If you recall, Travis got charged $280 in overdraft fees after Bank of America gave him some wrong information about his bank account when moving to a new state. He wrote a letter the CEO, which we posted. Now, good news. He writes:

banks

Sovereign Bank Branch Exposes You To Identity Theft As A Matter Of "Policy"

Concerned about identity theft, Seth had a fun time recently when he tried to get Sovereign bank to tell him why they need to record his driver’s license number when he withdrew $2.75. The teller kept saying, “It’s our policy,” but even when they finally showed the policy in writing, it only said “must record form of ID” and nothing about writing down license numbers.

BoA Gives Wrong Information, Charges Customer $280, Doesn't Care

Thanks to a Bank of America customer service rep’s incompetence, Travis got hit with $280 in overdraft fees.

FBI Trains Banks To Be Friendlier to Robbers Than to Customers

The FBI is training banks to be super-nice to robbers, as the unexpected friendliness can throw thieves off guard and have them walk away from a crime.

…The method is a sharp contrast to the traditional training for bank employees confronted with a suspicious person, which advises not approaching the person, and at most, activating an alarm or dropping an exploding dye pack into the cash.

Banking Dos And Don'ts: Answers And Clarifications

The employee who provided us the Goofus and Gallant 19 point guide to banking has some answers to your questions and clarifications, inside…

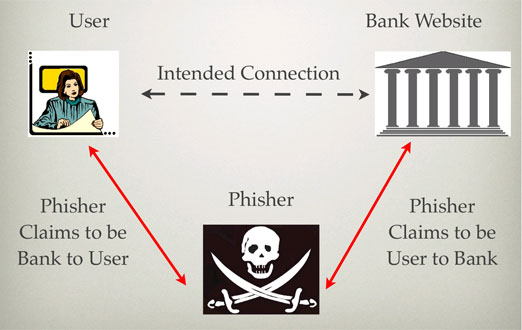

Bank of America's "Perfect" Security System Actually Vulnerable To Phishing

Bank of America has an online security measure called SiteKey and says, “[W]hen you see your SiteKey, you can be certain you’re at the valid Online Banking website at Bank of America, and not a fraudulent look-alike site.”

19 Banking Dos And Don'ts

A current employee in a big bank sent us a big list of banking do’s and don’ts that we know some people could stand to be reminded of [More]

How Banks Flag Ordinary Customers As Terrorists

The Washington Post has an article, “Ordinary Customers Flagged as Terrorists,” describing how the Office of Foreign Asset Control maintains a list of potential terrorist suspects, and how everyday citizens can wind up on it.

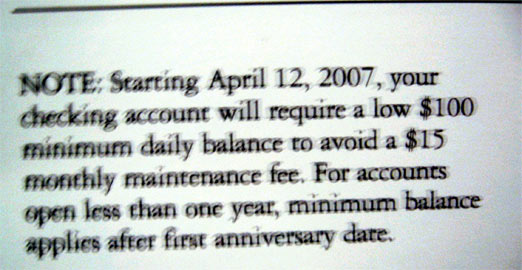

Commerce Bank's Free Checking Now Requires $100 Min Balance

Shoehorned into a postcard proclaiming the waiving all ATM fees, Commerce Bank announced their free checking will no longer be free.

Easily Compare Best Credit Card Offers

Bankrate has a very handy online tool for comparison shopping for a credit card.

Apparently, 5/3 Debit Cards Are Instant Magic Money Wands

In followup to our post on how 5/3 Bank racks up overdraft fees by treating pending charges like they’re processed, we asked customer service, “What’s the rationale for counting pending debits against the ledger balance? Isn’t that contrary to the definition of pending, and how banks traditionally handle transactions?”

Banks Target The Wealthy To The Detriment Of Minorities And The Poor

According to a report by the National Community Reinvestment Coalition (NCRC,) banks are predominantly concentrated in wealthy neighborhoods, leaving poor and minority communities without access to basic financial tools such as checking and savings accounts. The NCRC compared bank locations to minority and income data provided by the census. The findings suggest that banks are redlining with devastating consequences.

This report shows in 24 out of 25 MSAs [Metropolitan Statistical Areas], urban areas that have dense populations have fewer bank branches — therefore fewer mainstream banking opportunities — than the less populated suburbs. Without the ability to build relationships with the regulated banking community, working class and minority neighborhoods are more likely to use “fringe” services, such as payday lenders and pawnshops, for small loans. They are also more likely to have their home loans originated with mortgage brokers and subprime lenders, which often led to foreclosures and unmanageable monthly payments.

Houston, Philadelphia, and Los Angeles showed the greatest disparities, compared to the relatively equitable distribution of banks in San Francisco, Seattle, and Boston.

5/3 Bank's New Overdraft Fee Stream: Treat Pending Charges Like Processed!

5/3 Bank decided to rape customers for more fees by changing their policy for handling transactions.

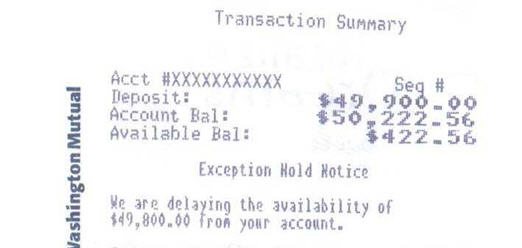

WaMu Holds Large Deposits For 2 Weeks, Doesn't Warn You First

How long should a bank be allowed to hold your money to “verify” it? A week? 5 days? 2 weeks?

Now Home Depot Wants To Be A Bank

Atlanta-based The Home Depot Inc. (NYSE: HD) also has applied to run its own bank…The bank would allow Home Depot to enable contractors to offer home improvement loans to their own remodeling customers.

Chase Refuses To Cash Check Without Thumbprint

Chase refused to let Ramsey cash his check without a thumbprint, even though he had called and verified that two forms of identification would suffice. The teller insisted that a thumbprint was required by a “rule.” How official sounding. Ramsey spoke with Heath, the bank manager.

- “Heath informed me that due to the Patriot Act, all negotiable instruments required a fingerprint as proof of my status as a holder in due course.”

Ah, the Patriot Act, that vague catch-all excuse for every vigilante action under the American sun.