Many bank accounts, and almost all credit cards, wireless services, private student loans, and payday loans contain clauses in their contracts that strip consumers of their right to sue these companies, and their right to join others in a class action, effectively allowing businesses to sidestep the legal system. While lawmakers in Congress debate the issue, and the U.S. Supreme Court has repeatedly given its approval to these practices, the Consumer Financial Protection Bureau is making good on its pledge to restore consumers’ constitutional right to having their day in court. [More]

cfpb

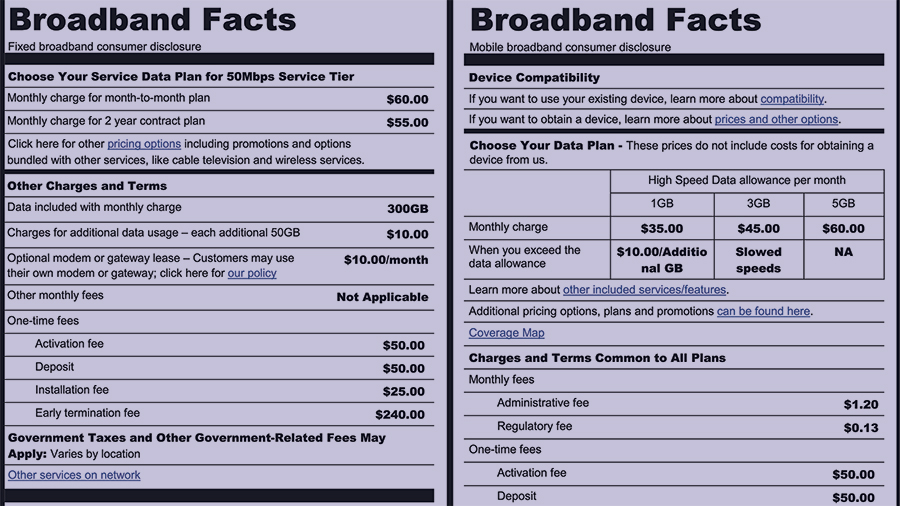

FCC, CFPB Announce Nutrition-Like Labels For Broadband

When the FCC narrowly approved the Open Internet Order a year ago, most of the discussion involved “net neutrality” — the rules against Internet service providers being able to block, slow down, or prioritize access to specific sites and content. However, the Order also contained new transparency rules requiring broadband providers to, well, be more transparent with consumers, which is why today the FCC announced a new labeling system to help keep consumers informed. [More]

Banks Are The Key To Stopping Scammers That Target One In Five Older Americans

If we’ve said it once, we’ve said it a million time: those who attempt – and often succeed – at scamming senior citizens of their savings are the worst of the worst when it comes to already unsavory, immoral fraudsters. Despite regulators’ attempts to take these operations out of commission, one in five older Americans report being the victims of financial exploitations either by ne’er-do-wells or family members. [More]

Citibank Caught Screwing Up Credit Card Debt Collections, Must Refund $5M

If you had a hunch that Citibank’s credit card division wasn’t terribly good at its job, you were right. Citi sold credit card debt to buyers with inflated interest rates, failed to tell those debt buyers when it accepted payments on these cards after the debt had been sold. [More]

Colleges Warned About Making Secret Deals With Credit Card Companies

In spite of rules intended to crack down on the once-rampant mis-marketing of credit cards to college students, some schools have not been fully transparent about lucrative agreements they’ve made with card companies, and could face federal penalties. [More]

10+ Things Consumers Should Know About The New Federal Spending Bill

This morning, after months of slapping on, then removing, then replacing pork barrel riders on the federal Consolidated Appropriations Act of 2016, we finally know exactly which add-ons made it into the omnibus spending bill and which ones didn’t. [More]

Groups Call On AmEx, Chase, Citi, Toyota, Others To Stop Forcing Customers To Sign Away Their Legal Rights

