When layoffs are coming within 60 days, federal law requires employers to notify employees and their state labor department. An industry publication reports that yesterday, the venerable and bankrupt grocery chain A&P issued these layoff notifications, called Worker Adjustment and Retraining Notification (WARN) notices, to employees at all of their stores. However, most of the stores remain on the market, and A&P hopes to sell them to competitors soon. [More]

bankruptcy

Columbia House Improbably Still Exists, Files For Bankruptcy Protection

You might have the same reaction that we did to news that the company that owns Columbia House filed for Chapter 11 bankruptcy today: astonishment that it’s still in business at all. Our younger readers are probably just wondering what a “Columbia House” is. Yet the company still exists, and business isn’t quite where it was at the company’s peak in 1996. [More]

Texas Attorney General Says RadioShack Knowingly Sold Gift Cards That Would Soon Expire

If the leadership of a company knows that they’re about to file for bankruptcy, should they stop selling gift cards? That’s what the Attorney General in Texas contends: that RadioShack knew after the 2014 holiday season ended that it would be declaring bankruptcy soon, and that gift cards they had issued would lose their value at the time of the bankruptcy or shortly afterward. Yet they sold ’em anyway. [More]

Former Corinthian College Students Seek To File $2.5B Claim Against Bankrupt For-Profit Operator

Former students of now-defunct for-profit education chain Corinthian Colleges continued their fight to recoup the money they spent on classes at the company’s Heald College, WyoTech or Everest University campuses, filing a $2.5 billion claim against the bankrupt educator.

[More]

Historic A&P Grocery Chain Files For Bankruptcy Again, Plans To Sell Or Close Locations

For the second time in five years, 156-year-old grocery store operator Great Atlantic & Pacific Tea Co. (A&P) filed for chapter 11 bankruptcy protection, laying out plans to sell off or close many of its stores. [More]

Agreement Could Temporarily Halt Legal Action On Loans For Some Former Corinthian College Students

Former Corinthian College students left with piles of debt after the company closed its Heald College, Everest University and WyoTech campuses earlier this year are getting a bit more relief, as the Department of Education announced it would temporarily suspend some legal actions related to borrower’s defaulted loans. [More]

Court Case Illustrates Just How Difficult It Is For Borrowers To Discharge Student Loans In Bankruptcy

Students being crushed under the weight of mounting student loan debt have few options when it comes to receiving forgiveness for their debts, and bankruptcy is often the least obtainable – thanks in part to the nearly impossible to meet “undue hardship” standard. To see just how difficult and seemingly arbitrary this guideline is, all one needs to do is hear about a recent federal court case out of Maryland that determined a woman couldn’t escape her debt obligation because she had failed to make a good faith effort in repaying the loans despite the fact she’s unemployed, disabled and living below the poverty line. [More]

RadioShack Sells Last Thing Of Value It Owns: $50 Million Worth Of Property

In its bankruptcy auction, RadioShack has sold its store leases, the merchandise in most of its stores, and even key intellectual property assets like its customer mailing lists and “TheShack.com.” Now the company has found buyers for its last multimillion-dollar assets: property in Texas and regional facilities in Maryland and in California have been sold, taking in about $50 million that will go to the company’s creditors. [More]

Abusive Lending Practices Can Lead To Negative Long-Term Consequences For Borrowers, Communities

Every year, more than 12 million Americans spend $17 billion on payday loans, despite the fact research has shown these costly lines of credit often leave borrowers worse off. Yet abusive lending practices are not relegated to borrowers in need of a couple hundred dollars to stay afloat until their next paycheck; there are mortgages, car loans, and other traditional lines of credit that can leave the borrower in a bind. Even if you never find yourself on the wrong end of a predatory loan, these products can still be a drain on your entire community. [More]

Consumers Can’t Void Second Mortgage In Bankruptcy, SCOTUS Rules

Consumers taking out a second mortgage will now have to consider the fact that if they encounter financial difficulties and file for bankruptcy, they won’t be able to strip off the additional loan obligation. [More]

JPMorgan Chase, Bank Of America Agree To Wipe Debt Cleared By Bankruptcy From Credit Reports

Two of the country’s largest banks are finally getting around to removing the debt consumers eliminated during bankruptcy proceedings from their credit reports, a move that puts Bank of America and JPMorgan Chase in line with federal law. [More]

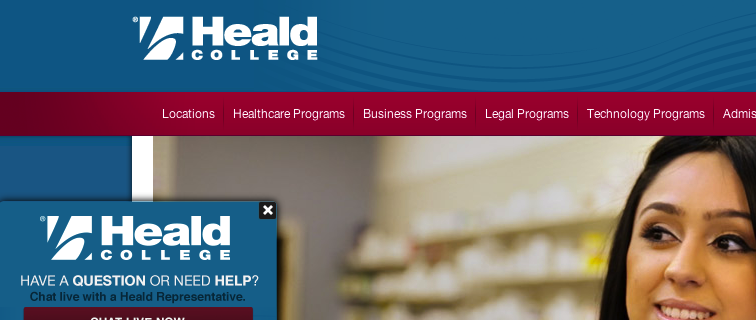

Super Bowl Ticket Broker Files For Bankruptcy After Not Being Able To Provide Paid-For Tickets

A lot of people who purchased legitimate Super Bowl tickets months in advance through ticket brokers later found themselves watching the game on TV after those brokers claimed they were unable to get the tickets that were promised. One New York-based broker who is being sued by the state of Washington recently filed for bankruptcy protection as dozens of customers look to get refunds on their tickets and other related travel expenses. [More]

Corinthian Colleges Inc. Files For Bankruptcy

A week after embattled for-profit college chain Corinthian Colleges Inc. closed its remaining Everest University, Heald College and WyoTech campuses, the company filed for bankruptcy, essentially closing the book on the company’s long downward spiral. [More]

GM Won’t Face Ignition Defect Lawsuits, Thanks To 2009 Bankruptcy

The same process that allowed a bankrupt General Motors to work its way back (with the help of several billion dollars from taxpayers) to being a viable business is, six years later, helping to shield the company from potentially billions of dollars in damages from class action fraud lawsuits involving the long-ignored ignition defect that claimed the lives of at least 84 people. [More]

Your Personal Data Could Be For Sale In RadioShack Bankruptcy Auction

Have you handed your name, address, e-mail address, or phone number over to RadioShack as part of a purchase or, inexplicably, when you returned an item that you bought with cash? As the bankruptcy auction of the smoldering remains of The Shack continues into its second day, we’ve learned that one of the assets for sale is RadioShack’s customer list, which includes more than 65 million mailing addresses and more than 13 million e-mail addresses. Update: The bankruptcy auction’s privacy ombudsman says that customer information isn’t for sale. Yet. [More]

Today’s Bankruptcy Auction Will Decide RadioShack’s Fate

On Monday, Radio Shack will forever cease to be the retailer it once was, and will turn into something different as the result of a bankruptcy auction. Exactly what will emerge from the ashes depends on the bidders bellying up to bid on the chain’s remains. [More]

You Can’t Discharge Your Student Loans In Bankruptcy Because Of Panicked 1970s Legislation

Although bankruptcy should only be viewed as the last option for consumers drowning in a sea of debt, even this final-straw course of action won’t help Americans with getting out from under hefty student loans — but it wasn’t always this way. [More]