As the August 15th deadline for bank customers to opt in to overdraft protection on their existing accounts looms, banks are trying some innovative new tactics. Nicole tells Consumerist that she visited an ATM Chase branch on a Saturday morning to withdraw some cash, and encountered an employee stationed near the ATMs, asking customers whether they had “made a decision” about their “debit card overdraft coverage.” [More]

banks

Wiring Money Is A Ripoff Red Flag

One good way to get ripped off in a transaction is to agree to wire the other person money. Whether it’s through your bank, money order, or Western Union, wiring money has zero protections against loss. Which is why con artists love it dearly. [More]

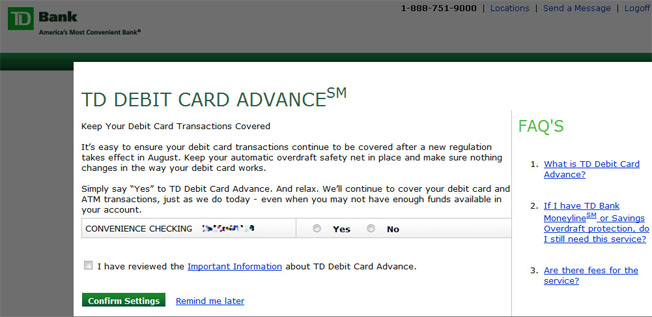

TD Ratchets Up Overdraft Opt-In Push With Pop-Up Scare Tactics

TD Bank is really stepping up its efforts to try to get customers to sign back up for “overdraft protection,” which really just protects their right to charge you $35 if you want to buy a $2.00 candy bar and only have a $1 in your account. Now they’re greeting customers accessing their accounts online with pop-up ads trying to scare them into agreeing to signing up for the service. [More]

Last $10 On Visa Gift Card Proves Seemingly Inextractable

Kate has a $50 Visa gift card. She used $40 on it and then tried to buy some DVDs for $7, but the card was rejected. What gives? [More]

TD Bank Pushes Totally Flat Debit Cards

Run your fingers over one of TD Bank’s new debit cards and you’ll notice something missing. There’s no embossed numbers. It’s not a fake, it’s the future: a completely flat debit card that can be issued right on the spot when you open an account at a local bank, with no waiting for it to arrive in the mail. [More]

Even Wells Fargo CEO Powerless To Reduce Your Punitive APR

The APR on Kevin’s Wells Fargo credit card got jacked up from 9.6% to almost 23%. He owes $16,000. At 9.6, he could afford to make double the monthly payments, but now he’s paying $300+ a month in finance charges alone. He’s begged up and down the hierarchy, from the CEO to any exec or VP he could reach, to please reduce his APR so he can carry this debt. Nope. The numbers have spoken. The odds are calculated. Your risk has been assessed, and the verdict has been issued: you lose. [More]

POLL: How Much Debt Do You Have?

Let’s play a fun game. I’ll show you mine if you show me yours. Debt, that is! [More]

Banks Luring You Into Signing Back Up For High Overdraft Fees

Banks are mad they can’t just automatically charge you a $35 overdraft anymore if you happen to try to buy a candy bar without enough cash in your account. Newly enacted legislation says they have to get you to opt-in to such overdraft programs. So, what they’re doing is renaming the overdraft programs something else, making them sound awesome, and then blitzing your mailbox and inbox with up-sells. Some banks are even calling people up! [More]

Unpublished Phone Number For Bank of America Online Banking Support

If you need to reach phone-based support for your Bank of America online account, it might be hard. You won’t find the number listed anywhere on their site. But we’ve got the unpublished number: [More]

Credit Cards Limits Reduced Based On What You Bought, Where You Bought It

New insight into how the credit card companies have been secretly judging us all has emerged in a new Federal Reserve report. From Nov ’06-Nov ’09, some credit card companies admit to using more than just the usual income, credit and repayment history to evaluate if they should reduce your line of credit or raise rates. Yep, they’re looking at where you shop. [More]

How Card Issuers Sneak Around New Laws

Crafty credit card issuers aren’t going to let a little thing like the law get in the way of their profits. Nope, they’re finding creative ways to get around the pro-consumer CARD act and maintain their grip on your pocketbook. [More]

Why Can't I Ever Save Any Money?

So you got that bank account, you even were smart and made sure to get an online savings account, so you get that higher rate of return, but gosh darnit, it just never seems to get any bigger! [More]

Why Don't I Get The Cash Discount For Gas When I Pay With My Debit Card?

David writes that he recently had a confusing experience at a gas station, and he wanted some clarification. He’s used to receiving a cash discount when he pays with his debit card at gas stations, but came across a gas station owner who wouldn’t give a cash discount for anything but actual greenbacks. Are this gas station’s policies illegal, David wonders? [More]

Someone Else With My Name Cashed My Mis-Delivered Google AdSense Check

Lee never received a check from a Google AdSense account, then tried for weeks to track it down. Finally, Google offered scans of the check, and it turned out someone else with the same name had gotten the check by mistake and cashed it through a local bank, which couldn’t determine whether or not the check was a fake and decided to “try depositing it and see what happens.” [More]

Clark And Dawes Comedy Team Skewer European Debt Crisis

Making poor lending decisions is by no means uniquely American. In case you haven’t heard, the Europeans are going through a debt crisis of their own right now, and it’s bound to have an impact on America’s economy. Seems that several broke countries have lent massive amounts to other broke countries and nobody can pay each other back. Bailouts are inevitable, but where is the money going to come from? Some other broke economy! And round and round it goes. Comedy team Clarke and Dawes take the piss out of it all in a mock business game show. [More]

Keep PayPal From Using The Default ATM Debit Setting

PayPal exists to make money, not to help you. That’s why the unregulated money broker likes to ensure that when you pay with a linked account, you pay via the ATM debit card setting, because it’s cheaper for PayPal. Of course, that “savings” is sometimes deducted from you in the form of a transaction fee by your bank, but PayPal doesn’t care. If you want to change that payment method the next time you use PayPal, be prepared to jump through a lot of hoops. [More]

Reach HSBC Finance Executive Customer Service

Here is some contact information for HSBC Finance. It’s good for when you have a Sisyphean customer service issue that you’d rather have the sneakers of Mercury. [More]

Fix Mortgage Errors By Promising The CSR "Phone Fun," At Least At Wells Fargo

According to a lawsuit filed in New Jersey, a CSR at Wells Fargo’s Home Mortgage Division refused to correct a payment error for Jamie Nelson unless she had some “phone fun” with him first. Phone fun, in this case, seemed to mean naked pics of the woman. She’s suing for emotional distress, since you can’t take someone to court simply for being a skeevy jackass. Wells Fargo says they’re taking the allegations seriously. [More]