The Fair Debt Collection Practices Act prohibits debt collectors from a number of annoying and aggressive practices, like calling late at night to hassle folks about their debt or publicly outing people as debtors. However, this morning — in Justice Neil Gorsuch’s first opinion — the U.S. Supreme Court ruled that this law doesn’t apply to banks that purchase defaulted loans with the intention of collecting on them. [More]

car loans

Supreme Court: Protections Against Debt Collectors Don’t Apply To Banks That Purchase Defaulted Loans

Honda Financial Services Really Sorry They Double-Billed Customers

If you can’t get through to Honda Financial Services, the automaker’s U.S. financing arm, don’t be surprised: they’re currently dealing with a double-debiting fiasco affecting customers who submit payments online. Some customers report that their accounts have overdrafted due to the unexpected double payments. [More]

Santander’s Auto Loan Business Under Federal Investigation

Each year, Santander writes or services billions of dollars worth of auto loans and leases in the U.S., making it one of the nation’s largest providers of automobile financing. Yesterday, the company revealed that the Consumer Financial Protection Bureau is looking into whether Santander violated federal fair-lending laws. [More]

CFPB To Oversee Non-Bank Auto Financing Companies

While some folks get their car loans from the bank or credit union, many Americans finance their vehicle purchases through non-bank entities, including auto dealers. But until now, the federal Consumer Financial Protection Bureau only had regulatory authority on car loans issued by financial institutions. A new rule from the CFPB will soon give the agency oversight of the nation’s largest non-bank auto finance operations. [More]

![Like my new wheels? I got it through an 8-year loan with a 22% APR. What a steal! [Note: Not actually my car] (photo Axion23)](../../consumermediallc.files.wordpress.com/2015/01/mynewcar.png?w=300&h=225&crop=1)

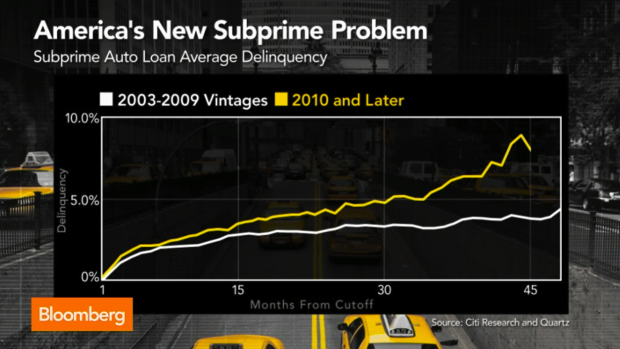

Why Are So Many Recent Car Loan Borrowers Missing Payments?

In 2014, new car sales increased to 16.5 million, the highest level since 2006, but did too many car buyers take on more than they could afford? [More]

CFPB Proposes Rule To Oversee Automakers’ Financial Units, Stop Discriminatory Lending

The lending arms for national car dealers, such as Ford and Toyota, may soon have to answer to federal regulators. The Consumer Financial Protection Bureau released a proposed rule that would give the agency oversight of automakers’ financing units in a step to prevent discrimination and other harmful practices – marking a move that was applauded by several consumer advocacy groups. [More]

Why Are Some People Having A Harder Time Paying Off Car Loans Post-Recession?

For many of us, things have improved since 2010, when the country finally began clawing its way out of the crater that resulted from the collapse of the housing market. So why are some consumers doing a worse job of making car loan payments than they were during the recession? [More]

Ally Bank To Pay $98 Million For Charging Higher Interest To Non-White Borrowers

Earlier today, the Justice Dept. and the Consumer Financial Protection Bureau announced the largest auto loan discrimination settlement in U.S. history with the news that Ally Bank has agreed to pay $98 million, including $80 million in refunds to settle allegations that it has been charging higher interest rates to minority borrowers of car loans. [More]

How Much More Expensive Is It To Have A Bad Credit Score?

Most people know that having a less-than-perfect credit score makes it more difficult to get a loan. And for those who can manage to be approved for a loan or new credit card, it also means they will end up with higher payments. [More]

Regions Bank: Offers Car Loans, Not Sure How They Work

Jennifer took out a car loan from Regions bank way back in 2005, and paid it off in 2009. She never received the title, but that wasn’t an urgent matter until she was ready to get a new car, and sell or trade in her old one. Then she kind of needed the title. Thanks to the stunning incompetence of everyone at the branch where she originally took out the loan, this process somehow took six months. [More]

Man Sues Lender For Revealing To Wife That Another Woman Was Making His Car Payments

A man in Chicago has filed a lawsuit against the company that serviced his car loan for allegedly ruining his marriage by revealing, via a voice mail, that another woman was making loan payments for him. [More]

Name Change On A Car Loan Completely Confuses Chase

Every day, people in America get married. Some of them change their last names. Evidently, though, no one in the history of Chase Bank has ever done this while they were in the middle of paying off their car loan. See, until the loan is paid, the bank has a lien on your car’s title. If you want to change the name on your car title and the loan hasn’t been paid off yet, Chase won’t let that happen. This isn’t a problem unless you have to move and register your car in a different state after your name change but before the car is paid off. That’s what happened to Michael’s wife, and how she ended up in a loop of bureaucracy sending them back and forth from Chase to the Maryland Vehicle Administration. [More]

Sketchy "Yo-Yoing" Car Dealers Can Take Your Down Payment And Leave You Without A Car

Even though you’ve traded in your old car, made a down payment on your new one and driven it off the lot, make sure you are 100% sure that any financing you have on your vehicle is complete. If it’s not, you might soon find yourself out your down payment and without your new wheels — or even the car you traded in. [More]

Call Every Time To Make Sure Extra Payments Go To Paying Down Principal

People trying to get ahead on their car and house payments are sometimes shocked to discover the default way that banks handle their extra payments. Instead of paying down the existing principal, they apply it to the future interest. Not only that, but you can’t just call them up one time and ask for them to change how they handle your payments. You need to call them every month you make a payment. Here’s a tale from reader Katherine: [More]

Wells Fargo Is Worst Friend Ever, Borrows $377.09 For Two Weeks Without Asking

Tom is angry at Wells Fargo, because they’re borrowing $377.09 from him without his permission. When Wells Fargo purchased Wachovia a few years ago, Tom’s car loan came along with it. Every month, the bank would draft a payment of $384.43 from Tom’s account. His last payment was due in March, and it was only $6.34, but Wells Fargo just went ahead and took the entire $384.43 out of habit. [More]

Chase Makes It Just A Little Harder To Pay Down Your Car Loan Principal

If you want to pay down the principal on your Chase car loan by adding a little extra to your payment when you pay online…well, don’t bother. Sean discovered that paying a little extra on your auto loan isn’t so simple. Any extra money you might send is considered an early payment for next month…not applied to the principal. Sneaky. [More]

Wachovia Harrasses Me For Phantom Car Loan Payment

Richard bought a vehicle, returned it and bought another from the same dealership. He says Wachovia erroneously paid off the second loan instead of the first. Once he got the finance department to correct the mistake — a process that took a month — Wachovia started hassling him to make a payment for which he was never billed. [More]