Chase Customers Can No Longer Use Credit Cards As Backup Funding For Overdrafts Image courtesy of frankieleon

Last year, banks made $11.16 billion from customers who overdrew their accounts with a majority of those overdraft fees going into the pockets of the three largest banks: Wells Fargo, Bank of America, and JPMorgan Chase. There could be more fees headed Chase’s way soon if customers don’t pay heed to the company’s changing overdraft policy.

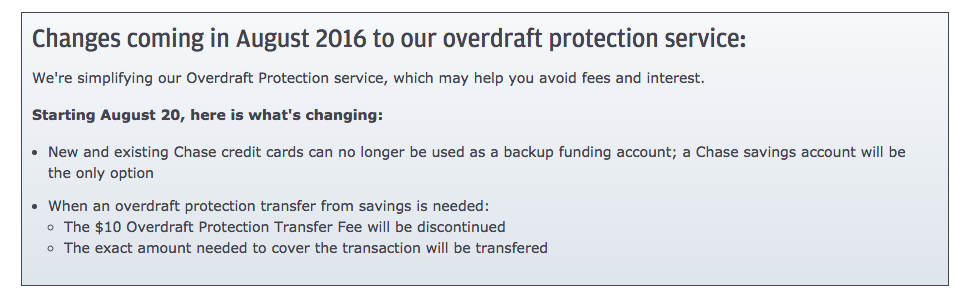

Starting Aug. 20, Chase will no longer allow customers to link a credit card to their checking account as a cushion in case they are felled by an overdraft transaction.

Under the revamped policy, account holders can only link a Chase savings account to a personal checking account to provide back up funding.

The processes essentially work the same: if the user overdrafts, the bank automatically pulls the money needed to complete the transaction from the linked account.

Previously, Chase charged a $10 Overdraft Protection Transfer Fee when a transaction required the linked account. Under the new policy, the bank says it will discontinue that fee.

A rep for Chase tells the Chicago Tribune that most customers enrolled in the overdraft protection program already have a savings account linked to their checking account.

Over the last six months, the rep says only 1.5% of all overdrafts have gone to a credit card.

The company says on its website that the change will simplify the Overdraft Protection service to help account holders avoid fees and interest.

Still, the Tribune points out that the change could cause issues for some customers that may not be aware of the new policy.

Once the credit card is removed from the equation, and the account is overdrawn, the customer risks being charged an insufficient funds fee. For Chase customers, that cost is $34.

While offering an overdraft protection plan that links to a secondary account might be convenient for consumes, Rebecca Borne, senior policy counsel for Center for Responsible Lending, tells Consumerist the best approach would be for banks to simply stop charging high overdraft fees.

Instead, banks could decline point of sale transactions that would create a negative account balance.

Chase changes overdraft policy: No credit cards for backup funding [Chicago Tribune]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.