Everyone has that one relative who was an adult during the Great Depression and hid boxes of cash all over the house because they didn’t trust banks. Someday, your own descendants might share tales of weird old Aunt Mykayla, who entered the workforce during the Great Recession and refused to get credit cards or even buy a car. [More]

credit cards

Here’s Everything We Know About The Rakuten/Buy.com Credit Card Breaches

Starting about a month ago, rumblings began on the SlickDeals forums among people who had recently made purchases from Rakuten Shopping, the new brand name of the marketplace Buy.com. The purchases made were diverse, ranging from time clocks in Colombia to newspaper subscriptions in Cleveland to plane tickets in Germany. Something is very, very wrong here: hundreds of victims from recent months have come forward on Slickdeals alone. [More]

Protect Your Credit And Debit Accounts When You Travel

The summer travel season is here, which means driving and flying to new locales and using exciting and unfamiliar ATMs. That increases your risk of both having awesome fun times and of being the victim of credit or debit card fraud, so it’s good to keep that in mind and take a few precautions. [More]

Ann Taylor Scrambles My Data With My Friend’s, Shrugs

Patty set out to make a purchase from Ann Taylor Loft. Her friend who lives in a different state did not. And yet, their data is somehow tangled. Patty’s friend’s credit card info is part of Patty’s Ann Taylor account record, and no one has any idea why. [More]

Green Billing At Macy’s Is Costing Me Lots Of Green

Robert and his wife aren’t poor: they’re currently in the process of buying a vacation home. His wife opened up a Macy’s credit card in order to get an additional discount, because yay for discounts! Robert set up “green” or paperless billing after gaining online access to the account, but it turned out to be more like billess billing: they never saw any bills. Should they have noticed that no bills were coming and checked their spam folders? Maybe. But no bills came. [More]

Credit Card Delinquency Rate At Lowest Since Today’s College Students Were In Diapers

In spite of the fact that many Americans are still feeling the headache, nausea, and exhaustion from the Not-So-Great Recession, it looks like we’re becoming more responsible about paying our loans on time. According to a new report, the delinquency rate on bank-issued credit cards is now at its lowest since 1994. [More]

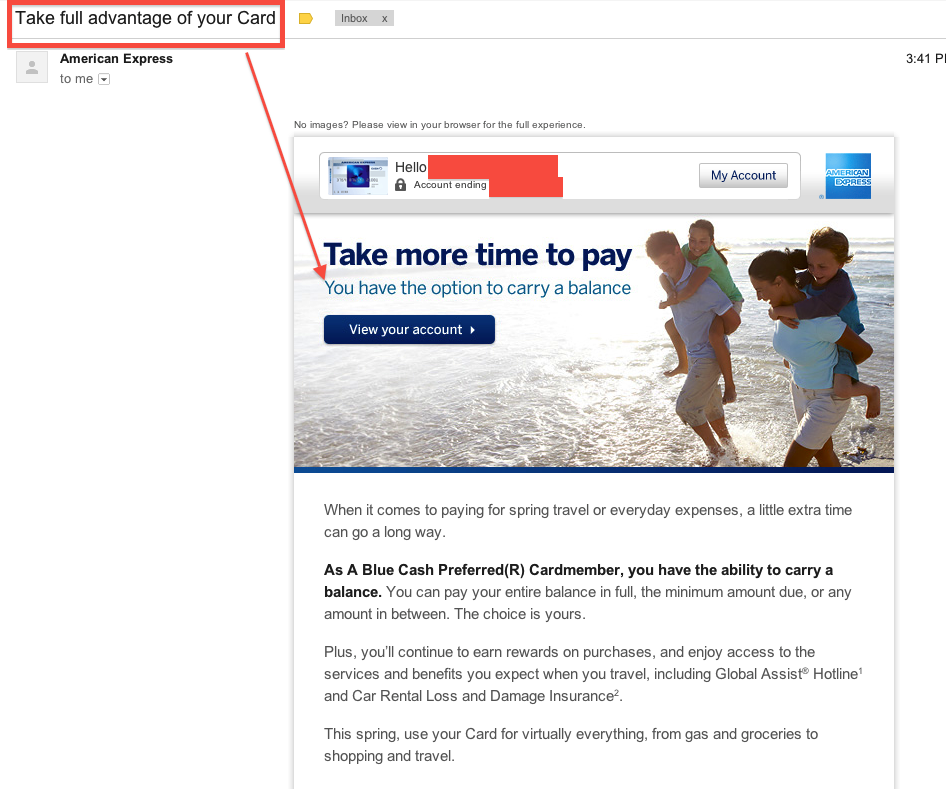

American Express, Where Carrying A Balance With An 18% APR Is A Perk

Forget airline miles, cash back, rewards points, or any of that rubbish. American Express wants you to remember that the best way to take full advantage of your card is to carry a balance. [More]

