Young Adults Not Eager To Take On Piles Of Credit Card Debt For Some Reason Image courtesy of (me and the sysop)

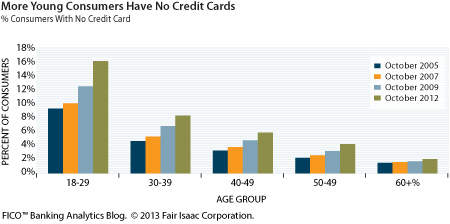

A growing number of young people have exactly zero credit cards. There are a few reasons for this, and the recession is only one of them. According to research from the Fair Isaac Corporation (the people behind the FICO credit score) 16% of Americans ages 18-29 had no credit cards in the fall of 2012, compared to 12% at the same point in 2009. The federal CARD Act raised the minimum age for getting a credit card to 21, eliminating the rite of passage that was signing up for too many credit cards during one’s freshman year of college in return for free Frisbees and t-shirts. That accounts for much of the decrease…but doesn’t tell the whole story.

Check out this graph, though: people are shedding credit cards across the board. For some people, the card-free lifestyle is because the recession wrecked their credit rating. For many youngsters, debit cards simply became a habit: easy, accepted everywhere, not a massive debt trap.

This isn’t an ideal solution. The problem with not having any lines of consumer credit in your young adult years is that when you go to buy a house or car later in life when (if?) you have an actual career, having no credit history will mean that you’ll get a less favorable interest rate…or no loan at all.

The Young and the Cardless [FICO Banking Analytics Blog] (via Bucks)

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.