Here’s a cautionary tale from a Consumerist reader whose credit card company contacted his out-of-date phone number and got authorization for a $4000 spending spree. withdrew thousands of dollars from his bank account for a payment he had supposedly scheduled and then OK’d over the phone. The problem? He hadn’t scheduled it, that wasn’t him on the phone, and that wasn’t his phone number.

credit cards

Don't Move House If You Have An Amex Card

Bankers' Letter To Senate Against Credit Card Reform

The American Bankers Association sent a letter to Senators yesterday to voice their opposition to the credit card reform act. Their big thing is they say the bill will make it so there’s less credit available, and it will cost consumers more. Definitely something worth bringing up when we interview Austan Goolsbee, senior economic adviser to Obama, in DC tomorrow. Here’s the letter:

Checking Yo Self Is A Way To Wreck Yo Self

Had the whole rapper/actor thing not worked out for Ice Cube, he could have gone into personal finance counseling. He clearly had a grasp on credit card principles when he penned the 1993 hit Check Yo Self, which seems to refer to those “courtesy checks” credit card companies bombard customers with, hoping you’ll use them to write yourself costly cash advances.

800 Number To Get Your Senator To Vote For Credit Card Reform

Now that you’ve checked out what the Credit Card Reform Act is all about, if you think it looks good and would like to see it passed, Consumers Union’s CreditCardReform.org has set a toll-free number that directly connects you to your Senator’s office so you can urge them to vote in favor of S.414. The number is 1-800-944-6762. They also have an online form you can use. The Senate is expected to vote next week.

What's The New Credit Card Reform Bill All About?

Guess what? There are a lot of pro-consumer changes in how the credit card industry will have to treat you if Chris Dodd’s Credit Card Reform bill goes through. Going through the questions you sent in and left as comments, it turns out that a good number of what you’re asking for are in this bill. So then, let’s check out the latest version bill out and see what changes are in store. I know Alex linked to this as a PDF but these are so important I wanted them posted front and center.

Chase Invites Customers To Skip A Payment, Accrue Finance Charges Instead

Chase is being awfully nice to their customers in tough economic times. Many of their customers received statements this month with a minimum payment of $0, even though they have balances. How nice! Customers take a month off, Chase will just let finance charges accrue for them.

Colbert's Credit Card Pre-Approved For Its Own Credit Card

“Being in a financial hole is as American as borrowing apple pie.” Colbert took on credit card reform last night. Here’s the clip. The best part is where his credit card is approved for its own credit card.

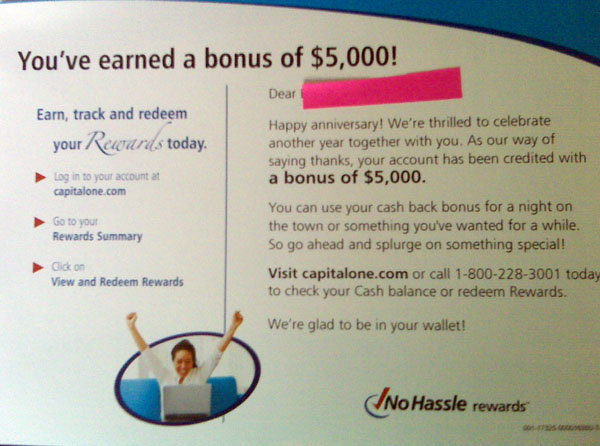

Capital One $5,000 Credit Card Customer Bailout Is Just A Typo

What’s in Lori’s wallet? Not $5,000. She received a letter from Capital One, telling her that since it was her anniversary date with the card company, she had earned a $5,000 bonus, to be credited to her account. Really? It must be true. Capital One wouldn’t send a letter like that out by mistake, now would they?

Get Informed About Credit Card Reform

As we prepare to talk credit card reform with the Obama folks, we want to make sure you’re all able to follow along at home. Inside, we present a cornucopia of fact sheets, charts, and links about the fight for credit card reform.

HSBC Credit Card's Pay-By-Phone Fee Is Higher Than The Bill

Why does HSBC charge $15 to make a payment over the phone? Other, often smaller, companies charge $3 or less, as MG notes in his email below. In this case, since the alternative is so unwelcome—a possible late payment, and a corresponding hit on MG’s credit score—it seems pretty outrageous to hold him hostage to a $15 fee.

Austan Goolsbee Confirmed For Consumerist Interview

We’ve got the senior policy guy we’re interviewing on Thursday in DC about credit card reform confirmed, it will be Austan Goolsbee, senior economic adviser to Obama. We’ll be shooting it in the Eisenhower Executive Office Building next to the White House. This should make for a good interview! Besides lengthy academic credentials in business and behavioral economics, Goolsbee often acts as Obama’s surrogate, is an extemporaneous debate champ, Skull & Bones member, and from Chi-town, so Meg can rap with him about sport peppers.

Top 10 Reasons Your Chargeback Will Be Denied

A reader who works in the chargeback section of a major credit card company has just about had enough with people tossing around “chargeback! chargeback!” as the solution to every customer service problem. While it is a great tool, you gotta make sure you use it right. To help you do that, here’s our credit card company insider’s guide to the top 10 reasons why your chargeback will get rejected.

../../../..//2009/05/05/the-house-subcommittee-on-commercial/

The House Subcommittee on Commercial and Administrative Law is currently holding a hearing on forced arbitration and credit cards, appropriately titled “Federal Arbitration Act: Is the Credit Card Industry Using It To Quash Legal Claims?” Our friends at Public Citizen will be testifying. You can view (or at least listen to) the Real Player stream here.

Chase Charges You Fees For The Privilege Of Being Charged Fees

Corbin had a very confusing experience with his Chase credit card. Because of a unexplained returned payment by his bank, his $30 automatic minimum payment led to $156 in late fees, overlimit fees, returned payment fees, and a fee charged, as far as I can tell, for being charged fees.

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

Laid Off? You May Be Asked To Pay Off That Corporate Credit Card Anyway

Rob lost his job, but kept the company credit card. Well, not so much the card, but the unpaid balance that went with it. As Rob’s employer stopped cutting him paychecks, it also stopped making payments on the account as well, and the creditor started hounding Rob, who wrote in to syndicated columnist Todd Ossenfort.

Would You Like To Get Charged For A Bill You Already Paid?

Definition: Double-cycle billing or two-cycle billing: When the credit card company calculates finance charges not just for the past cycle (month), but the past two.