Getting A Car Loan Might Someday Depend On How Well-Updated Your LinkedIn Page Is

The Economist recently looked at the new ways in which lenders are looking beyond bank and tax records to consider an applicant’s ability to pay back a loan.

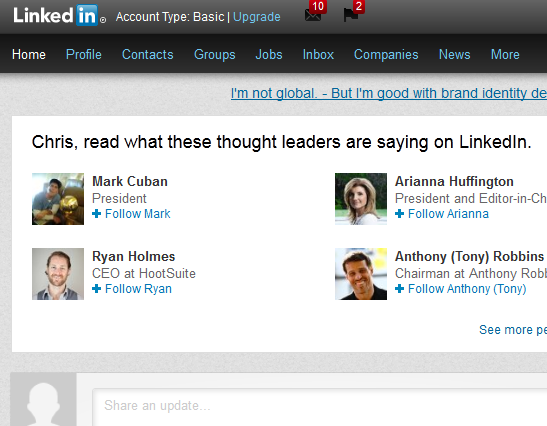

There’s a start-up called Neo that uses applicants’ online interactions to help lenders decide whether to make the loan. For example, it can use LinkedIn as a way to verify the accuracy of an applicant’s employment record. It also looks at that person’s professional connections to judge his or her “character and capacity” to repay the loan. The company says these searches are done with the applicant’s permission.

But there’s not much to stop anyone at the bank from simply checking your profile out, so either keep it up to date or make it as private as possible.

Then there’s ZestFinance, which has created a loan underwriting algorithm it claims has a default rate 40% lower than that of your average payday lender. The company accumulates all manner of data about potential borrowers, from what they write on Facebook to how they type their words out (do they capitalize or go the all-lower-case route?).

“We feel like all data is credit data, we just don’t know how to use it yet,” the company’s CEO, who used to run Google’s internal information systems, told the NY Times last year. “This is the math we all learned at Google. A page was important for what was on it, but also for how good the grammar was, what the type font was, when it was created or edited. Everything. What Gil is doing at Factual is the same. Data matters. More data is always better.”

Overseas, a company called Kreditech asks applicants to allow for temporary access to their Facebook account. The company’s founder says it can judge creditworthiness by a borrower’s Facebook pals. If the friends have good jobs and live in nice areas, it’s a plus. Friends who have defaulted on loans are not good.

Movenbank uses info gleaned from Facebook to tweak users’ credit card rates. Say nice things about the bank to your friends, and see your rate drop.

The Economist points out that big banks are likely to stay out of this Facebook-scanning stuff for now, letting the smaller banks deal with the legal hurdles that will inevitably be put in their way.

Citibank’s head of social media Frank Eliason (you might remember him as Comcast Frank), says that using social media interactions to judge whether a borrower is creditworthy is “a dangerous game.”

And we couldn’t agree more. While there might be validity to some of these companies’ theories and methods, there’s a slippery slope involved here.

Merrill and his ilk are operating under the misguided notion that just because you can measure and track someone’s behavior, that means you should measure and track that behavior. Should lenders start asking about TV preferences and judging applicants based on whether they watch Animal Planet vs. HGTV? What about the repayment behavior of science-fiction fans vs. chick lit readers — and what of those people who enjoy both?

And while there may be hundreds of millions of Facebook accounts, there are still hundreds of millions of people without one — and plenty of account-holders who have stopped using the site. These social-media-mining methods of underwriting a loan seem to gloss over this fact.

The fact is that the housing bubble didn’t happen because Countrywide was failing to amass oodles of granular data about each borrower’s social media interactions. It failed because Countrywide and other lenders were knowingly handing out loans to people that tried-and-true underwriting methods showed were unable to repay.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.