Hey, remember how the major credit card companies were going to replace all of our magnetic stripe credit cards sometime this year with computer chip cards sometime this year? You know, like what the rest of the world uses? That isn’t happening. We’ll get our computer-chip cards, sure, and some retailers might be able to read them. However, banks might take until 2017 or so to replace all of our cards. [More]

credit cards

American Express To Fight Court Ruling That Would Let Retailers Encourage Use Of Competing Cards

Back in February, a federal court ruled that American Express merchant agreements violate antitrust laws, resulting in higher costs for consumers, by forbidding retailers that accept AmEx from encouraging customers to use competing cards like those from Visa, MasterCard, and Discover. Today, the credit card company’s CEO said the company is asking the court to stay this ruling. [More]

Meijer Offering $10 Coupon To Customers After Two Credit & Debit System Failures

Meijer is trying to win back customers with an apology and a $10 coupon, after customers were forced to either pay cash or abandon their shopping carts two days in a row last month. The retailer suffered two credit card system failures, two days in a row, that kept shoppers from paying for their goods with credit or debit cards. [More]

American Express Partners With Macy’s, Exxon Mobil & Others For Coalition Loyalty Program

Forget about Costco, American Express seems to have moved on from being dumped by the warehouse club, announcing its partnership with a plethora of retailers and companies for a new venture: a coalition loyalty program. [More]

Gasoline Credit Cards Might Not Be Worth The Hassle, High Interest Rates

Saving a few bucks at the gas pump is always nice, but signing on for a gas station-branded credit card might not be the way go about it, according to a new report. [More]

Man Arrested After TSA Finds 200 Credit Cards Hidden In Duffel Bag

The Transportation Security Administration keeps a long list of items travelers aren’t permitted to fly with including guns, knives, daggers, and box cutters. While the agency doesn’t explicitly tell consumers they can’t bring along stolen merchandise, like say 200 credit cards, if agents find the pilfered items you’ll likely be arrested. Just ask a New York man who suffered that very fate earlier this week. [More]

In Wake Of Arbitration Report, Consumer Advocates Ask CFPB To Revoke Banks’ “License To Steal”

This morning, the Consumer Financial Protection Bureau released its final report on forced arbitration, showing how banks and credit card companies use contractual clauses to short-circuit class-action lawsuits from their customers. Now that the Bureau has done its research, consumer advocates are calling on regulators to use their authority to end the practice. [More]

