WaMu went on an insane building spree in Chicago a few years ago, and when combined with Chase, already a huge player in the Chicago market, it became obvious that there are just too many damn bank branches. Chase recently announced that it would close almost 300 WaMu locations nationwide — 57 of them in the Chicago-area alone. The bank branches replaced local businesses during the boom, but will they come back during the bust?

chase

WaMu: Please Take All This WaMu Branded Crap Before We Cease To Exist

Reader James says he doesn’t want all this crap that the teller at WaMu forced on him earlier today. The Frisbee sucks, he doesn’t like caramel corn, and his refrigerator isn’t magnetic.

Chase Replaces Automatic Payments With Monthly Minimum On All WaMu Credit Cards

Is your Washington Mutual credit card set to receive automatic payments? If it is, and you pay anything less than the full balance, then come March 6, you’ll be paying only the monthly minimum. Why? Because it’s an easy way for Chase, WaMu’s new corporate overlord, to make money off unsuspecting cardholders…

8 Banks Took $153.4 Billion In Tax Payer Money, Spent $845 Million On Naming Rights

Should bailout out banks be buying naming rights? Dennis Kucinich doesn’t think so, and last week he urged the Treasury department to cancel one such deal between Citibank and the New York Mets. Now Bloomberg says that seven more bailed out banks are spending money on stadium rights.

Chase Wants You To Pay Your Taxes By Credit Card. Don't.

Chase has emailed its customers a friendly reminder that if you can’t pay your taxes this year, you can charge them on your Chase credit card! Even the IRS site suggests you consider using a credit card if you can’t pay your debt. However, before you do something as debt crazy as charge up a high credit card balance, consider the following points and make sure you’re doing the most financially responsible thing.

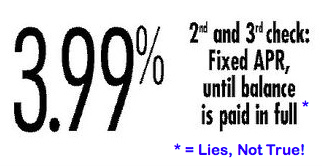

Chase Promises To Honor Promotional APR Until Balance Is Paid Off Or They Change Their Mind—Whichever Comes First

Chase doesn’t want to honor an old promotion promising to lock in a customer’s APR until their balance is paid off, so they’re just ignoring the original terms and jacking up interest rates. The bank wants to hike a promised 3.99% rate to either 7.99%, or 5% of the total balance plus a $10 monthly service charge, terms that are dull enough to put you to sleep until you receive the next month’s bill. Inside, Credit Slips walks us through how this is legal, along with tips for recapturing the stolen promotional rate.

Angry Consumer Slices and Dices Credit Cards To Protest Rate Increase

Like many Americans, Christian and his wife got themselves into debt with a car loan and by using credit cards to pay for their wedding. Now they’ve been working on paying off their debt and had gotten it down from $35,000 to $15,000 — when their credit card companies decided to randomly raise their APR. Now they’ve cut up their cards forever in protest.

Family Receives 23 Pounds Of Credit Card Applications In A Year

I guess on some level we were all wondering just how many credit card offers we get in a year, but one Chicagoland family decided to count them. And weigh them.

Chase Eats All WaMu Credit Cards In March, What Happens?

When Chase completely takes over the old WaMu credit card division in March, a new super-power will be granted to WaMu credit card customers who also have a Chase credit card, reports CreditMattersBlog. As long as you have a zero balance on one of the cards, the two cards will be combined and your Chase’s credit limit will now be the sum of the two credit limits. WaMu cardholders without a Chase card will get to convert their cards into Chase cards.

WaMu To Close 299 Branches, Many In Chicago

Chase has announced that they will be closing 299 branches, 57 of them in the Chicago-area alone. The Daily Herald says that most of the branches are across the street or down the block from existing Chase branches and consolidation is necessary. The remaining WaMu branches will be converted to the Chase brand.

No More Free FICO Scores For WaMu Customers After March 9

It looks like after March 1, 2009 quondam Washington Mutual cum Chase customers won’t be able to get their FICO scores for free anymore through their bank. Those people in the picture look pretty excited about yet another WaMu feature being taken away. Woohoo, indeed. [Chase] (Thanks to Luke!)

Chase Invents $120 Annual Fee For Balance Transfer Customers

Some customers who transferred their balances to Chase were hit with a new fee this month: a $10 monthly surcharge just for having the account in the first place. This $120 annual fee is pure profit for Chase and doesn’t get applied to the balance. Oh, and they’re doubling the minimum payment as well, although the sooner you pay off your Chase credit card and close it, the happier you’ll be.

Kiss Courtesy Overdraft Fees Goodbye With WaMu Debit-Only Card?

Whoever came up with the name “courtesy overdraft fee” is one smart cookie. They figured out a way to let you do something you don’t want to do, charge you a fee, and make it sound like they’re doing you a favor. WaMu is one of the few banks that let you…

Secret Phone Numbers And Email Addresses To Reach Executives At 101+ Companies

Inside, email addresses, phone numbers, and addresses for over 100 different companies to inject your customer service complaints into their corporate executive offices, and get it well on the way to success.

Chase To Fix 400,000 Option-ARM Mortgages

Chase will turn 400,000 high-interest option-ARM mortgages into lower-cost fixed ones, the bank announced this Friday. Foreclosure processes on the loans will be stopped for 90 days while the procedure gets set up. Banks mainly have latitude to adjust the mortgages they themselves own. The complexities of modifying a loan that may have been sold and repackaged into a security are intricate. For one, hedge funds have threatened to sue banks if they modify the loans underlying their bonds. So hooray for the lucky 400,000. Only a few more million to go. If you’re a homeowner facing foreclosure and you’re unable to get your lender to work with you, try contacting the HOPE NOW hotline at 1-888-995-HOPE for free advice from a home preservation counselor.

March Madness-Style Bracket Makes Bank Mergers Fun

TechCrunch has posted this “March Madness” style bracket of the recent financial meltdown. It was reportedly created by a general partner at Sansome Partners named Mark Slavonia, says TC.

This WaMu Sign Is Incredibly Accurate

I’m currently a Chase customer, but my brother is WaMu. As he was walking down the street in Brooklyn the other night, he managed to catch this picture.