CarHop, one of the country’s largest “buy-here, pay-here” auto dealers, promotes itself as a company that offers fast approval for “just about anyone, despite bad or no credit.” While the company prides itself on the ability to help consumers, federal regulators say the dealer and its financing arm often did more harm than good when it came to reporting on customers’ credit behavior. To that end, CarHop must pay $6.4 million in penalties for providing damaging, inaccurate consumer information to credit reporting agencies (CRAs). [More]

credit reporting

CarHop Must Pay $6.4 Million In Penalties For Jeopardizing Consumers’ Credit With Inaccurate Reports

NCLC: More Can Be Done To Protect Consumers From Hurtful Medical Debt On Credit Reports

Upcoming changes to the way FICO calculates credit scores will improve the way americans access credit, but advocates from the National Consumer Law Center – and legislators – are aiming to create an overhaul of the entire credit reporting system; starting with medical debt. [More]

Subprime Auto Lender Fined $2.75M For Providing Inaccurate Information To Credit Agencies

Even the slightest bad rating on a credit report can have long-lasting negative affects on consumers’ lives – from getting jobs to renting or buying a home. And while most bad credit behavior detailed on credit reports are of the consumers’ own doing, sometimes it’s the result of inaccurately furnished information from financial institutions. That appears to be the case for a Houston-based financial group that now faces a hefty fine from the Consumer Financial Protection Bureau. [More]

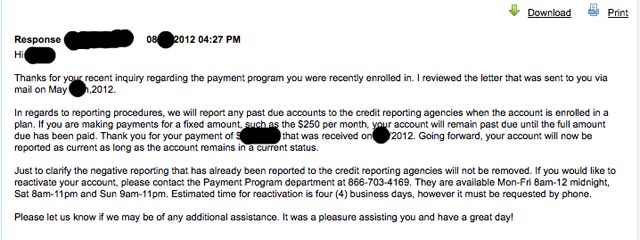

American Express Payment Plans Won't Do Your Credit Any Favors

Ryan was in a tight spot, and late with the payment on his American Express account. The problem didn’t seem as scary as it could have been, though. The company’s Web interface offered him the opportunity to sign up for a payment plan, so he could pay down the outstanding balance over a period of as long as twelve months. Neat! But the plan didn’t quite have the credit-saving effects that he expected. He was reported to credit bureaus as delinquent during the entire repayment period. That’s how the plan works. [More]