credit

Why Don't Banks Offer Padayesque Loans, Just With Lower Interest?

Credit Slips digests a recent article in the Journal of Economic Perspectives on Payday Loans. The article’s answer to why banks don’t offer low-cost, short-term, unsecured loans is that banks find fees, like from bounced checks, more profitable. Bob Lawless disagrees, offering this alternative explanation:

Credit Card Vending Machines?

The early answer: yes.

Oh, joy. Someone tell the Stop&Shop credit swipe thieves they have a whole new venue to exploit. —MEGHANN MARCO

HOW TO: Get Your First Credit Card

Hello. I read the consumerist every day and since I turn 18 later on this month I wanted to ask how do I start a credit score or getting credit or a loan to start my credit score?

Amazon Fumbles Gift Card Order

Amazon failed to deliver a $75 gift card reader Michael purchased for a business associate in 2004. Michael was notified of the failure in 2006, and issued a claim code worth $75. When Michael tried to use the code, it came up as invalid. Michael called Amazon and went through three representatives before reaching a supervisor.

She eventually decided that the reason the claim code was not working was because Amazon had expired it after sending it to me, and there was nothing she could do. It didn’t matter that Amazon’s web site said that gift certificates sold to people in Massachusetts don’t expire. It didn’t matter that Massachusetts state law required that the gift certificate remain valid for a minimum of 7 years (or forever if it doesn’t clearly state an expiration date, which is what actually applies to this case). It didn’t matter that Amazon had never sent the gift certificate to the original intended recipient, it didn’t matter that Amazon had told me it was valid right before expiring it, what mattered was that the gift certificate had expired and so there was nothing that could be done.

The resolution, and Michael’s email, inside…

Audible Issues $5 Credit To Inconvenienced Customers

Audible will issue a $5 credit to anyone inconvenienced as the podcast and audiobook retailer moves their New Jersey offices. The only caveat: you must explicitly request a credit. Jayson discovered the compensation policy, which will be in effect “for a couple of weeks,” when he complained after his episode of Car Talk failed to download.

When I told the customer service rep that I felt I deserved some sort of credit for the inconvenience, she replied that Audible had decided to give $5 credits to anyone who called and explicitly asked for a credit due to this problem.

We are not surprised, given Audible’s track record of excellent customer service. If you are an Audible subscriber and your podcast fails to download, call and ask for a credit. Audible customer service can be reached at (888) 283-5051.

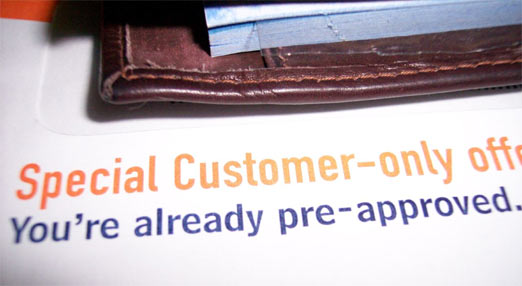

Is Anyone In America NOT Pre-Approved?

Elizabeth Warren over at the intellectually rigorous Credit Slips blog points out the correlation between tightened bankruptcy laws and credit card offers increasingly inundating the American consumer.

The Most Common Forms Of Troubling Debt

In general, there are two types of individuals who seek out my services: the extremely poor who are in a relatively large amount of debt and the middle class who have leveraged themselves into a whole world of debt.

The poor can’t make ends meet (they fall behind and it snowballs), but the middle class buy their way into debt with luxury cars, private schooling, and huge balances on their credit cards.

To help these people that are swimming in debt, I also offer one-on-one counseling where we discuss which assets can be refinanced, such as a car or a home. Another possible solution for many individuals is to look into a tax-deductible HELOC (Home Equity Line of Credit) with a much lower interest payment than their credit cards. Although many of these problems can be solved by paying off high interest debts and using a little creative refinancing, education is essential to making sure that this issue does not arise again.

