Just three years after getting into the mortgage origination business, Discover Financial Services plans to shutter its home lending operations. [More]

credit

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]

9 Things We’re So Grateful Mom Taught Us About Money

Today is the day we pause to reflect on everything our mothers have given us, from kisses on scraped knees and comfortable laps to sit on, to financial wisdom that has the power to stick with us through adulthood. We asked you to share the personal finance tips your mother imparted to you, because hey, sharing is caring and she’d probably approve. [More]

Nearly 26 Million American Adults Have No Credit History

While a recent survey found that nearly 35% of consumers have never pulled their credit report, a new report from the Consumer Financial Protection Bureau points out that some of those consumer might not have anything on their reports anyway. [More]

FICO Expands Program To Give Millions Of Consumers Free Access To Credit Scores & Reports

Millions of financially struggling consumers who work with qualified nonprofit counseling agencies now have access to free credit scores and credit reports with the expansion of the FICO Score Open Access program. [More]

Credit Card Issuers Increase Limits For Subprime Borrowers; Raise Concerns About Risks

As the economy continues to improve, credit card issuers have begun to loosen their vice grip on lending standards in order to raise borrowing limits for consumers. But the move to provide extend credit to those with blemished histories has raised concerns with consumer groups. [More]

Potential FICO Credit Score Changes Could Hurt, Rather Than Help Some Consumers’ Creditworthiness

The Fair Isaac Corporation – better known to consumers as FICO – is on the verge of turning the credit score game on its head with the release of a new credit-scoring approach that would consider consumers’ monthly bills, such as those for utilities and wireless plans, when determining creditworthiness. The change is purportedly intended to help consumers on the low end of the credit spectrum, but some consumer advocates are concerned that lower-income Americans could be the ones most adversely affected. [More]

3 Ways You Could Be Hurting Your Credit Score Even If You Pay Your Bills On Time

If you pay make regular credit card payments that are well above the minimum, and no one is hassling you about outstanding bills you might assume that your credit score is getting healthier or at least maintaining its current level. But there are some mistakes that consumers don’t even realize they’re making that could be hurting their FICO numbers. [More]

“Checking Your Credit Report Will Hurt Your Credit Score” And 4 Other Credit Myths

I can’t count the number of times I’ve been talking with my friends or family members about credit scores (Hey — I never claimed to lead a thrilling life) when someone would say “I’d like to check my credit report, but I don’t want to ding my credit score.” This is just one of several popular misconceptions that many people have about credit. [More]

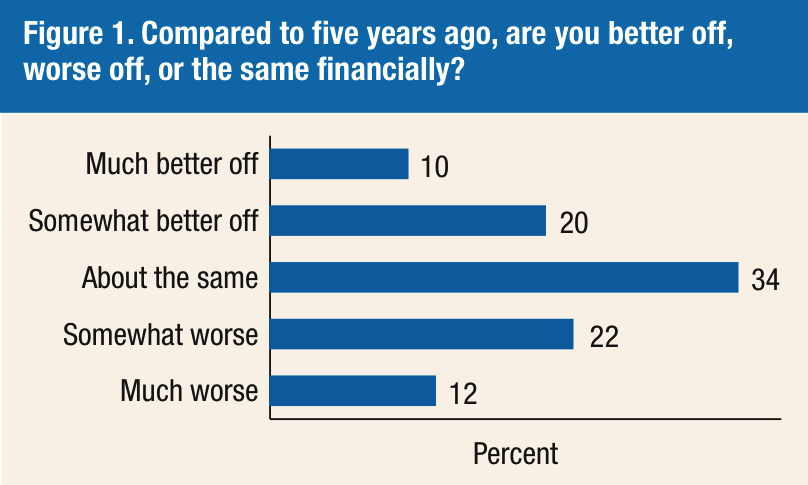

1-In-3 Americans Still Feeling The Sting Of Recession

While many Americans are now doing better than they were during the Great Recession, those dark days took such a toll on many consumers’ savings that some people who are currently doing well enough to pay the bills and enjoy a decent living aren’t able to make necessary longterm investments, like buying a new home or saving for retirement. [More]

We Would Like To Shake The Hand Of The Man With A Credit Score Of 848

If you know what your credit score is (and you should), you might know that the best possible score is 850. So the fact that there is a man who has a score of 848 might just impress you — and maybe simultaneously make you super, super jealous that he’s managed to pull that off in this economy. As he explains it, it’s not that he doesn’t have debt. He’s just very wise about how he handles it. [More]

Will My Deadbeat Roommate Trash My Credit?

A terrible roommate can make your life unhappy in a lot of ways. But let’s say you have a financially irresponsible roommate who never pays their bills. Do their bad habits affect you … other than constantly having to chase down the rent? [More]

Justifications For Going Into Debt

It’s usually wise to avoid spending your way into the red, but sometimes it makes more sense to go wild and take on some debt rather than play things conservatively. [More]

Layaway Can End Up Costing More Than A Credit Card, Senator Schumer Warns

Retailers are trying to push layaway this holiday season as a way to buy stuff you don’t immediately have the money for. For people without available credit, this can be a way to eventually get what they can’t afford now. But NY Sen. Chuck Schumer is warning that layaway fees can add up to be a much higher interest rate than any credit card would be allowed to charge. [More]

While Getting House Financed, TWC Dings Score With Unauthorized Credit Report Pull

Shawn is peeved. He’s in the middle of securing financing on a new house and the last thing you need during that time period are any surprise people looking at your credit report. These inquiries can bring your score down. But he got exactly one of those, a “hard” one, thanks to an unauthorized peek-a-boo Time Warner Cable decided to do on his credit report when called them up to ask about reducing his cable package. [More]

Credit Card Companies Begin Flirting With Subprime Borrowers Again

After getting all hot and heavy leading up to the recession, then turning completely cold shoulder, credit card companies are once again starting to selectively flirt with subprime borrowers. [More]

What To Do When You Get Your First Credit Card

Since credit cards don’t come with manuals that teach you how not to get buried in debt and saddle yourself with ludicrous interest rates and fees, it’s best to start slowly and work your way into a comfort zone. Use credit with discipline and it can yield tremendous advantages. [More]

Quick Fixes To Up Your Credit Score

Sweeping things you can do to improve your credit score, such as paying off large loans, aren’t the only moves you can make to appear more attractive to lenders. Small, immediate fixes to your personal finances can go a long way toward your goal. [More]