Meet the subprime mortgage meltdown’s other victim, a millionaire mortgage investor who has been forced to put his yacht up for sale—for $23.5 million.

credit cards

New Law Requires Minnesota Retailers To Purge Personal Information After Two Days

Minnesota retailers will soon be required by law to purge PIN numbers and credit card information after 48 hours. The new law, the the Plastic Card Safety Act, takes effect on Wednesday; beginning next year, the act will empower banks to sue retailers whose data-retention practices lead to a security breach. From the Star-Tribune:

A Big List Of 0% APR Credit Cards

We know how you guys love 0% APR credit cards, so check out this list of 50 of them from Consumerism Commentary. 0% APR credit cards let you do a number of things—you can use someone else’s money for free, help yourself pay off your debt without gaining interest, etc. Each offer is different, however, so you want to make sure you read and understand the conditions of the offer and choose one that fits your needs.

Pimp Your Credit Card!

Credit cards look stupid, but you can trick yours out with a DIY design using this guide and these materials:

Check Your Credit Card Statement For "VIP TUNES" Fraudulent Charges

Check your credit card statement. Is there a $29.99 charge for VIP TUNES or VIP Tune Limassol CYP that you can’t remember what it’s for? It could be a fraudulent charge. Some of our readers and people online noticed the bogus charge this month from the company located in Limassol, Cypress. If you notice the charge, dispute it immediately with your credit card company.

Is Your Shopping Compulsion Just Repressed Anger?

Former debt addict Diane Conlinn writes about how she discovered here desire to go shopping was really an expression of emotions she wasn’t dealing with.

ExxonMobil Mails Customer 2,000 Credit Cards

ExxonMobil sent a box containing 1,000 credit cards to Frank Van Buren, who had requested two (2) new cards to replace one that was about to expire. The cards contained Frank’s name and account number, and would have worked right out of the box since ExxonMobil saw activation stickers as an unnecessary extravagance. Frank saved the two cards he had requested, and spent three hours shredding the remaining 1,000.

He thought that was that. Until another box arrived this week.

Making Only Minimum Monthly Credit Card Payments Could Mean Paying Double For Everything

This chart, via OnMyOwnTwoFeet, shows the incredible costs if you incur $5,000 in credit card debt and only make the monthly minimum payments. By the time the debt is paid off, you’ll have effectively paid double the original debt.

Reach Chase Executive Customer Service

847-488-6833, or 888-622-7547 x 6833 – Jessica Pozehl

90% Of Households Think They Carry Average Or Below Average Amount Of Debt…

A CreditCards.com survey found that 90% of respondents thought their household had “average” or “less than average” amount of debt.

Are Aribitrators Punished By Credit Card Companies For Ruling In Favor Of The Consumer?

According to a study by the Christian Science Monitor, the top 10 most used arbitrators ruled for consumers only 1.6% of the time, as opposed to 38% for those who were not dependent on arbitration fees.

../../../..//2007/07/19/250-in-gift-cards-one/

$250 in gift cards, one domestic airline ticket, or 25,000 membership reward points for AMEX signup. [Bargaineering]

../../../..//2007/07/17/get-100-from-for-opening/

Get $100 from for opening a Citibank “Ultimate Savings Account.” [Poorer Than You]

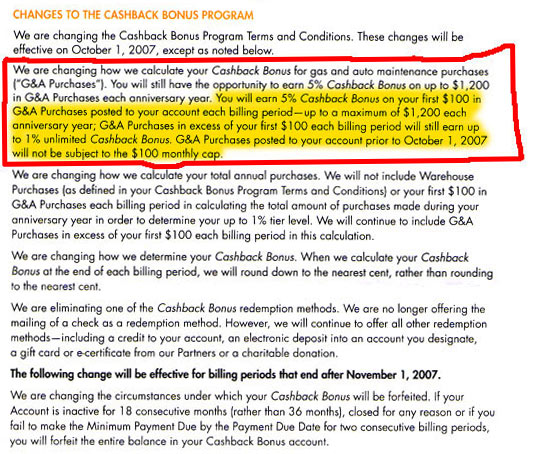

Discover Downgrades 5% Cashback Rewards

Discover recently downgraded its 5% cashback rewards. Used to be you got 5% cash back up to $1200 annually. Now, you only get 5% on the first $100 each month. Don’t charge up to $100 that month? You’ve just missed an opportunity to save $5.

Four Accounts You Need, Four Accounts You Don't

It’s easy to manage your finances when you close unnecessary bank accounts and credit lines and chisel down to the bare essentials. Blueprint For Financial Prosperity has compiled an excellent list of accounts that you need, and accounts you should avoid.

Hey Fatty, Stop Charging Big Macs To Your Credit Card

Cash-paying customers spend less on fast food than people who pay with a credit card. Though 80% of fast food purchases are still made with cash, credit and debit card use is on the rise. From Bankrate:

- “But while customers like the convenience of being able to pay for fast food with plastic, their waistlines might not be so forgiving. A number of studies show that consumers are less likely to drive by fast food restaurants if they know the restaurants accept credit cards. In 2002 Visa USA conducted a poll and found that 32 percent of customers admitted that they had limited their drive-through orders because they did not have enough cash to pay for what they wanted. The ability to use credit cards eliminates that obstacle.

Restaurants May Use Portable Credit Card Readers To Prevent Identity Theft

Portable credit card readers have the potential to make your dining experience safer and faster. The portable readers make it unnecessary for customers to hand over their credit cards, preventing waiters from stealing personal information with skimming devices. Up to 70% of skimming scams take place in restaurants.

Pay-at-the-table systems are popular in Europe and other parts of the world, but they haven’t yet caught on in the U.S., largely because equipment makers have been unable to point to a reason restaurateurs should invest in the gear.