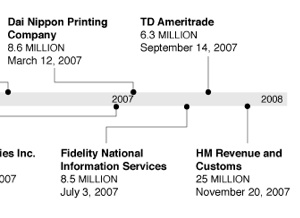

The info-loving people at Flowing Data pulled the figures on data breaches (available at Attrition.org) and created a chart showing the top 10 biggest breaches in the past eight years. The most disturbing trend, which probably will surprise few Consumerist readers, is that the breaches are increasing in frequency.

credit

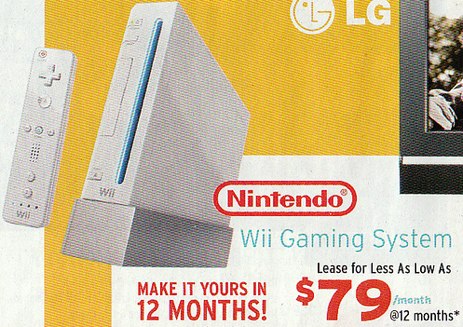

Kelly’s Will Rent-To-Own You This Wii For $948

Here’s a perfect example of what a ripoff rent-to-own or “lease-purchase” (to use the Kelly’s phrase) arrangements are to the consumer. This $250 Wii console can be yours for only $79 a month, and after 12 months, it’s yours to keep. By that time, you will have paid $948 for it. By comparison, if you charged it to a credit card with 18% interest, you could pay $23 a month and have it paid off after 12 months. Kelly’s offer will cost you $673 more than paying with the credit card.

Comcast Dings Your Credit Report For Moving With Their Precious Cable Modem

Comcast told reader Marcus that he could just take his cable modem with him when he moved from the Philadelphia suburbs into the city. Then he checked his credit report and found out that he was a cable modem thief.

How To Avoid Pre-Screened Offers Of Credit

Joseph writes in with a helpful reminder:

Now might be a good time to remind people that they can opt-out of pre-screened offers of credit. In light of the HSBC debacle I’ve been victim of, I checked out my credit report yesterday. I was amazed at how often the major credit card companies (AMEX, Capital One, Bank of America, etc…) access my credit history in order pre-screen me for promotional purposes. Consumers can opt-out at: www.optoutprescreen.com

It's Bigger Than The U.S. Stock Market, It's Unregulated, And You've Never Heard Of It

Credit default swaps form a large but obscure market that will be put to its first big test as a looming economic downturn strains companies’ finances. Like a homeowner’s policy that insures against a flood or fire, these instruments are intended to cover losses to banks and bondholders when companies fail to pay their debts.

../../../..//2008/02/13/katie-says-her-sidekick/

Katie says her Sidekick wasn’t connecting to the network for the past day or so, so she “called T-Mobile and there’s an outage in NYC affecting all gprs-using devices (sidekicks, blackberries, etc).” They gave her a $5 credit for compensation, so if you’re in a similar situation you might want to call T-Mobile to complain.

Mortgage Meltdown Isn't Just A Subprime Problem Anymore

The New York Times says that the mortgage meltdown isn’t just a subprime problem anymore, but has spread into the prime market where consumers with good credit are now struggling to pay their bills.

Red Card! MLSGear.com Shoppers Exposed To Identity Theft

Computerworld is reporting that “a series of SQL injection attacks” on a third-party e-commerce company’s servers has compromised the personal data of customers who shopped at Major League Soccer’s MLSgear.com website. One affected customer told us he received a letter from MLSgear.com letting him know what had happened and offering him free credit monitoring services for a year, which is apparently the standing corporate response to personal data theft.

../../../..//2008/02/12/filife-takes-a-look-at/

FiLife takes a look at a campaign that likens debt to STDs. Remember to practice safe borrowing, kiddies. [FiLife]

Gas Company Abandons Plan To Report Delinquent Customers To Credit Agencies

Last fall, CenterPoint Energy—Minnesota’s largest natural gas supplier—announced it was considering reporting the payment histories of its customers to credit reporting agencies in an effort to reduce delinquencies.

This Hooters Credit Card Is For Winners Only

Here’s a great credit card that will allow you to express how awesome you are at a variable APR between 7.75% and 26.95%. Yes, kids, it’s the Hooters MasterCard, and according to their website, it’s been “rated #1 by some fake award.”

Americans Struggle With The Concept Of Spending Less Than They Earn

“We live in a small town, and everybody looks at your clothes and what you drive and where you have your hair done,” said Ms. Gamble, who earns about $2,600 a month as a grievance counselor at a local prison.

Woman Says NY Cabbie Punched Her In The Face Because She Wanted Pay With A Credit Card

Tamara Perez caught a cab to her Manhattan home Tuesday, when she noticed that she didn’t have enough cash. The cab had a credit card machine, so she decided to pay with credit.

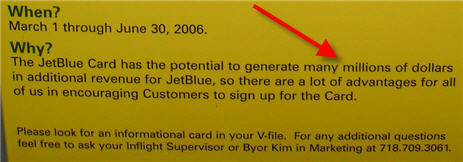

Misplaced Poster Reminds You To "Generate Many Millions of Dollars" For JetBlue

My girlfriend and I had a layover at JFK last week. While I was waiting for her in the bathroom I started reading a poster that seemed to be prompting me to get a JetBlue American Express card.

Dreamhost Busy Cleaning Up The Great Billing Apocalypse Of 2008

Dreamhost is busy cleaning up the mess after accidentally overcharging their customers by $7.5 million dollars due to a typo. The process is not going smoothly and we’ve been receiving a mix of complaints and praise.

Recession Fears Bring "Mass Luxury Movement" To An End

The aspirational upper-middle-class customer who helped companies like Coach and Saks post double-digit growth in the past few years has disappeared due to the current rotten economy, writes BusinessWeek. The result: luxury goods companies that expanded their product lines to appeal to the not-quite-rich now have $150 purses and nobody to buy them. Coach went so far as to offer coupons recently “to drum up sales.”