To the naked eye, general purpose reloadable prepaid cards function much like long-established credit and debit cards and have quickly gained traction with consumers, especially those who have been shut out from traditional banking options. In fact, about 23 million consumers use prepaid cards regularly. [More]

consumer financial protection bureau

CFPB Proposes Delay Of New Mortgage Rules By Two Months

Prospective homebuyers anticipating a more streamlined disclosure process while buying their dream home may have to wait a little longer, as the Consumer Financial Protection Bureau is proposing a delay to new rules. [More]

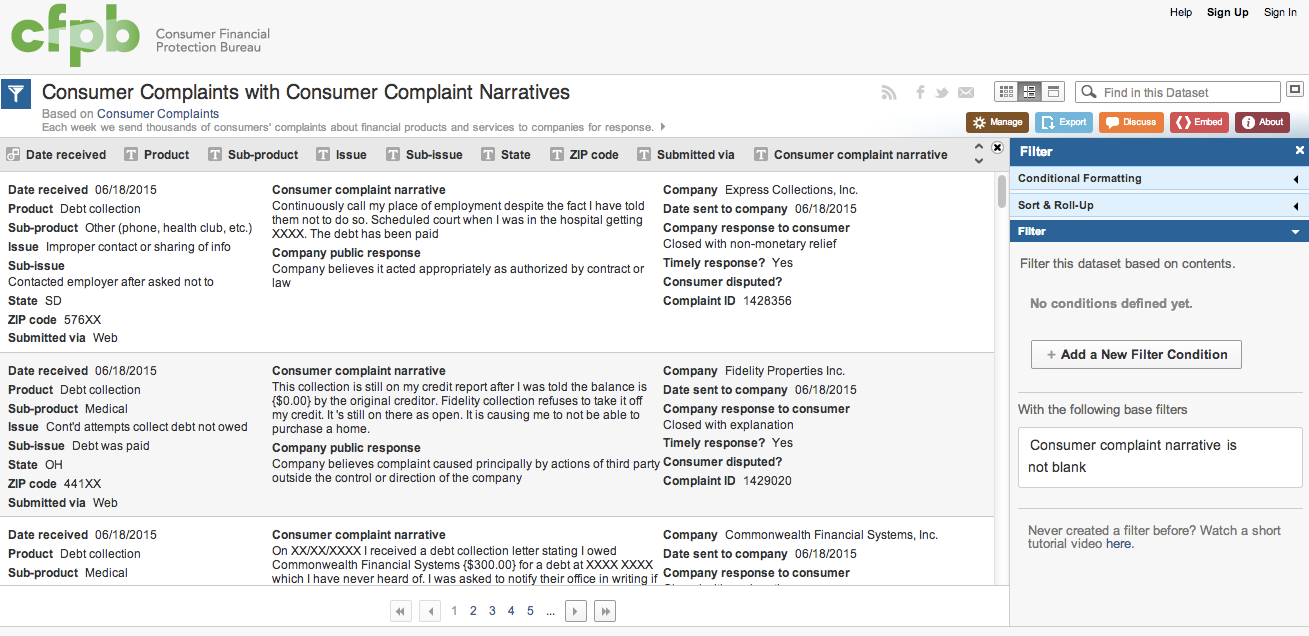

CFPB Publishes More Than 7,700 Detailed Financial Grievances To Public-Facing Database

Sharing your nightmare experience with a financial institution, product or service could help another consumer avoid such dastardly situations. And from the looks of the Consumer Financial Protection Bureau’s new public-facing Consumer Complaint Database, people have a lot to share. [More]

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

Medical Debt Collector Must Pay Consumers $5.4M For Improperly Handling Disputes

What happens when you combine expensive — and often unanticipated — medical bills and overzealous debt collectors? An environment ripe for abusive, unfair collection practices. At least that appears to be the case for an operation that must pay $5.4 million in relief to consumers for allegedly mishandling credit reporting disputes and preventing individuals from exercising their debt collection rights. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

CFPB Sues Auto Lender For Aggressive Debt Collection Tactics Against Servicemembers

By now it should come as no surprise that lenders shelling out thousands of dollars to help consumers make purchases for things like houses and cars often use lies and threats in attempts to recoup those funds. And while those tactics might result in some payments, they will also likely draw the ire of federal regulators. [More]

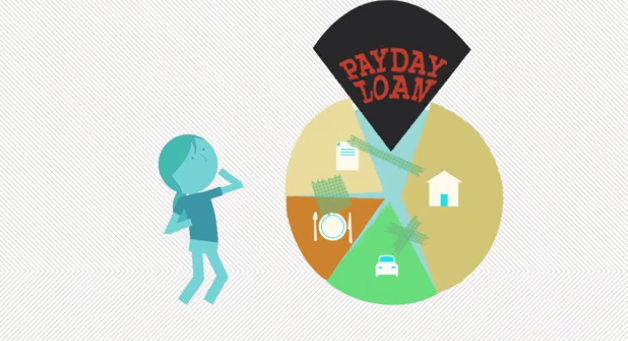

Pew Charitable Trusts Illustrates The Devastating Effects Of Payday Lending, How It Can Be Fixed

