Roughly 240 days from now, banks and other financial companies will no longer be allowed to prohibit customers from banding together in class-action lawsuits through the use of binding arbitration clauses, as the Consumer Financial Protection Bureau today released a long-awaited finalized rule on arbitration. [More]

cfpb

CFPB’s Finalized Arbitration Rule Takes Away Banks’ ‘Get Out Of Jail Free Card’

Four Credit Repair Agencies Accused Of Misleading Customers, Charging Illegal Fees

Four different “credit repair” operations have been ordered to pay a total of more than $2 million in penalties for allegedly tricking people into thinking their bad credit could be easily fixed. [More]

Student Loan Borrowers Face Delays, Bad Information About Loan Forgiveness Program

The Department of Education’s Public Service Loan Forgiveness program allows student borrowers a way to eventually erase federal student loan debt by working for the government or at a non-profit for 10 years. Students have already accused the government of failing to keep its promise, and a new report not only appears to bolster this claim but shines a light on other concerns about other roadblocks to loan forgiveness. [More]

GOP Doesn’t Just Want To Weaken Consumer Financial Protection Bureau; They Want To Sell Off Its Offices

The Financial Choice Act, which just passed through the House on a party-line vote, doesn’t just seek to prevent the Consumer Financial Protection Bureau from regulating banks, credit card companies, debt collectors, and payday lenders. A last-minute amendment to the bill could strip the Bureau of its offices. [More]

House Passes CHOICE Act In Move To Roll Back Consumer Financial Protections

The House of Representatives voted today to pass the Financial CHOICE Act, a piece of legislation that, if enacted, would strip away a number of consumer protections put in place following the devastating collapse of the housing market. [More]

Report: Financial CHOICE Act Would Harm Servicemembers

Since its creation, the Consumer Financial Protection Bureau has worked to protect servicemembers from ne’er-do-wells that aim to line their own pockets by taking advantage of those who protect us; from fining auto lenders for failing to issue refunds to servicemebers to ordering banks to pay for their bad debt collection practices. But with a bill to gut the agency’s power making its way through the legislature, these types of protections come to a screeching halt. [More]

Appeals Court Hears Arguments For, Against Letting President Fire Consumer Protection Chief

For the second time in a year, judges of the Court of Appeals for the D.C. Circuit have heard arguments about the constitutionality of the structure of the Consumer Financial Protection Bureau. How the court ultimately rules will determine whether or not the head of this watchdog agency can be fired and replaced at the whim of the President. [More]

