Most people know that having a less-than-perfect credit score makes it more difficult to get a loan. And for those who can manage to be approved for a loan or new credit card, it also means they will end up with higher payments. [More]

credit cards

Citi Decides Customers Want $5.95 Security Service, Check Off Box In Advance For Them

If there is anything Americans love, it’s when big banks make decisions for them. For example, some Citi customers recently looked at their credit card bills and noticed that the bank had already checked off the opt-in box for some sort of security service called “Watch-Guard Preferred” at the low, low price of $5.95/month. [More]

You Must Pay Your T-Mobile Bill In Person, In Cash, Forever

If I’ve learned anything from reading readers’ letters, it’s that I should never get divorced. Or married. Or die. All of these seemingly routine life changes confuse companies so badly that you’d think they had never happened before. But Jake, a longtime T-Mobile customer, has been cast into a special consumer hell after his divorce. His ex canceled the credit card he had used to set up automatic payments, and reversed his payments to the phone company. So they charge him the balance on his next bill, he pays it, and all is well, right? I mean, he’s a 7-year customer with no late payments. It’s not like he’s a credit risk or anything. Except….he is now. And he has to pay his T-Mobile bills in cash, in person, for the remainder of his contract. [More]

Bank Of America Apparently Doesn't Want Credit Card Customers Who Pay Their Cards Off

Contrary to any ads touting financial responsibility, banks don’t really make much money on people who pay attention to their money, and they may just kick you to the curb when they realize you won’t be a huge source of fees and interest for them. [More]

Macy's Actually Has No Idea What Your Credit Card Number Is

From what we’re hearing at Consumerist HQ, it’s easy to picture what goes on at Macy’s credit card headquarters. When a check arrives, someone throws it in the air, and then it’s applied to whatever completely random bill it lands on. That might help explain what happened to Joe, or not. He doesn’t even know what his account number is supposed to be in the first place, and no one in the credit card department does, either. [More]

Wells Fargo Has Been Billing Me For "Credit Defense" Program I Never Signed Up For

Consumerist reader Andrea has had checking and credit card accounts at Wells Fargo for several years, but she recently noticed that somewhere along the line the bank had enrolled her in something called “Credit Defense,” which has been quietly siphoning off a small percentage-based fee every month. And even though Wells could offer no proof that Andrea had ever opted into the program, the bank would not refund her money. [More]

Visa Shuts Down Your Credit Card, Figures You'll Find Out Eventually

If you try to use your credit or debit card and find that it’s been abruptly shut down, thank your bank. They’ve proactively shut down your compromised card, theoretically saving you from a cascade of fraudulent charges. So that’s nice. But what bothered Scott when this happened to him is that no one called him to give him a heads up. [More]

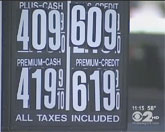

Some NY Gas Stations Adding $2/Gallon Credit Card Fee

It’s no secret that gas stations all around the country sometimes tack on the cost of credit card processing for fuel payments. And while you may be willing to pay a few cents more per gallon pumped, some stations in New York are reportedly charging credit card customers a few dollars more per gallon of gas. [More]

HSBC's Credit Card Policies Feel Like 1994 All Over Again

Victor knows that shopping at Best Buy isn’t a popular choice around here, but he really likes getting 4% back in Reward Zone points to spend on even more stuff at Best Buy. That does sound pretty sweet. In this situation, his actual beef is with HSBC, the bank that runs Best Buy’s credit cards. He made some big purchases, then made an electronic payment from his bank account to pay off the balance. Now there’s a mysterious hold on the account, and he can’t use the card. Turns out that large electronic payments are “held” for eleven days to make sure everything clears. Longer than it would take with a paper check. Unable to make any more purchases with his card, Victor just went and bought his iPad 3 somewhere else. Darn. [More]

J. Crew Divides Rewards Points Between Me And Evil Twin

Julie has a secret evil twin with the same name. That’s the only possible explanation for why her favorite store, J. Crew, has decided to split her reward points between two different accounts, neither of which receives enough points to get actual rewards. She wrote to Consumerist not only to complain, but to find out whether there are other customers experiencing the same problem. [More]

CFPB In Charge Of Reversing & Revising Rule That Limited Credit Card Fees

The bad news is the Consumer Financial Protection Bureau has to reverse a rule that capped credit card fees associated with opening a new credit card, but the good news is they’re asking for public comment while they revise it. [More]

What Not To Do With Your Credit Cards

Credit cards are tools that can make your life easier and give you more financial power, but they also provide a quick path to financial ruin. It’s important to use common sense when wielding the massive buying power that plastic provides, especially if you’ve just started using credit. [More]

Customers Pay Off Bank Of America Credit Cards, Get Sent To Collections Anyway

Over at AmericanBanker.com, there is the story of a Maryland woman who spent several years fending off debt collectors even though she had proof in writing that the Bank of America credit card account in question had already been paid off. And in a related investigation, it looks like she may be one of many BofA customers to end up in such a trap. [More]

Paying For Gas With A Credit Card? $1 Extra Per Gallon, Please

It’s not legal for a store to charge an extra fee or percentage when customers pay by credit card, but it is legal to offer a discount to customers who pay in cash. Great. The flaw in this plan is that, at least in New York state, there aren’t any laws regulating how big that discount can be. Which is why some Long Island gas station operators recently hiked the price per gallon of gas a dollar, then offered a one-dollar discount to customers who pay cash. [More]

Ask For Your Deposit Back, Capital One Hangs Up On You

Seeking to build his credit and be all responsible and stuff, Matt got a secured credit card from Capital One. If you’re not familiar with the concept, that’s a type of credit card where the creditor is… well, you. You deposit, say, $500 with the credit card issuer, and that gives you a spending limit of $500 or a little more. A good repayment history with this card will help build or rebuild your credit when you’re not able to get another card. And when you have good enough credit to move on and shut down the card, you get that deposit back. In theory, anyway. [More]

Feds Probing Chase On Credit Card Collection Practices

Following the lead of whistleblowers, the Office of the Comptroller of the Currency has reportedly been investigating JPMorgan Chase over allegations that, over the course of at least two years, the bank used inaccurate records when suing thousands of delinquent credit card customers. [More]

Scare Yourself Into Paying Off Your Credit Cards With This Tool

If you’re accustomed to paying just the minimum payment on your credit card bills each month, you might change your ways if you discover how long it will take you to get rid of your debt. [More]

Tips For Haggling With Credit Card Companies Over Debt Mountains

If you’ve buried yourself in credit card debt and are strangled by your payments, you can try to work out a better deal by negotiating with the companies you owe. Some smooth talking might net you lower rates, more manageable payments and more time to pay up. [More]