The academics behind the Credit Slips blog chew economic macrodata t to consider whether…

credit

10 Ways To Avoid Credit Card Pitfalls

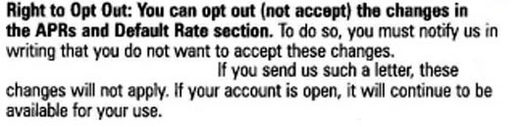

•Be aware that the card issuer has a great deal of leeway. They reserve the right to change the terms of your card, including the APR (annual percentage rate), at any time, for any reason–with as little as 15 days notice. So check your monthly statement carefully.

Chase to Eliminate 2-cycle Billing

- Last week Chase Card Services announced a few changes in its credit card services. Most importantly, they decided to end double-cycle billing, which calculates interest over a two-month period and can result in higher finance charges.

They point out that while it’s a consumer friendly move, it came a week before “Sen. Christopher Dodd, D-Conn., and the Senate Banking Committee begins its hearings on credit card practices (the hearings begin tomorrow).” Double-cycle billing is bad. —MEGHANN MARCO

Should You Give Your Teenager A Credit Card?

A lot of you already do, it seems. “A 2005 study by the Jump$tart Coalition for Financial Literacy reveals that 31.8 percent of high school seniors use a credit card. About half of these students have a card in their own names and the rest use cards issued in a parent’s name.” Is this wise?

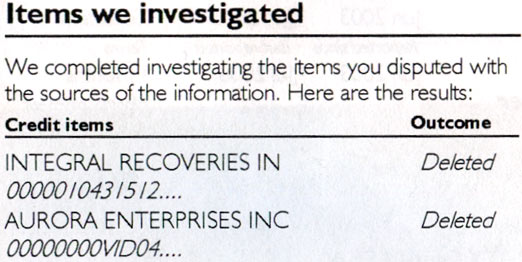

Delete Negative Items From Your Credit Report

Recently we checked out our credit report and were surprised to see a $500 unpaid charge. It was from a video store we frequented in college. (We could’ve sworn we returned Wicker Man….) The video store had never sent us any notice and the debt was sold to a collection agency, who had also never contacted us. Odd.

Walmart Layaway Ends Friday

If you’ve got something on layaway at Walmart, this Friday is your last day to pick it up. Of the major retailers, Kmart still supports layaway.

Capital One’s Credit Trap

Way back when we were 19 years old and getting our first credit card, Capital One sent us a pre-approved card with a $500 limit. Yippie! We soon found out that no matter how early we sent our payment in, we always got a late fee. Every. Single. Month. After writing letters and causing a fuss, we cancelled the card. Imagine our suprise when, so many years later, reader Tim sends us a Business Week article explaining how and why Capital One uses various tactics to increase fees. In this case, it’s over limit fees, but the whole deal sounds very similiar to the problems we had with Capital One back in ’99.

Your Good Name: Build Credit With Loans & CD’s

Here’s a method from Wikihow on building up your credit and creating credit references.

AudioEdit: Consumerist.com Fears Identity Theft

What To Do When Your Identity Is Stolen

We noticed a strange item on our credit report yesterday, a credit card we had no idea about *.

Debit or Credit? The Cashier Doesn’t Know Either

Don’t the guys behind the counter know anything?