collectors Real & Fake Top List Of Most-Blocked Phone Numbers

According to a new list of most-blocked telephone numbers, the only people more tenacious than debt collectors about making non-stop calls to consumers are bogus debt collectors possibly looking to steal your information or trick you into making a payment. [More]

T-Mobile Tells Me My Account Is Paid-Up, Then Sends Me To Collections

UPDATE: After Consumerist put Art in touch with T-Mobile, it was discovered that there was still — in spite of what he’d originally been told — a small balance on his account. They came to an agreement where Art pays for the service that he should have been billed for when he closed his account, while T-Mobile waives all other remaining charges and fees. The company says it will also notify the credit bureaus to undo the damage from having his account sent to collections. [More]

Report: Debt Collectors Work In Emergency Rooms, Demand Payment Before Patients Receive Care

One of the nation’s largest medical debt collection companies — already the subject of a lawsuit over alleged privacy violations — finds itself in more hot water as newly released documents claim that agency employees are actually working in hospital emergency rooms and sometimes demanding that patients pay up before they receive any further medical attention. [More]

Customers Pay Off Bank Of America Credit Cards, Get Sent To Collections Anyway

Over at AmericanBanker.com, there is the story of a Maryland woman who spent several years fending off debt collectors even though she had proof in writing that the Bank of America credit card account in question had already been paid off. And in a related investigation, it looks like she may be one of many BofA customers to end up in such a trap. [More]

Debt Collectors Out To Prove They Are Not All Zombie Bullies Who Want To Eat Your Face

For decades, U.S. debt collectors have plied their trade under the watchful but lazy eye of the Federal Trade Commission, which has the authority to go after the worst of the bunch but can’t create new rules governing these businesses. But later this summer, debt collectors will come under the supervision of the new Consumer Financial Protection Bureau… and that scares them, especially after complaints about debt collectors jumped 17% last year to 140,036. [More]