Citi CEO Vikram Pandit is reassuring investors today after his firm lost $7.6 billion in 2009 by telling them to look on the bright side — at least they fired 100,000 people. [More]

citigroup

Citi Promises No Foreclosures Or Evictions For One Month

About 4,000 borrowers who were either scheduled to have foreclosure sales or who were going to receive foreclosure notices will be left alone until January 17th, according to CNN. [More]

Citi Getting Out From Under TARP

Citigroup plans to repay $20 billion that it borrowed from U.S. taxpayers through the Troubled Asset Relief Program. That’s good news for Citi execs, who will be able to pay themselves whatever they want once they’re free from TARP restrictions. And it may be good for taxpayers, as long as Citi doesn’t take any of those ultra-cheap Federal loans like BofA did. Citi shareholders? Hey, somebody’s gotta pay for this. [More]

Former Citigroup Head Waxes Nostalgic For Regulation He Helped Kill

Retired head of Citigroup John Reed seems to have some misgivings about the repeal of the Glass-Steagall Act of 1932, which his company lobbied to kill in the first place.

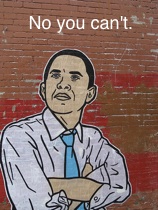

Government Orders Pay Cuts For Bailed-Out Firms

The huge salaries and bonuses paid to executives of banks and other firms that received government bailout funds have been the subject of a lot of taxpayer rage. The Obama administration listened, and will order pay cuts.

Citibank Markets To Only Rich People, Large Cities

True to its name, we suppose, Citibank will be focusing its marketing efforts on six major U.S. metropolitan areas and wealthy customers, and not the rest of us deadbeats.

Bailout Banks Will Keep Using Your Money For Private Jets

Under government pressure — and by “pressure” we mean asking meekly in a very soft voice — companies that have received funding from the taxpayer-funded TARP program have outlined the controls they plan to put in place to limit “luxury expenditures.” And — surprise! — the definition of “luxury” is very different for the corporate titans spending your money. While most big banks have put at least some limits on personal use of corporate jets, many seem to echo Bank of America‘s policies on official use, which state that that execs can use private planes for “safety and efficiency reasons,” no advance approval required.

Welcome To The New Gilded Age, Fueled By Your Money

Remember all of those banks that were “too big to fail” and had to be bailed out? Newsweek’s Niall Ferguson is out with a report today pointing out that a year after the collapse of Lehman Brothers signaled the start of the bailout boom, they’re still big, and thanks to the safety net you tossed them, they’re “back to making serious money and paying million-dollar bonuses. Meanwhile, every month, hundreds of thousands of ordinary Americans face foreclosure or unemployment because of a crisis caused by … a few Wall Street giants.”

Citibank To Raise Salaries By 50% In Reaction To Bonus Limits

The AP is reporting that Citibank will be raising salaries for certain employees by as much as 50% in order to offset the new bonus restrictions. The company faces the restrictions because it took bailout money.

Citibank To Spend $10 Million On New Offices For Executives?

Bloomberg is reporting that Citibank is planning to spend at least $3.2 million for basic construction, and as much as three times that much after architects fees and other expenses are paid, to renovate the executive offices at the bank’s Park Avenue headquarters.

Citi "Homeowner Helper" Site Merely Potemkin Village?

Did Citi set up its “homeowner helper” site to comply with Obama’s mortgage assistance programs, but then not actually attach it to any humans that will help homeowners? After inputting his info on the site, Citi told reader CoarseLive to schedule an appointment with a representative. No one ever called him. When he tried calling Citi directly, multiple agents told him they had no idea what he was talking about, and they hung up on him, again and again. His story, inside…

Markets Rally On Bernanke Comments, Citigroup Profits

Full Text of Bernake’s Speech [Federal Reserve] (Photo: AGRR 4059)

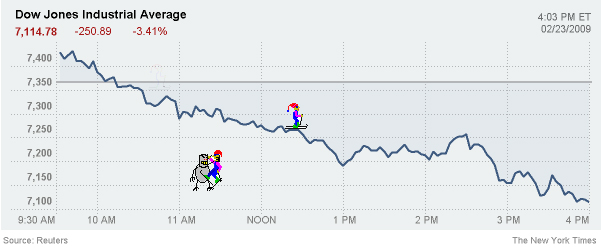

Freak Out Continues: Markets Close At Lowest Level Since 1997

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

Should Citibank Pay $400 Million To Name A Stadium While Taking Taxpayer Money?

The New York Mets are getting a new stadium. It’ll be called Citi Field and that honor cost Citibank (and by extension, one could argue, taxpayers) $400 million.

White House To Citi: Don't Even Think About Buying Luxury Jets With Taxpayer Money

Yesterday, we wrote that Citigroup had decided to spend $50 million of its bailout money on a French luxury jet to ferry execs around town. The White House was not pleased about this.

Bailed Out Citigroup Stimulates French Economy By Purchasing $50 Million Corporate Jet

With $45 billion in taxpayer funds burning a hole in its pocket, Citigroup is purchasing a $50 million Dassault Falcon 7X, according to the New York Post. Apparently none of the existing jets that ferried execs to Washington to ask for bailout funds was ironic enough.

US Bails Out Citigroup

Federal regulators took extreme steps to prop up Citigroup, backing $306 billion of mainly real estate loans and securities and directly injecting money by buying $20 billion of preferred stock. The $20 billion of stock will pay an 8% dividend. Regulators will also get an additional $7 billion of preferred stock. Citigroup will basically halt dividend payments for 3 years and limit some executive pay. It will also implement the FDIC’s loan modification plan, which is close to the one it had already announced for itself.

20% Of Citigroup Cardholders Can Expect Rate Increases For 2009

If you have a Citigroup-issued credit card and you haven’t had a rate increase over the last two years, expect to be notified of a 2-3% rate increase on your November statement. Congratulations! You’re going to help Citigroup offset its losses in the global credit card division, whether you were directly part of those losses or not. As the New York Times points out, by doing this Citigroup is breaking the promise they made to Congress in 2007 that they would not arbitrarily raise rates on accounts—which may be why they’re offering a fairly lenient opt-out policy.