Prospective home buyers may need to pony up more cash up front to secure a mortgage if they are looking to buy in one of hundreds of zip codes that lenders now consider “soft markets.” Countrywide and GMAC recently ranked over 1,000 zip codes on a risk scale of 1-5. Lenders to moderate risk zip codes, ranked 1-3, may require borrowers to pay an additional 5% down payment. Unlucky buyers in high risk zip codes, ranked 4 or 5, are now automatically required to put down the extra 5%.

countrywide

../../../..//2008/01/28/countrywides-ceo-is-eschewing-a/

Countrywide’s CEO is eschewing a $37.5 million severance package as he leaves the company that profited torrid billions during the housing bubble, sometimes through duplicity and reams of questionable fees. After all, there’s only so many gold-plated Rolls Royces one can drive. [Reuters]

BREAKING: Bank Of America Buys Countrywide, CEO Gets Up To $115 Million Parachute

Hey there, sports fans: Bank of America will buy everyone’s favorite evidence-forging subprime lender, Countrywide for a cool $4 billion dollars.

Bank Of America May Buy Countrywide

Marketwatch says that Bank of America is in “advanced” talks to acquire Countrywide. No word on if said talks took place on Vader’s Star Destoyer or on Captain Hook’s pirate ship. Bank of America already bailed out Countrywide last year, chucking $2 billion into the troubled mortgage lender in exchange for preferred securities that could be converted into stock at $18. Countrywide is currently trading at around $7.75.

Countrywide Invents Evidence In Foreclosure Hearing

One of the nation’s biggest mortgage lenders, Countrywide, admitted to a Pennsylvania judge that it had fabricated some of the evidence supplied in a homeowner’s bankruptcy case. The evidence in questions were a series of letters the lender said it sent to the homeowner notifying her that she owed $4,700 because of problems with escrow deductions. The homeowner had filed for Chapter 13 bankruptcy and the mortgage debt was discharged after she met the terms of her 60-month bankruptcy plan. But then later Countrywide told her they were foreclosing on her house because she still owed them money. They said they had sent her three letters notifying her of the debt. The homeowner, her lawyer, and the Chapter 13 trustees say they never got them. When Countrywide produced the letters it supposedly sent, the homeowner’s lawyer noticed that the ones addressed to him didn’t have the address of his office at the time; they had the address of the office he had moved to AFTER the dates on which the letters were said to have been sent. What a bunch of crooks.

Countrywide Subpoenaed by Illinois Attorney General

Lisa Madigan, the attorney general of Illinois, is investigating subprime mortgage lender Countrywide “as part of the state’s expanding inquiry into dubious lending practices that have trapped borrowers in high-cost mortgages they can no longer afford,” says the New York Times.

Critics Say Countrywide Isn't Doing Enough To Help Foreclosed Homeowners

Countrywide is catching hell from consumer advocates who say they’re not doing enough to help the homeowners they’ve foreclosed on.

Countrywide Mortgage Adjustment Getting Outsourced To India

An excellent NYT article alludes to Countrywide Mortgage’s AOL-esque culture of phone reps only concerned about boosting their personal stats, regardless of the ruin it would spell for its customers.

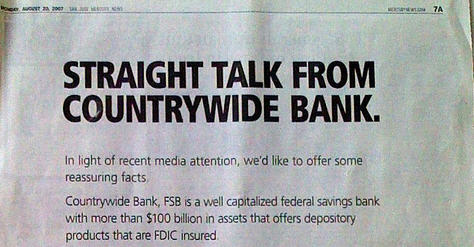

Countrywide Gets Another $12 Billion In Bailout Money Financing

Reuters is reporting that Countrywide has announced that it has secured an additional $12 billion in financing to help it hang on through the housing slowdown.

WaMu Says Housing Market In "Perfect Storm"

“The combination of rising delinquencies, higher foreclosures, more housing inventories, increasing interest rates on many mortgages and greatly reduced availability of mortgages due to limited liquidity is creating what we call a near-perfect storm for housing,” Chief Executive Officer Kerry Killinger said.

Inside The Countrywide Subprime Lending Frenzy

The New York Times has a very interesting article about the business practices that resulted in Countrywide’s dramatic spiral into the dirt. Recently, the nation’s largest mortgage lender had to tap $11.5 billion in emergency credit and was the beneficiary of a $2 billion investment bailout from Bank of America.

Countrywide Borrows $11.5B from 40 banks

Countrywide has secured $11.5B in financing from 40 banks in an effort to remain afloat as the mortgage market crashes.

Countrywide, America's Largest Mortgage Lender, May Have To File For Bankruptcy

“If enough financial pressure is placed on Countrywide or if the market loses confidence in its ability to function properly then the model can break, leading to an effective insolvency,” Bruce wrote. “If liquidations occur in a weak market, then it is possible for Countrywide to go bankrupt.”

Countrywide Mortgage Identity Theft: We Can’t Find the Crime

We haven’t been able to determine to what degree the identify theft letters from mortgage companies are legit. But thanks to an astute reader ‘fotonique,’ we’ve discovered what might be the source of the letters being sent out from other mortgage companies, including ABN-AMRO.

Mortgage Company Lying About Identity Theft to Promote Identity Theft Protection?

This is potentially heinous. Ed writes:

Attached is a copy of a letter sent to me most recently by Countrywide, my mortgage holder for some years now, but also by another company, a mortgage broker, from NJ with whom I am not affiliated (they implied I was a customer). [Ed’s qualified with us that he got the exact same letter from two separate companies. -Other Ed.] I unfortunately threw the other one away in disgust after calling them and finally harassing them until they admitted that it was just a marketing ploy. The fact is that their claim that one of their employees ripped off identities of applicants is a complete fabrication and a scam to get you to sign up for their identity theft insurance products (the first year is free, oh yeah I’m sure). The fact that large financial services companies are blatantly lying to their own customers is mind boggling even in this day and age. Try calling the number here and speaking to the Zuckerman woman, or ask the name of the law enforcement agency they reference. What blatant bullshit.

We did call the company, but they wouldn’t give us any details about which organization they were working with to solve the ‘problem.’ We were told that if we had an account with Countrywide, they could look at our account to see if we had been affected by the (presumably apocryphal) rogue employee.