Massachusetts Court: Retailers Can’t Ask For ZIP Codes To Verify Credit Card Purchases

Don’t want your mailbox crammed with circulars? Neither did a Massachusetts resident who used a credit card at Michaels and was asked for her ZIP code to complete the transaction in 2011. She’s not alone — a few years ago California ruled against retailers that asked customers for ZIP codes when using credit cards. [More]

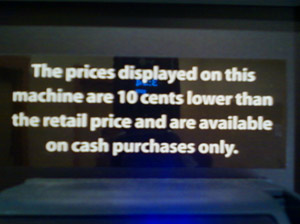

Have You Seen A Vending Machine That Imposes Credit Card Surcharges?

It used to be that if a retailer charged a fee or surcharge to use a credit card, that violated their merchant agreement with the credit card companies, and they got in trouble. Those heady days are over, and it’s now cool for merchants to impose surcharge on your purchases with plastic. And so it begins. Here’s one spotted in the wild on a vending machine. [More]

Supreme Court To Decide Whether Companies Can Use Forced Arbitration To Skirt Federal Laws

It’s been nearly two years since the Supreme Court slapped U.S. consumers across the face, ruling in AT&T Mobility v. Concepcion that companies could take away customers’ rights to class-action lawsuits by including a tiny arbitration clause in user agreements. Today, SCOTUS hears another arbitration case that could shift the balance even further in favor of corporations. [More]

Court Rules Airline Doesn’t Need To Accept Cash For In-Flight Purchases

There’s a widely held belief that because dollar bills are legal tender that all cash must be accepted by any business for any purchase. This simply isn’t true, but try telling that to the man who sued Continental Airlines for refusing to let him buy $8 worth of stuff with cash during a flight. [More]

Getting A Car Loan Might Someday Depend On How Well-Updated Your LinkedIn Page Is

Whether they admit to it or now, we all know that some employers and schools stalk applicants’ Facebook pages, Twitter accounts and all the other ways in which someone can make a fool of himself online. But should your social media connections be involved in applying for a loan? [More]

Feds Charge 18 People With Ringing Up $200 Million In Fraudulent Credit Card Charges

Credit card fraud is nothing new — identity theft is common enough — but managing to make up enough identities to steal $200 million from credit card companies? That’s a staggering feat, and yet 18 people managed to pull it off. At least, until the U.S. Department of Justice managed to crack the case. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

The Financial Powers That Be Shut Down Credit Card Use At Vatican City Sites

Vatican City had a bit of an embarrassing situation on its hands come New Year’s Day, when tourists and pilgrims waited in long lines to see holy sites only to find out all electronic purchases had been suspended. That means no credit cards anywhere in the city state. [More]

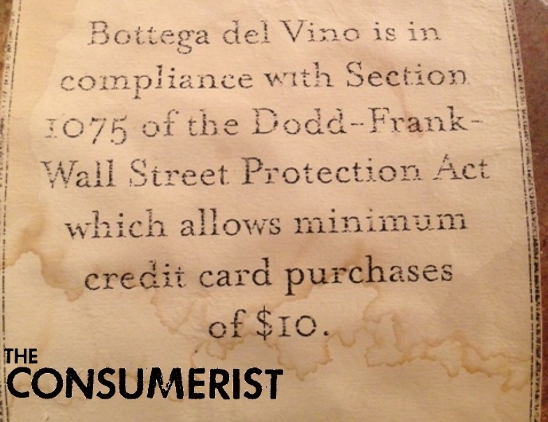

This Restaurant Really Wants You To Know Why It Can Now Require $10 Minimum For Credit Card Purchases

Rather than your typical hand-drawn sign letting customers know that they must buy at least $10 worth of stuff in order to use their credit card, this restaurant goes a step further and (sort of) cites the law that gives it the right to require the $10 minimum. [More]

Calculate The True Cost Of Credit Card Purchases Before You Buy

This is good advice any time of the year, but since many of us are about to launch into spending sprees in the oncoming days, it’s as good a time as any to remind shoppers to think long-term about how much they are actually going to pay for an item purchased with a credit card. [More]