Last month, the Huffington Post launched a campaign called Move Your Money that urged people to support community banks. The idea is that by moving your money to a community bank, you can help put the “too big to fail” banks on a diet so that they get smaller, while at the same time help a local bank remain competitive. The NPR program All Things Considered took a look at the campaign over the weekend, and talked to some experts about whether it’s worth making the switch. [More]

banking

Bank Of America Took Customer's Name Off CD, Won't Give Her Access Now

V. and her parents are having a heck of a time cashing in the certificate of deposit they opened jointly. She says it just matured, but she’s in Canada (she doesn’t say where her parents are) and they gave power of attorney to another party. BofA won’t deal at all with this other person, but what’s worse, V. says they’ve taken her name off the account entirely. [More]

E*Trade Sticks Me With $40 Inactivity Fee, I say G'bye

Dave says he feels he was stuck with a hidden fee by E*Trade, which threatened to sell his stock to recover a $40 inactivity fee. So much for the buy and hold strategy. [More]

White House Proposes New Banking Rules, Wall Street Freaks Out

So, we used to have this thing called the Glass-Steagall Act, which separated investment banking from commercial banking. Then we didn’t anymore. Now the President has proposed new rules that would effectively restore some of the provisions of Glass-Steagall. Wall Street is like, so not cool with it, however. [More]

Consumer Financial Protection Agency On The Chopping Block

According to the Wall Street Journal, Senator Chris Dodd, a Democrat from Connecticut, has offered to abandon the Consumer Financial Protection Agency (CFPA) proposal in exchange for Republican support on other legislation. Nobody is saying anything official right now, but the WSJ reports that “the offer is conditional on the creation of a stronger consumer protection division within another federal agency.” [More]

This Citibank Balance Transfer Offer Sure Sounds Dangerous

RP was just offered a transfer on his Citi card by a Citibank CSR, but the CSR was kind of vague on the details of the offer and could only repeat the benefits. RP looked online while the CSR pitched the offer, and found that there’s quite a big catch in the fine print–after six months, the interest rate jumps from 3.99% to 29.99%. [More]

Chase Cannot Find A Human Being To Read A Check

Chase has these fancy new ATMs that take checks without envelopes. It scans the check and blah, blah, robots, science, a better tomorrow. The interesting thing about them is that reader Angela says that when the ATM makes an error, Chase mails the check back to you so that you, the customer, can take it to a branch bank and show it to a human being. Apparently, even though Chase already has the check in its possession — it cannot find a human being to read a check. [More]

This Chase Customer Service Rep Is An Impenetrable Fortress

Stephanie just encountered a Chase CSR who I’m pretty sure will never fall victim to social engineering, and who would likely be unbreakable in a courtroom cross-examination, too. Of course, in Stephanie’s situation this just means that the CSR refuses to help her in any way at all, which isn’t the kind of thing you hope to find when you call customer service. [More]

Go Ahead, Strategically Default On Your Underwater Mortgage

“Homeowners should be walking away in droves. But they aren’t. And it’s not because the financial costs of foreclosure outweigh the benefits. One can have a good credit rating again–meaning above 660–within two years after a foreclosure.” That’s the conclusion reached by a law professor who’s written a paper about strategic default, which is when you elect to walk away from an underwater mortgage because you stand to lose more money trying to keep it than if you cut your losses immediately. The problem is, lots of people think it’s the wrong thing to do, because individuals are supposed to play by different rules than the companies they do business with. [More]

My Bank Refused To Believe I Was A Person

Inspired by the tale of a couple whose Wachovia checking account was frozen for a month, Loan shares a similar tale. [More]

What Is A Money Market Account?

If you visit your local bank, you might advertisements for money market accounts. You might be familiar with CDs, checking and savings accounts, but money market probably sounds fancy and exotic. Fortunately, they’re not.

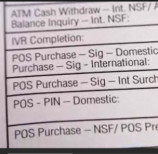

Starting July 1, 2010 Overdraft Fees Will Require Consumer Consent

The Federal Reserve has announced a new rule requiring overdraft fees on one-time debit card transactions and ATM withdrawals to be “opt-in.” The new rule will take effect July 1, 2010. “The final overdraft rules represent an important step forward in consumer protection,” said Federal Reserve Chairman Ben S. Bernanke in a prepared statement. “Both new and existing account holders will be able to make informed decisions about whether to sign up for an overdraft service.”

Citibank To Charge Fees On Checking Accounts

If you’re a Citibank customer who has one of the bank’s two smaller checking account plans—the ones where the monthly fee is waived as long as you use direct deposit or their online bill payment—then maybe it’s time to consider taking your business elsewhere. Starting in February, anyone with an average balance of less than $1500 will be assessed a monthly $7.50 service fee, reports the New York Post.

Former Customer Says Wells Fargo Bills Him $101.70 On Closed Account

Royal says it’s costing him more than $100 to break free of Wells Fargo after he closed his checking account before waiting for all pending charges to clear.

Taking Credit Card Offers Hurts Your Credit

Last week, I wrote about how to turn your good credit into cash. I purposely excluded credit card offers from the list because I wanted things that, should you implement them, wouldn’t hurt your credit. Today, I want to warn to the overzealous.

Revealing The Hidden Cost Of PrePaid Debit Cards

With credit cards harder to come by and more annoying to use, the prepaid debit card market is projected to explode from $8.7 billion loaded on the cards to $119 billion in 2012, but a good chunk of that is going to be eaten up by hidden fees and gotchas. This sexy graphic visualization shows how.

100 Bank Failures And Counting!

“More banks have failed in 2009 than the rest of the decade combined,” writes Ariel Nelson at CNBC. Today, Partners Bank in Naples, Florida closed its doors, making it the 100th bank to fail this year. Click the link to see a map of where bank failures have happened the most over the past 10 months.

Prepaid Debit Cards Are Money Sucking Black Holes In Your Pocket

Be very careful about activating any sort of over-the-counter prepaid debit card, reports the New York Times. They looked at a handful of prepaids currently on the market and discovered ridiculously high hidden fees—the first two months of use can cost you up to $80.