Once upon a time, if a company wronged a customer — not just by screwing up an order or having poor customer service, but by actually breaking the law — that customer could file a lawsuit and try to hold the company accountable. And if the company wronged lots of customers in the same way, they could join together in a class action. Now, thanks to the U.S. Supreme Court, companies can get away with breaking the law by simply including a few handy lines of text in their customer agreements and contracts. But just because the company can use this “get out of jail free” card, doesn’t mean it should. [More]

Consumer Advocates Ask Regulators To Investigate T-Mobile Over Advertising, Debt Collection Practices

Those two-year mobile phone contracts we all signed for so long became a relic of the past pretty quickly over the last two years, with national providers all abandoning ship. T-Mobile moved to “contract freedom” almost two years ago now, and has since then continued to make a big deal over the fact that their users are neither locked into time-locked agreements nor face old-school high data overage fees. [More]

Banks Urge Congress To Continue Renewing Their “Get Out Of Jail Free” Cards

Nestled deep in the text of the lengthy contracts for most credit cards and bank accounts are little clauses that not only prohibit harmed customers from suing their bank or card issuer, but also prevents them from banding together with similarly injured consumers to argue their dispute as a group. In October, the Consumer Financial Protection Bureau announced it would consider limits on these clauses, but now the banking industry is trying to use its leverage with D.C. lawmakers to shut down that process. [More]

JPMorgan To Pay $100M To Settle Unlawful Debt-Collection Allegations In California

Four months after JPMorgan Chase agreed to pay at least $136 million to close the books on state and federal investigations into its credit card collections practices, the company reached a $100 million settlement putting an end to a similar investigation in California. [More]

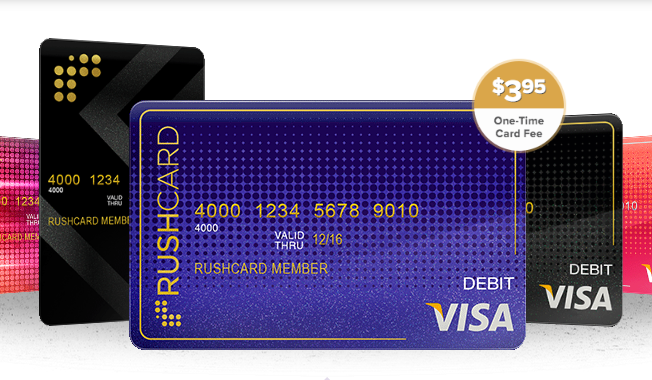

RushCard To Create Reimbursement Fund For Customers Unable To Access Money

The thousands of unbanked consumers who rely on prepaid RushCards but have been unable to access their funds because of a technical glitch, may receive compensation for the issue. [More]

After RushCard Fiasco, Consumer Advocates Urge More Oversight Of Prepaid Cards

For the better part of two weeks, thousands of unbanked consumers who rely on prepaid RushCards have been unable to access their funds because of a technical glitch. While the company run by Russell Simmons continues to fix the issue, consumer advocates are pointing at the incident as evidence that federal regulators need to do more to protect prepaid cardholders. [More]

CFPB To Consider Rules That Would Revoke Banks’ “License To Steal”

The lengthy, often complicated terms of use for more than half of all credit cards — and nearly half of all federally insured bank deposits — include clauses that force customers into arbitration, taking away their right to sue these companies in a court of law and usually blocking them from joining together in a class action. Critics argue that these forced-arbitration clauses allow banks and other businesses to break the law with impunity. Heeding the call of lawmakers and consumer advocates, the federal Consumer Financial Protection Bureau has decided to consider rules that would ban this practice among financial institutions. [More]

CFPB Sues Debt Relief Firm, Alleging It Bilked Customers For $67M

Being in debt can be paralyzing, leaving some people with the feeling like they’ll never climb their way out of the hole. So when a company promises it can help ease that burden, it might some like a good idea to spend even more money in the hope that you’ll ultimately be pointed in the right financial direction. Federal regulators say one debt relief operation took in $67 million from customers in need of help, but most of that money just went to the firm’s fees while the customers’ debts continued to pile up. [More]