Back in March, the Consumer Financial Protection Bureau took its first long-awaited step in reining in the payday loan industry by releasing an outline for potential regulations over the small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer groups were quick to applaud the steps, they also expressed concern that more could be done to protect people from the devastating consequences of such loans. This week, Pew Charitable Trusts released a video detailing the predicament nearly 12 million Americans face every year when taking out payday loans and how regulators might be able to find an answer. [More]

No Surprise Here: CFPB Finds Reverse Mortgage Ads Create False Impressions

Last year, Consumerist reported on why you shouldn’t run out to sign up for a reverse mortgage just because Fred Thompson or other paid spokespeople opine about the benefits in national advertising campaigns. Today, the Consumer Financial Protection Bureau echoed our fears that these ads can be misleading by releasing the results of a focus group and issuing an advisory warning consumers that promotions for the costly product often don’t tell the whole story. [More]

CFPB Fines Mortgage Company $20M For Pushing Customers Into Spending More Than They Had To

While a report earlier this year suggested that consumers don’t spend nearly enough time shopping for the right mortgage, that doesn’t mean lenders are off the hook for purposefully steering potential homeowners into costlier mortgages. Because doing so will land a company in hot water with federal regulators. Just ask RPM Mortgage and its top executive, who must now pay $20 million for their allegedly deceptive practices. [More]

58 Senators Urge CFPB To Create Rules Against Forced Arbitration Clauses In Financial Products

A month after legislation was introduced to eliminate mandatory arbitration clauses in employment, consumer, civil rights and antitrust cases, a coalition of 58 lawmakers and several consumer advocate groups are urging the Consumer Financial Protection Bureau to take things a step further by protecting consumers from forced arbitration clauses in financial services contracts. [More]

CFPB Launches Financial Coaching Program For Transitioning Servicemembers, Financially Underserved

The first step in living a fiscally responsible life is to understand what financial products are available and how they fit into your goals. Or at least that’s the idea behind the Consumer Financial Protection Bureau’s recently launched Financial Coaching Initiative that aims to assist certain groups of consumers become financially independent and knowledgeable. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

Nearly 26 Million American Adults Have No Credit History

While a recent survey found that nearly 35% of consumers have never pulled their credit report, a new report from the Consumer Financial Protection Bureau points out that some of those consumer might not have anything on their reports anyway. [More]

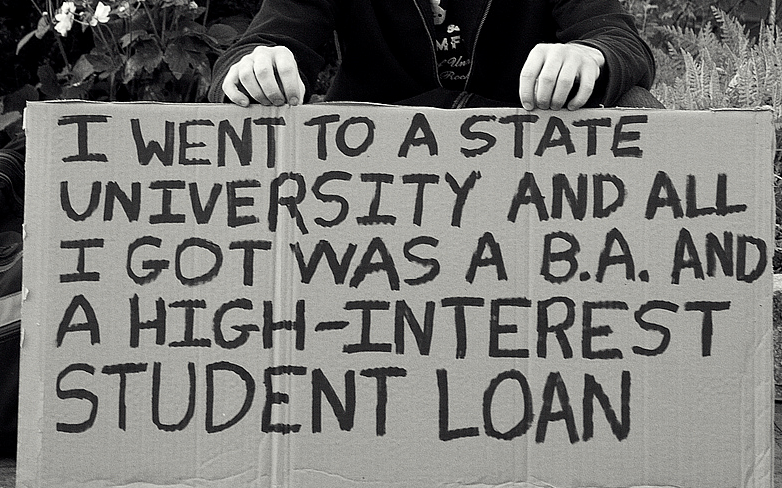

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

Arbitration Fairness Act Would Reinstate Consumers’ Right To Sue In Court

Companies have been taking away your right to sue them when they screw up for years, using small, hidden clauses to require mandatory binding arbitration instead. After years of consumer groups voicing their concern over this anti-consumer practice, there’s finally a new bill in congress that proposes to bring back your right to sue.

Executives & Loan Officers Must Pay $600K For Being Part Of Illegal Mortgage Kickback Scheme

Nearly five months after Wells Fargo and JPMorgan Chase agreed to pay more than $35 million – including $11.1 million in redress to affected consumers – for their part in an illegal mortgage kickback scheme, the purported masterminds behind the “pay-to-play” arrangement are finally facing action from federal regulators for their shady dealings. [More]