The downside to responsible lending is that the lenders will need more information about you, says the WSJ. [More]

credit bureaus

Credit Score Myths Debunked

Ray at Financial Highway goes Mythbusters on credit scores, revealing 7 myths about the financial benchmarks. [More]

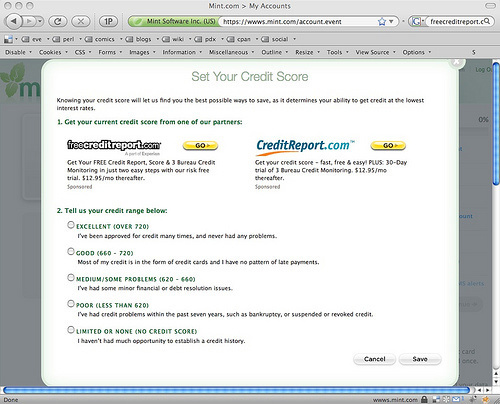

Mint Upselling To "Free"CreditReport.com

It didn’t take long for Intuit to start ruining a great product. They’ve begun upselling Mint.com customers to two “free” credit report sites that are anything but. UPDATE: Turns out Mint was already doing this pre-Intuit. Bully for them.

Sorry, No Mortgage: Experian Says That You're Dead

Shortly after surviving the death of her husband and a life-threatening medical crisis, Ann Howe of Seattle decided to refinance her home mortgage. Everything went smoothly until the bank informed her that the refinance couldn’t be completed because the credit bureau Experian was convinced that she was dead.

How A Disputed Item On Your Credit Report Can Screw Up Your Home Loan

Thanks to federal regulations, when you dispute an account on your credit report and the dispute is resolved in your favor, the credit reporting agency is required to remove or correct the account. Credit reporting agencies often don’t do this, though, and the Washington Post notes that it can come back and interfere with your next home loan application.

FTC Wants Your Input On How To Improve AnnualCreditReport.com

The problem with annualcreditreport.com—other than its name—is that getting your reports from the site is a little like dealing with GoDaddy: you have to deal with upsells and side-sells at every step. You can indeed get your free credit reports from the site, but you’ll also have to keep turning down other offers from the three participating bureaus. Hell, there are even ads (sorry, “sponsor” links) on the home page, the one place where you’d hope for the least consumer confusion.

You Paid Your Bill 3 Hours Early? Then It's 30 Days Late

John’s fiancee bought an Apple computer earlier this year, financing it with a Juniper Visa account, then paying the account off early. That’s the responsible thing to do, right? Not according to Juniper, which branded her as a filthy, filthy deadbeat. The bank marked the payment she sent in as “late” for arriving three hours before the end of the billing cycle.

Will My Credit Score Hurt If I Pay Off And Close My Credit Card?

Does paying off and closing a credit card hurt your credit score? That’s a two-part question. The answer to the first one is no, it helps, and the answer to the second is yes, closing your credit card hurts your credit score. Credit bureau Exerpian’s “Ask Max” says,

The Good, The Bad And The Ugly Of Fixing Credit Report Errors

A great way to improve your credit score is to get rid of errors on your credit report that are dragging you down, but how do you start?

"Help, I Fell For The Apartment Rental Credit Check Scam!"

Since posting an article about Craiglist apartment listing scams a month ago, we’ve heard from lots of people who fell for the scam. If you’re one of them, here’s what you need to know.

Erroneous Public Records Data, Or: Who The Heck Is This Hipolito Guy?

Kathy has an unusual problem. She thinks that there might be a problem with some of her public records and/or her credit report, but she isn’t sure how to find out how it got there, let alone remove it. See, there’s a man named Hipolito, with the same relatively common last name as Kathy, who keeps popping up in public records questions used to verify her identity. She has no idea who this man is, and neither does anyone in her family.

Experian Stoppped Selling FICO b/c Contract Dispute (FICO '08 Related?)

Just like I figured, the reason Experian won’t sell you your FICO score anymore is because of a contract dispute with the Fair Issac corporation, and I’m guessing it has to do with the rollout of FICO ’08

Four Unexpected Situations Where Bad Credit Hurts

If you aren’t planning on getting a big loan in the next couple of years, you probably shouldn’t be worried about your credit score right? Wrong.

Experian Yanks FICO Score Away From Consumers

Soon consumers will only be able to see two out of the three credit scores lenders use to judge their credit worthiness. Out of nowhere, Experian announced it will no longer be selling its version of the FICO score through myFICO.com.

6 Ways Your Credit Score Changes Thursday

A new system for determining your credit-worthiness, FICO ’08, rolls out this Thursday, and there’s nothing you can to do stop it. By these 6 changes, ye shall be judged:

Debunking Five Credit Score Myths

Your credit score. It’s amazing how one little score can have such an impact on our finances and how misunderstood that number can be. We’ll debunk five common myths about it right here, right now.