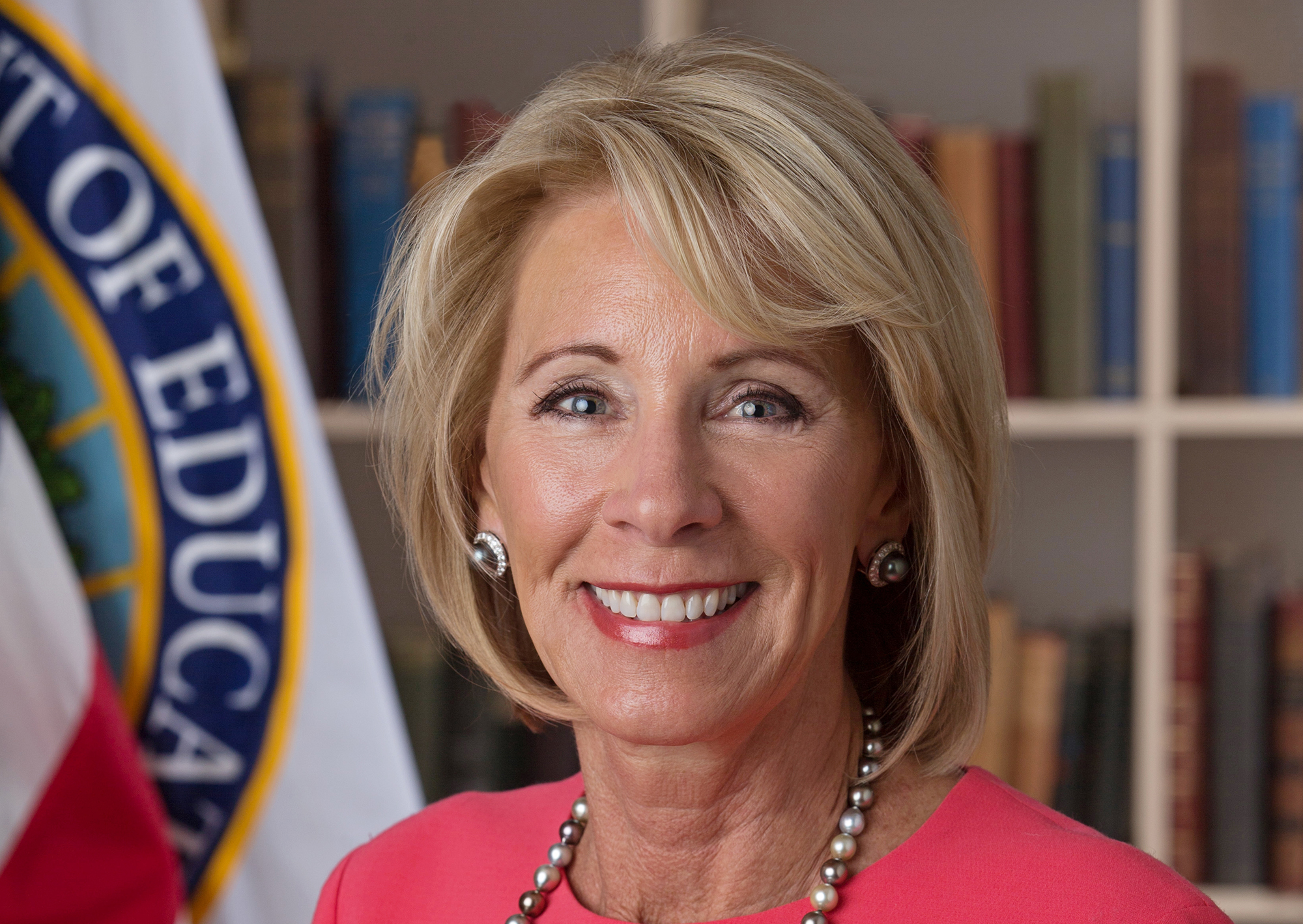

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]

90% Of At-Risk Student Loan Borrowers Not Signed Up For Affordable Repayment Plans

Paying back tens of thousands of dollars in student loan can be difficult, and more than 1 million Americans defaulted on their federal student loans just last year. But why are nearly all of these same borrowers failing to take advantage of programs to help them avoid defaulting again? [More]

‘Financial CHOICE Act 2.0’ Rolling Back Consumer Protections Moves Forward

The House Financial Service Committee approved the Financial CHOICE Act 2.0 today, signaling the first concrete move to roll back consumer protections and gut the Dodd-Frank Wall Street Reform and Consumer Protection Act. [More]

People Paying Back Student Loans Could Also Be Hurt By Outage Of FAFSA Tool

A Department of Education decision take down an online tool that helped student loan applicants file for aid isn’t just making things difficult on students. It’s also a problem for those who are repaying their student loans through a federal payment plan. [More]

‘Financial CHOICE Act 2.0’ Blasted By Retailers & Lawmakers

The retail industry has already politely asked Congress to please not roll back financial reforms involving debit card transactions, but as lawmakers on Capitol Hill inch closer to undoing these protections, retailers are once again voicing their concerns that undoing the 2010 law will lead to higher prices and hurt small businesses. [More]

Complaints About Student Loan Servicing Increase In Nearly Every State

Newly released complaint data from the Consumer Financial Protection Bureau appears to support recent claims by nearly two-dozen states that Education Secretary Betsy DeVos may be making a big mistake by rolling back protections for student loan borrowers. [More]

As Congress Preps To Scrap Prepaid Card Protections, Lawsuit Seeks Release Of Emails Between Lawmakers & Lobbyists

At some point in the coming weeks, Congress is set to consider a fast-tracked proposal that would nullify a slew of new protections for the millions of Americans who use prepaid debit cards. With the clock ticking down to that vote, a lawsuit is trying to compel the release of any communications about these rules between industry lobbyists, lawmakers, and federal regulators. [More]

Data Shows Too Many Americans Being Pestered About Medical Debt They Don’t Owe

What’s worse than being overwhelmed by medical debt after a hospital stay or doctor’s visit? Being told you owe money for healthcare procedures and services you never received. Yet, a new analysis of federal data shows that too many Americans are being pestered to pay off medical debt that they don’t actually owe. [More]

18 States Urge Congress Not To Stop Prepaid Card Reforms

Earlier this year, lawmakers on Capitol Hill began the process of dismantling the Consumer Financial Protection Bureau’s long-awaited prepaid card rules — meant to improve transparency and curb runaway fees — that are set to to go into effect. As Congress prepares to consider three bills that would erase these rules, attorneys general from 18 states have called on legislators to put consumers’ needs over those of the prepaid card industry. [More]

White House Wants Authority To Fire Consumer Protection Chief

While the heads of most federal agencies have been replaced since the new administration moved into the White House, Richard Cordray remains Director of the Consumer Financial Protection Bureau. That’s because President Trump currently can’t fire him without having to first show cause — a requirement the White House wants to get rid of. [More]