What makes the next story about reader Pavel trying to get satisfaction from Chase executive customer service so interesting is that Pavel himself is Executive Assistant to the President of his company. He knows how executive customer service is supposed to work. As he puts in, he has the ability to “walk on water” within in his company. Which makes his experience with Chase, where they closed his account for having a zero-balance for less than a week, and then held his money hostage, all the more frustrating…

chase

Reach Chase Bank Executive Customer Service

If you have a problem that regular customer service hasn’t been able to solve, give this gal working in the Chase Bank executive customer service office a shot: 713-262-3866, Michelle Crabtree. Although, she figures in an upcoming reader complaint, and not favorably. If you have a specific credit card complaint, that info is here, and the general Chase Bank executive customer service desk is 800-242-7399.

Man Arrested For Trying To Pass A $360 Billion Check

Meet Charles Ray Fuller, 21, of Crowley, TX. He was arrested on April 22 after allegedly trying to pass a check for $360 billion at a Forth Worth Chase bank.

Round 31: Chase vs United Healthcare

This is Round 31 in our Worst Company in America contest, Chase vs United Healthcare. Vote which sucks more, inside…

Banks Canceling All App-O-Rama Player's Credit Cards?

Are credit card companies cracking down on “app-o-rama” (AOR) gamers, those folks who do a slew of credit card applications at the same time for to get as many bonus offers, credit lines, and 0% balance transfers as they can? After some of these FatWallet forum members did an AOR, all their credit cards were closed with one bank. For one guy, stook2001, this meant five new Citicard credit card accounts as well as three already existing Citicard accounts in good standing. The only reason given for the closing was the number of inquiries on his credit report. AOR thrived when credit card companies were throwing all sorts of enticing promotional offers in a desperate drive to get more customers. Now that credit card defaults are rising and credit card companies are trying to get rid of customers that might end up as liabilities, AOR could be just as on its way out as a no-doc stated income interest-only option-ARM mortgage.

Bear Stearns Bag Found At Knickknack Shop

I spotted a tote bag for Bear Stearns, the investment bank that recently nearly collapsed and JP Morgan Chase purchased, on sale outside a used goods store here in Brookyln. No doubt it was pawned off by one of the many recently liquidated Bear Stearns employees in the New York area (hey, that Tivo doesn’t pay for itself). I didn’t check the price tag, but it was probably more than $10, which is more than can be said for a share of Bear Stearns stock. Note the new Chase bank sign reflected into the store window.

How To Get An "Iffy" Loan Approved

Sometimes when you’re trying to get a borrower approved for a mortgage the system will tell you something stupid like “this person is not qualified.” Luckily, this internal document from Chase shows a few tips and tricks you can use to tweak a borrower’s profile so they can get a stated-income asset loan (which recently has received the unfair pejorative of a “liar’s loan” by the sensationalist media apparatchik) a piece of The American Dream. It’s specific to Chase’s internal loan approval system. Irregardless, many of the principles have universal application, no matter what level of the fast-paced exciting field of sub-prime mortgages you work. Highlights:

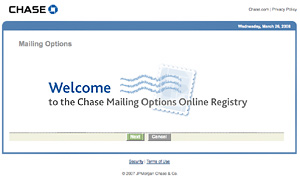

How To Get Chase To Stop Sending You Direct Mail Offers Over And Over And Over

Anyone who’s a customer of Chase knows how hardcore they can be about direct mail advertising. Martin writes:

Over the last 12-24 months, I’ve been annoyed with about 3-4 mailings a week from Chase for various add-on services and useless products. Already a customer of theirs, I did not appreciate this onslaught of advertising. Here’s a quick opt-out website in which you can cancel all direct marketing letters from Chase… dnmoptions.chase.com.

../../../..//2008/03/17/chase-is-no-longer-increasing/

Chase is no longer increasing the rates of cardmembers based on their credit-bureau information as of March 1, 2008.

Chase Reactivates Dead Card Without Your Permission

Erica writes:

Recently, my husband and I got two new Chase credit cards in the mail. I didn’t look closely, assuming that this was a new card for our never-used Chase Mastercard account. This account has been around for seven years, but we prefer another card with a rewards system; the Mastercard account is open only to benefit our credit rating. Therefore, no urgency in activating it — I dropped it in the bill pile to deal with later.

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

Banks Make Up For Their Subprime Losses By Charging You $3 To Use An ATM

JP Morgan Chase and Bank of America now charge $3 for non-customers to use their ATMs. Wachovia increased fees at a potion of its ATMs, and the average fee that your bank charges you to use another bank’s ATM has risen as well.

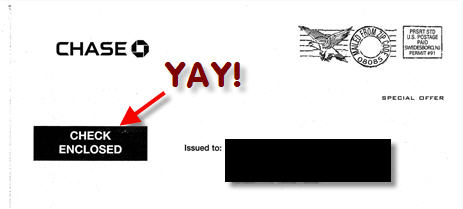

Chase: By Cashing This $9.25 Check You Agree To Give Us $59.99

Reader Aaron writes in to complain about a “scam” that he can’t believe is legal. Many of you know about this little marketing tactic, and we’ve written about it before, but some of you probably do not.

10 Confessions Of A Chase Customer Service Rep

Do you know the one thing to never say to a customer service rep if you’re late on your bill? Do you know how Chase ranks you, and how you’re ranked determines whether they help you out in a bind? Do you know the best way to get what you want from customer service? After you read these 10 confessions from a Chase customer service rep, you will.

Shenanigans With Chase Credit Cards?

Anyone else get a call from Chase about their credit cards?

I thought I would pass along a problem I ran into today. I received a couple phone calls from Chase Bank fraud department concerning 2 credit cards I have with them (Amazon Visa and Chase Freedom Card). They reported (in a separate call for each card) that both cards are suspected of being compromised and that they are being closed.

82-Year-Old Woman Sues Chase To Recover Life Savings

Chase is refusing to honor a cashiers check for $19.700.22, 82-year-old widow Willie Floyd’s life savings. Willie stored the check, originally drawn by her late-husband in 1985, in a $10 per year safe deposit box at the local bank. When she tried to shift the funds into a regular savings account last year, she was told that the check expired after five years, and that her life savings now belonged to the state.

Chase Resets Marketing Preferences, Asks You To Opt-Out Again

Chase will reset everyone’s marketing preferences under the guise of providing “more options to specify which mail offers you do not want.” Remember when you originally opted-out? They didn’t quite understand. What about their Value Added Products And Services and Used Vehicle Financing? Unless you opt-out again by January 24, Chase will acknowledge your implied change of heart. Read their notice after the jump.