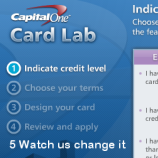

We’re starting to think Capital One isn’t just hurting financially, but also throwing a temper tantrum about the new credit card legislation. Eric received notice that they’re converting his current fixed rate to a “promotional rate.” In January 2011 they’ll switch it over to an adjustable rate and hike it to 17.9% (it’s currently 9.9%). Erik has until July 28th to agree to the new terms or they’ll close the account on August 2nd, 2009.

credit cards

Here's How The CARD Act Will Actually Change Credit Cards

Bob Sullivan at MSNBC—who coincidentally was one of the speakers at our event last night—has published a list of myths and facts about the new credit card bill. His article dispels some of the misinformation that’s out there right now about just what the act does, and what card companies are going to do in retaliation.

Credit Card Reform Bill Passes With Guts Intact

NYT: It sounds like most of the good stuff stayed in the Senate Credit Card Reform bill:

Senate Passes Credit Card Reform Bill

Hooray! 90-5, the Senate has passed the Credit Card Reform bill. The job now is to iron out the differences between it and the slightly weaker House bill, or for the House to approve the Senate bill. Either way, Obama has asked for legislators to send him a bill by Memorial Day. [Washington Post] (Photo: afagen)

Debt Collectors Mess With Your Head To Get You To Pay More

Santana had actually already sought permission from the bank to settle for as little as $10,000. It’s an open secret that if a debtor is willing to wait long enough, he can probably get away with paying almost nothing, as long as he doesn’t mind hurting his credit score. So Santana knew he should jump at the offer. But as an amateur psychologist, Santana was eager to make his own diagnosis – and presumably boost his own commission.

See Madoff's AMEX Bills

Wanna see the Maddoff clan’s AMEX statements? They’re online here. 2 grand Giorgio Armani in Paris, 8 grand at a hotel, 10 grand to charity, $441 at a bagel store, the garners of unlawful gains really know how to live it up. But you gotta give the guy some credit: he did pay his bills on time. [Scribd] (Thanks to Chris!)

Your Credit Card Company Is Building A Psychological Profile Of You

The next time you apply for a credit card, your credit report and income will be only a part of the criteria used to determine your creditworthiness. For that matter, as long as you have the card, what you use it for will be noted and added to a growing set of data that makes up your psychological profile, which will then be referred to every time the bank deals with your or reevaluates your risk as a customer.

Credit Card Reform And Guns Are The New Peanut Butter And Jelly

If the government decides to reform the credit card industry, you may be able to celebrate by bringing a gun into Yellowstone National Park and firing some celebratory shots into the air.

CARD Act Will Also Prevent Gift Cards From Expiring For Five Years

One unexpected benefit of the CARD Act, if it passes the Senate vote, is that Senator Charles Schumer of New York has included a provision that prevents abusive gift card practices.

Liveblog Transcript From Obama's Credit Card Reform Town Hall

Our fearless co-leader Ben just sent us this link from the Consumerist Washington delegation. The New Mexico Independent sent a reporter to liveblog today’s credit card reform town hall meeting at a high school in Rio Rancho, NM. The transcript includes comments and questions from readers, and also comments from national and regional consumer advocates.

Credit Card Reform Act Could Let You Pay Less If You Use Cash Or Debit

A Wall Street Journal story highlights one potential amendment to credit card reform legislation, which could allow vendors to charge different prices depending on how you make your purchase. Under the Durbin-Bond amendment, if you pay with a credit card, you’ll also have to fork over the fee the business will have to pay for accepting your transaction that way. Pay by cash or debit card and you’d get a discount.

Home Depot Credit Card Charges Perpetual Interest

Bryan was proud to pay off his $8500 Home Depot store credit card balance. Then received a bill the next month with $130 in finance charges. Finance charges on a $0 balance? Wait, what? How does that happen?

../../../..//2009/05/13/senator-bernie-sanderss-i-vt-attempt/

Senator Bernie Sanders’s (I-VT) attempt to amend the credit card bill to impose a national usury limit of 15% (the same rate applied to credit unions) just failed by a large margin. This isn’t the Senate’s only attempt to cap interest rates, though. (Photo: BinaryApe)

Credit Card Company Threats Don't Scare Consumerist Readers

When we wrote earlier about credit card companies’ threats to treat customers even worse in light of Congress passing credit card reform legislation, it ignited a righteous firestorm of consumer rage in the comments. Inside, our favorites.