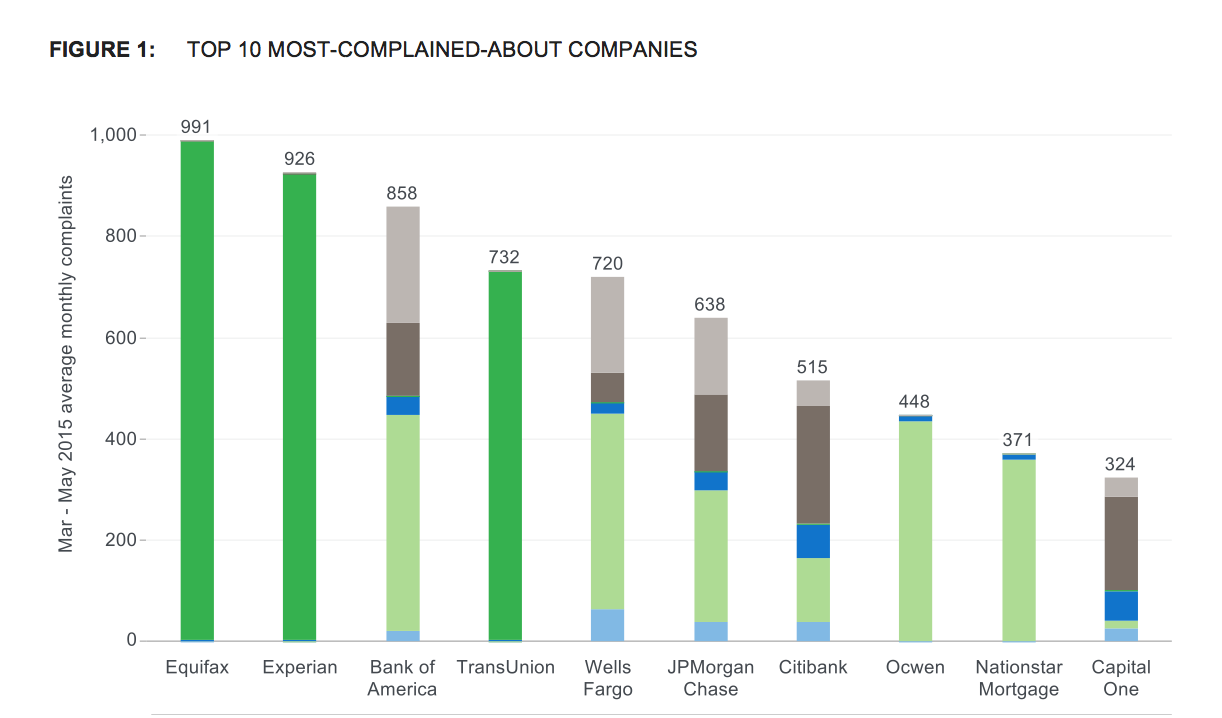

Credit Bureaus, Bank Of America, Wells Fargo Top List Of Most Complained-About Financial Companies

The Consumer Financial Protection Bureau has released its latest report on the various complaints the agency has received about banks, lenders, debt collectors, and other financial services. Amid a sudden increase in the number of complaints involving credit report errors, the country’s largest credit bureaus now dominate the top of the CFPB’s list of most complained-about companies. [More]

Retailer That Overcharged, Then Sued Military Personnel Is Going Out Of Business

A year ago, Virginia-based USA Discounters was in the spotlight after the supposedly discount retailer — which had several locations adjoining military bases and directly marketed its financing to servicemembers — was criticized for charging ridiculously high prices on its products and then suing soldiers in such a way that they could rarely defend themselves in court. The retailer then changed its name to USA Living and promised to not be so evil, even though the lawsuits continued. Now comes news that the retailer is going to close up shop for good. [More]

Santander’s Auto Loan Business Under Federal Investigation

Each year, Santander writes or services billions of dollars worth of auto loans and leases in the U.S., making it one of the nation’s largest providers of automobile financing. Yesterday, the company revealed that the Consumer Financial Protection Bureau is looking into whether Santander violated federal fair-lending laws. [More]