If you’ve ever bought a house, you’re more than familiar with the mountain of paperwork you have to deal with at closing, not all of which are easy to understand. But a study claims that homeowners who utilize a newer electronic method for reviewing closing documents may better comprehend what they’re signing. [More]

consumer financial protection bureau

Regulators Sue To Shut Down Illegal Offshore Payday Loan Network

While most of us think of payday lenders as small-time storefront operations, there is also a complicated web of interconnected payday businesses operating outside the U.S. borders, but illegally issuing costly short-term loans to American borrowers. A newly filed lawsuit hopes to put an end to one such network. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

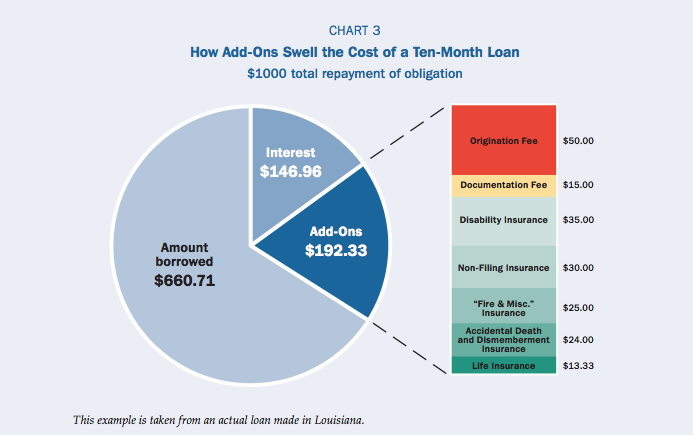

Most State Laws Can’t Protect Borrowers From Predatory Installment Loans, Open-End Lines Of Credit

As regulators continue to craft rules meant to crackdown on costly and harmful short-term payday lending, companies are offering alternative products like installment loans and open lines of credit to consumers. But, as it turns out, these cash infusions can be just as devastating to those in need, and few states offer sufficient protections for borrowers. [More]

Western Union-Owned Mortgage Company Must Return $33.4M To Customers

A mortgage payment company owned by Western Union has agreed to return $33.4 million to consumers following allegations that it misled customers into thinking they could save thousands of dollars on their home loans. [More]

Appeals Court Revives Texas Bank’s Lawsuit Challenging Constitutionality Of CFPB

This week, the Consumer Financial Protection Bureau celebrates its fourth anniversary of protecting consumers from harmful practices and shady characters in the financial sector. But instead of buying the regulatory arm a big ol’ birthday cake, a federal appeals court is gifting the Bureau with a revived lawsuit challenging its constitutionality. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

Citibank Must Pay $700M Over Illegal Marketing, Collection Practices

The Consumer Financial Protection Bureau ordered Citibank and one of its subsidiaries to pay $700 million in relief to more than 8.8 million consumers for engaging in a string of illegal credit card practices, including deceptively marketing and billing for debt protection and credit monitoring services, and misrepresenting fees related to debt collection actions. [More]

CFPB Reminds Retailers They Can’t Accept Military Allotments For Certain Purchases

Allotments allow military servicemembers to automatically direct some of their paycheck to parties of their choosing, ideally for savings, insurance premiums, housing payments, and support of dependents. Until recently, allotments could also be used to make retail purchases, but such transactions weren’t covered by many of the legal protections that come with traditional payment methods like electronic checks and debit cards. Recently enacted rules now prohibit the use of allotments for buying personal property, and federal regulators are reminding retailers they have to follow the law. [More]

CFPB Launches Monthly Reports To Showcase Financial Difficulties In Specific Areas Of The U.S.

Have you ever wondered if people on the other side of the country run into the same difficulties dealing with financial institutions as you do? Well, wonder no more, as the Consumer Financial Protection Bureau announced today that it will provide a peek into the overall state of consumer complaints in the U.S. and how individuals in certain areas deal with companies providing financial products and services through a new monthly series. First up: Milwaukee, WI, and debt collection. [More]

Honda Finance Unit Must Pay $24 Million For Charging Higher Interest To Non-White Borrowers

Under the Equal Credit Opportunity Act, creditors are prohibited from discriminating against loan applicants based on race or national origin. But that was a rule Honda’s financing unit allegedly violated, resulting in thousands of African-American, Hispanic, and Asian and Pacific Islander borrowers paying higher interest rates than white borrowers for their auto loans. Now, as part of a settlement with federal regulators to resolve allegations that the company allowed discriminatory loan pricing, the company must provide $24 million in restitution to borrowers. [More]

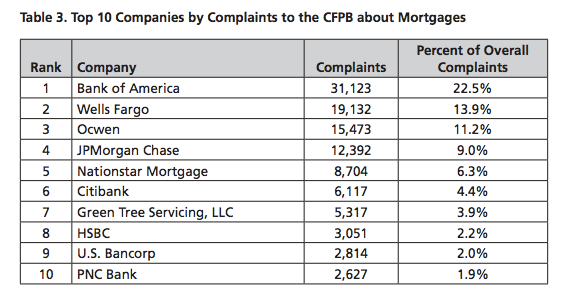

Bank Of America, Wells Fargo Top List Of Most Complained About Mortgage Issuers

For the past four years, the Consumer Financial Protection Bureau’s Consumer Complaint Database has seen its fair share of consumer issues related to mortgages. In fact, complaints regarding loan modification, collection, foreclosure, loan servicing, payments and escrow accounts continue to be one of the biggest financial thorns in consumers’ sides. And the worst offender? Bank of America. [More]

CFPB Releases Educational Guides To Help Non-English Speakers Avoid Scams, Understand Financial Issues

Understanding the world of finance can be difficult for just about anyone in this country, but especially so when the rules of the industry are written in a language that you might not be proficient in. For these consumers, the Consumer Financial Protection Bureau has created a new set of guides aimed at helping them avoid financial devastation. [More]

Regulator Issues “Guiding Principles” For Making Real-Time Payments Safe, Secure

If you buy something with a debit/credit card or an online check, there can be a delay of hours or days before the other party gets those funds. Advances in technology are allowing payment platforms to cut that down to mere seconds, which could help consumers by preventing banks from re-ordering multiple transactions to maximize overdrafts. But as non-cash payments inch closer to real-time transactions, federal regulators want to ensure that companies are following certain best practices to make things safe and consumer-friendly as possible. [More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]

Consumer Groups Urge CFPB To Provide Better Oversight, Rules Over Student Loan Servicing

Two months ago, the Consumer Financial Protection Bureau took the first steps in tackling issues within the student loan servicing arena by asking consumers and organizations to share their thoughts on the state of an industry that is tasked with recouping the more than $1.2 trillion in outstanding student loan debt in the U.S. Now, as the deadline to submit comments has come and gone, we know a bit more about just how the industry is perceived by those tasked with sticking up for consumers. [More]