Jasper got a notice in the mail about marketing from Bank of America, so he called them up to opt-out. After agreeing to stop spamming him, the Bank of America CSR launched into a sales pitch for their “credit protection” services…

boa

Bank Of America Gives You A Sales Pitch When You Call To Ask Them To Stop Giving You Sales Pitches

Worst Company In America 2008 "Sweet 16": Bank of America VS Blue Cross Blue Shield

Here’s your seventh “Sweet 16” match-up: #7 Bank of America VS #23 Blue Cross Blue Shield

Bank of America Gives 6-Year-Old A Credit Card

Didn’t you hate not having access to credit when you were 6? Today’s kids don’t have to suffer like you did. Meet Bennett Christiansen of Aurora, IL. He’s got a shiny new Bank of America credit card with a $600 limit.

Bank of America: "Free" Checking Means You Have To Call And Have The Fee Waived Every Month

Reader Tara has a checking account with Bank of America that’s supposed to be “free” if she meets 1 of 3 balance requirements. She meets one of them, but Bank of America keeps charging her $20 — and they don’t intend to stop.

5 Confessions Of A Bank Of America Personal Banker

We confess, we love confessions. We are fascinated that BOA can be the largest and the most despised bank chain in the country. We received a letter from a person who identifies himself as a former Bank Of America personal banker and he’s ready to talk. Have a seat in the Consumerist confessional. 5 confessions of a BOA personal banker, inside..

Polite Letter Gets Bank Of America To Refund Overdraft Fees

Jenn’s checking account with Bank of America recently had a policy change designed to increase overdraft fees, and it worked: sometime between Friday night and Saturday morning she was hit with 6 NSF charges going back the previous 48 hours, because she was about 15 minutes late transferring funds into her account the day before. Technically she had broken the new policy, but Jenn hadn’t realized or remembered that there was a policy change and she was taken by surprise. She decided to try to reason with BoA’s corporate office about the fees, and explain why she thought they were unfair.

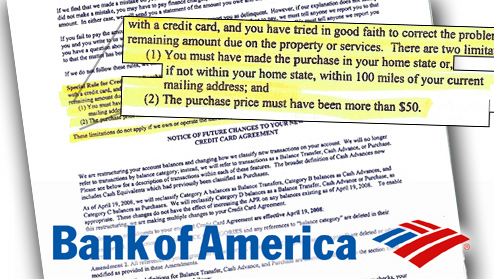

Chargebacks Have Geographical Limitations

Longtime Consumerist reader TBT read the fine print for a credit card she recently opened with Bank of America, and discovered that buried in pages 13 and 14 is a section that limits your right to request a chargeback to your home state or within 100 miles of your home address, and only for purchases over $50. He found this shocking, but, actually, this is a limitation provided by the Fair Credit Billing Act. If you dislike it, here’s a great post of ours on writing effective letters to Congress.

../../../..//2008/03/26/want-to-reduce-your-bank/

Want to reduce your Bank of America spam mail? Our commenter tinder posted a link to their opt-out page in our earlier post on Chase spam. [www.bankofamerica.com/privacy/]

Bank Of America Refunds $325 In Overdraft Fees To Customer Who Was On Cruise

Don’t say we never printed anything nice about you, BoA. One of your customers just had an experience with you that—despite still having an overdraft fee of $20 to pay—has left her feeling pretty good about you.

FBI Said To Be Investigating Countrywide

The FBI has opened an investigation into Countrywide for suspected securities fraud, reports the New York Times. The Justice Department and FBI “are looking at whether officials at Countrywide, the nation’s largest mortgage lender, misrepresented its financial condition and the soundness of its loans in security filings.” So far everything is unofficial because nobody has been authorized to discuss the case, and a Countrywide spokeswoman says, “”We are not aware of any such investigation.”

Bank of America Angers More Customers With Unjustified Rate Hikes

More about Bank of America’s inexplicable rate hikes against good customers who never pay late: the Charlotte Observer talks to some recent recipients of BoA’s infamous rate-increase letters from the past few weeks. The first person they talk to is a 60-year-old woman who “had never been late on a credit card payment, just refinanced her home at a lower interest rate, and just been rewarded by her credit union with a lower rate on her credit card there.” Bank of America just raised her card from 13% to 24.99%.

Why Is Bank Of America Raising Interest Rates On Its Good Customers?

BusinessWeek has just published an article about Bank of America’s recent surprise mailings in January to some of its customers, announcing “that it would more than double their rates to as high as 28%, without giving an explanation for the increase.” These customers have good credit scores and hadn’t made any late payments, and those who called Bank of America to ask why this was happening weren’t given clear reasons. Industry experts say Bank of America has reached a “new level” of “lack of transparency in raising rates,” beyond anything Citigroup and JP Morgan Chase currently practice, because BoA is apparently using some undisclosed internal metric to determine who gets the rate hike.

How Bank Of America Spun Raising ATM Fees To $3

Bank of America defended raising ATM fees to $3 for non-customers to withdraw from its ATMs by spokesperson Betty Riess spilling this lovely bucket of hogwash:

New ATM Increases Reader’s Likelihood Of Being Riddled With Bullets

Garth used to be able to jump out of his car and deposit his checks in under a minute. That changed when his Bank of America installed a new ATM.

Consumers Speak: Bank of America’s Missing Envelope

ve been rejected and subsequently sent to another account. My money, as of this writing, is still being held and I am waiting for it to be released to me.

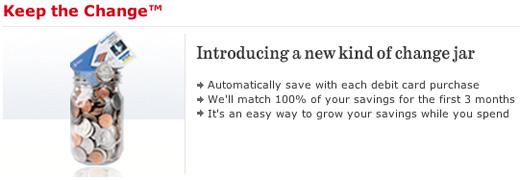

Bank of America’s Change Jar: There Must Be Evil Here Somewhere

Since we’ve spent a large portion of our day tearing at Bank of America, we thought we’d offer this recommendation for a new savings program, sent in by (probably astroturf) reader Greg. It seems Bank of America has a new program that rounds up your debit charges to the nearest dollar, then puts the change in a savings account. Gamey, but we like it.

But here’s the interesting part: for the first 3 months they’ll match it up to $250. So if you rack up $250 or more in change over 3 months, BofA will give you $250. After 3 months, they’ll continue to match but only at 5%.