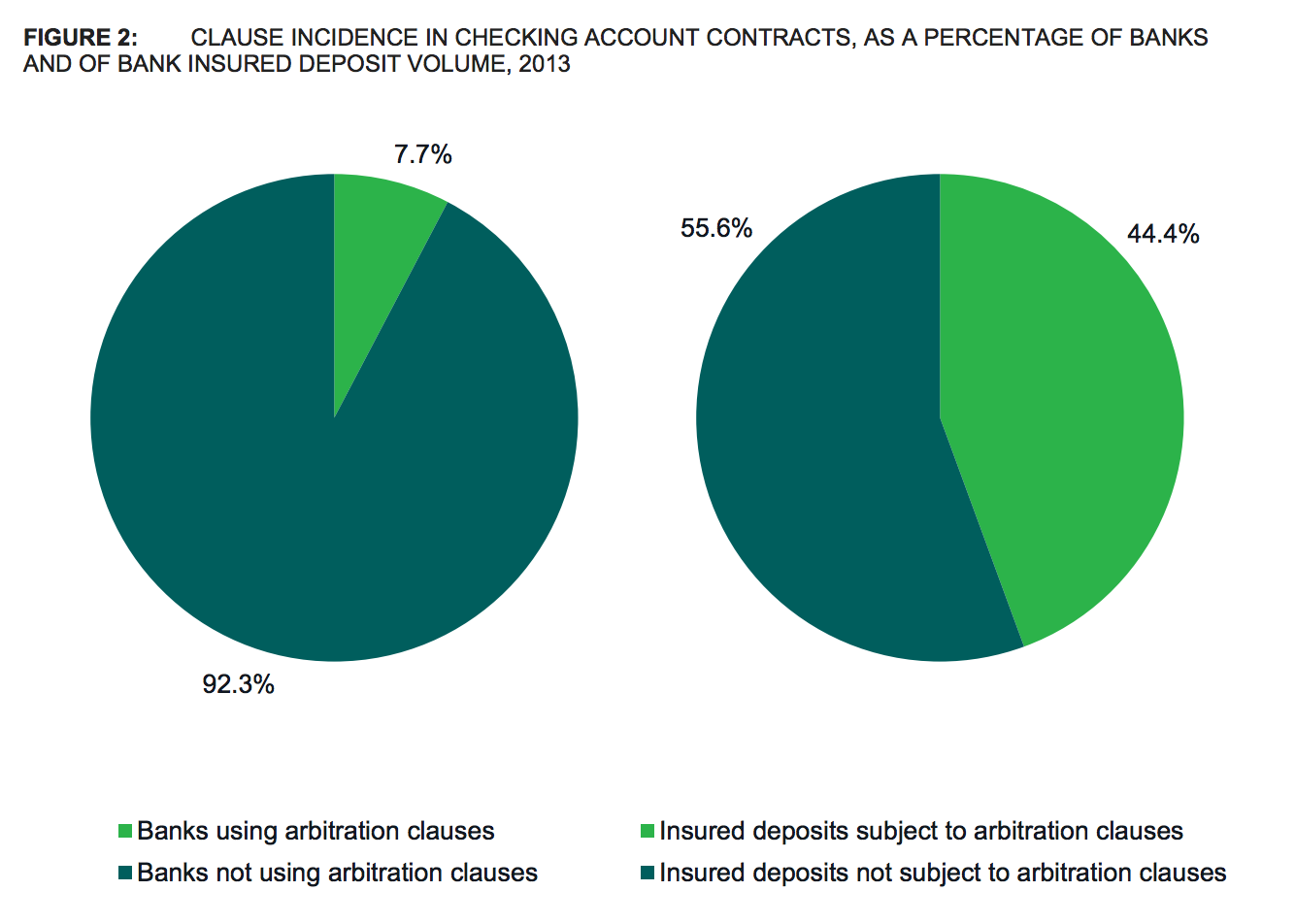

Banks & Credit Card Companies Saving Millions By Taking Away Your Right To Sue

Tens of millions of American consumers have clauses in their credit card, checking account, student loan, and wireless phone contracts that take away their rights to sue those companies in a court of law, and more than 93% of these people have no idea they’ve had this right taken away from them. The companies involved are presumably quite happy about this lack of awareness, as it results in millions of dollars in savings that aren’t being passed on to you. [More]

Report: Stolen Credit Card Information Used By Fraudsters To Make Purchases With Apple Pay

A rash in data breaches at national retailers may have led fraudsters to use Apple Pay to make big-ticket purchases with credit card information stolen during national data breaches. [More]

High-End Mandarin Oriental Hotels Confirm Data Breach

Mandarin Oriental Hotel Group – operators of more than two dozen upscale hotels from Atlanta to Jakarta – confirmed late Wednesday that its properties are the latest victims of a credit card breach. [More]

3 Ways You Could Be Hurting Your Credit Score Even If You Pay Your Bills On Time

If you pay make regular credit card payments that are well above the minimum, and no one is hassling you about outstanding bills you might assume that your credit score is getting healthier or at least maintaining its current level. But there are some mistakes that consumers don’t even realize they’re making that could be hurting their FICO numbers. [More]

Costco Announces New Credit Card Partnership With Citi, Visa

It seems Costco is not one to sit around pining for old flames very long, as the shopping club announced today that it’s rebounding from the end of its relationship with American Express with a new partnership with Citigroup and Visa. [More]

My Credit Card Interest Rate Is Going Up. What Are My Options?

Earlier this week, American Express announced that it would be raising annual interest rates on more than 1 million accounts, leading lots of people to ask if this could happen to their credit card — and what they should do about it. [More]

CFPB Wants Better, Faster Database Of Credit Card Agreements

Much like a restaurant that has to shutter for a short time while installing new kitchen equipment, federal regulators occasionally have to press pause on an important process to fix things for the long haul. So in order to improve the Consumer Financial Protection Bureau’s public database of credit card agreements, the agency is planning to give banks a brief break from having to file those documents with the system. [More]

American Express Raises Interest Rates In Effort To Be Just Like Other Credit Cards

The bad news continues to mount for American Express customers, as the company announced plans Wednesday to raise the annual interest rates on a number of consumer credit cards. [More]

4 Things To Think About Before Paying Your Taxes With A Credit Card

Millions of Americans will owe the IRS anywhere from a few dollars to many thousands of dollars when they file their income tax returns, and not all of them have funds available to pay what they owe. The simple answer might be to just put that bill on your credit card, but you could end up paying a lot more than you expect. [More]

American Express Loses Antitrust Lawsuit Over Merchant Rules

After nearly five years of legal battles, a federal court has ruled that American Express’s merchant agreements violate antitrust laws and has resulted in higher costs for consumers. [More]