This advice seems so elementary, and yet there are so many people like the ones CreditPro describes. Why do people buy things they can’t afford? It is a great mystery of life. —MEGHANN MARCO

What To Look For In A Credit Counseling Service

Credit counseling is not for everyone, but may be for you if you are struggling with debt. Credit counselors work by negotiating a reduced payment plan with creditors. In exchange for receiving timely payments, creditors may return a small portion of the amount received to the counseling service. Only consider a counselor if you can reign in your spending and pay off your debt in less than five years.

Payday Lenders Are on the Defensive

• Introduce an extended payment plan that may be used once a year for those who can’t pay their bills on time.

For those of you not familiar with payday loans, they are essentially short-term loans. Let’s say things are tight and you need $100 to pay the electric bill. You go to a payday loan company and write them a check for $115 (they usually charge $15 per $100 loan). You walk out with $100. They won’t cash your check for a certain period of time (usually two weeks). If at the end of the two weeks, you don’t have enough money to cover the check, the lender will be more than happy to roll you over into a new loan (with another $15 or more fee). This is how most people get into trouble. According to the WSJ article, the typical client of a payday lender takes out seven loans per year.

Bank of America Is Now The "Bank of Opportunity"

New television commercials incorporate the bank’s “flagscape” symbol with images of customers getting new homes and envisioning future careers. Additional spots will highlight home equity and savings products.

The marketing move comes on the heels of controversy about the Bank’s new credit card policy, which allows major credit cards to be obtained without a social security number.

Experian Announces Service That Notifies Collection Agencies Of Your Ability To Pay

The introduction of additional trigger criteria and attributes within Collection Triggers increases the ability for companies to act quickly when new information is available. Subscribers to Collection Triggers are notified within 24 hours when the financial status of a consumer within their collection portfolio has improved.

“Collection Triggers increases revenue by allowing companies to be first to the door of consumers who have improved their ability to pay,” said Zaydoon H. Munir, senior vice president, Experian’s Consumer Information Solutions. My, what a lovely industry. —MEGHANN MARCO

Repair Your Credit By Disputing

Max started his journey with a credit score in the low 500s, and now, in a matter of months, it had crested above 600. Eventually, and through great discipline, Max managed to eliminate every negative item on his credit report, simply by asking for proof that they belonged there in the first place.

Avoiding Payday Loans

CreditPro is a new blog written by a non-profit credit counselor, and he has some harsh words about Payday loans and why they are never a good idea:Another common problem that I encounter on a daily basis has to do with payday loans.

IDT's Sigo Pre-Paid Mastercard Is A Huge Scam

ATM Cash Withdrawal – Domestic $1.50

If that wasn’t enough, their “Confidentiality” clause functions like a screen door on a submarine, letting a flood of IDT affiliated marketing into your home.

Should You Pay Off Your Credit Cards With Home Equity?

Ah, one of the questions for the ages. Shall you or shall you not pay off your credit cards with home equity? Let’s say you ran up a credit card on a bunch of crap you didn’t need and are now being charged 15%. You’ve seen the error of your ways, and now are interested in paying off your debt. How should you go about it? Should you use Home Equity? Blueprint For Financial Prosperity suggests that, while you may be saving big money by cutting your interest rate, you should think the decision over carefully.

Watch Sexy Credit Card Senate Hearing Cam!

- Guests include Elizabeth Warren, Leo Gottleib Professor of Law and author of The Two Income Trap: Why Middle Class Mothers and Fathers are Going Broke, Harvard Law School; Dr. Robert Manning, Professor of Finance and Author of Credit Card Nation, Rochester Institute of Technology; John Finneran , President of Corporate Reputation and Governance, CapitalOne Financial; Richard Vague, Chief Executive Officer, Barclaycard US; Carter Franke, Executive Vice President of Marketing, JP Morgan Chase & Co.; Tamara Draut, Director, Economic Opportunity Programs, Demos; and Travis Plunkett, Legislative Director, Consumer Federation of America.

Ohh, CapitalOne. If they show up late we hope the senate charges them a fee.—MEGHANN MARCO