While we certainly know when big companies are trying their hardest to be funny, that doesn’t make it any less enjoyable when one of them actually succeeds. In this case, it’s the Swedes who have nailed it, in a new deliberately transparent ad for a bank that in turn, promises transparent services. [More]

banking

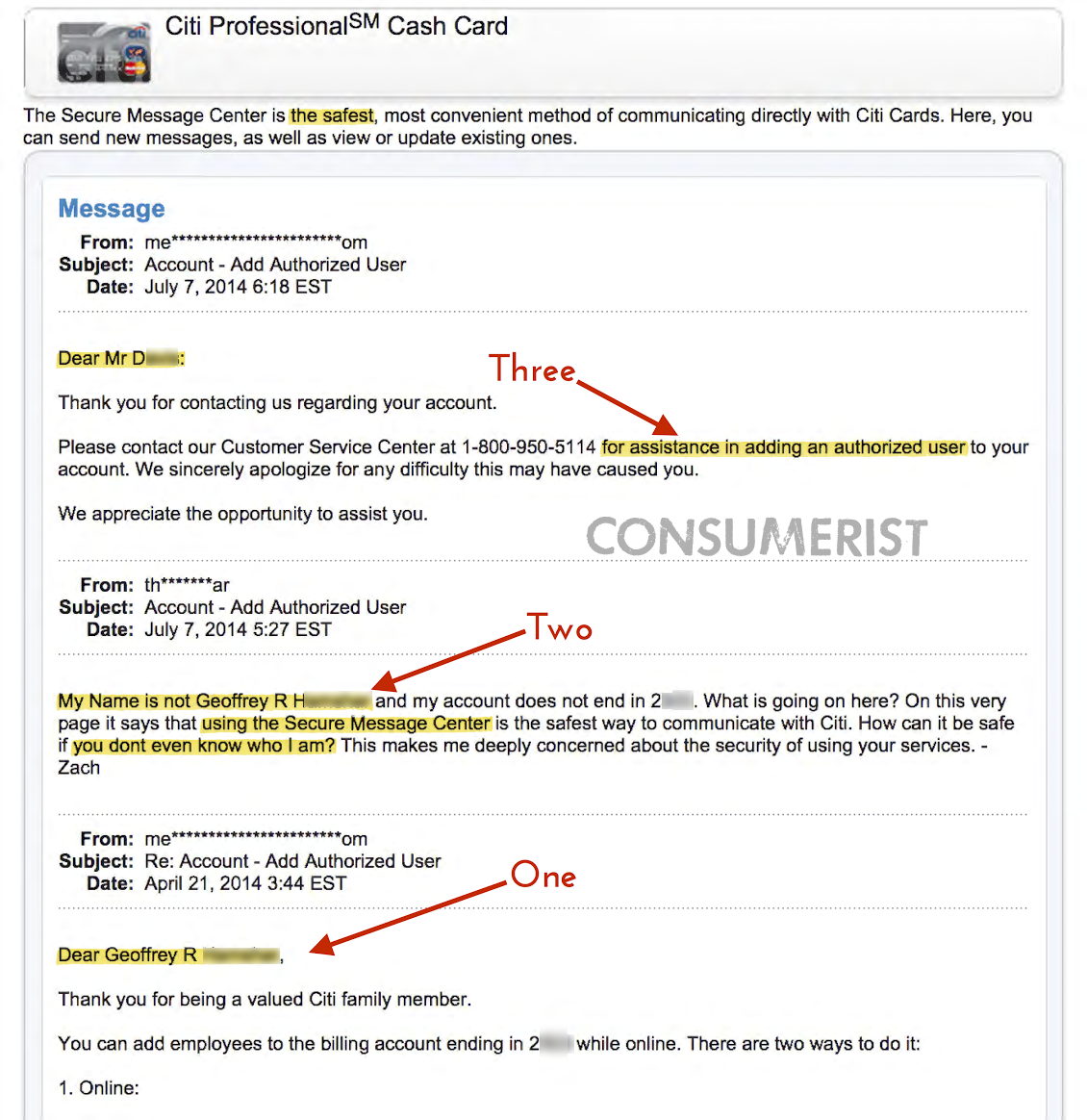

Citi’s “Secure Message Center” Run By Idiot Robots Who Don’t Care They Sent E-Mail To Wrong Person

If you’re a customer of any of the big banks, you’ve likely gotten a few messages in an online inbox that is only available via the bank’s website. You probably ignore most of these because they’re either about site downtime or upsells for add-on products you’ll never buy, but you probably assume that — unlike your gmail, yahoo, hotmail, or AOL account — this inbox doesn’t include messages that are intended for someone else. Wrong. [More]

Charging Fewer Fees Doesn’t Mean Banks Aren’t Making Billions Of Dollars From Customers

Despite the fact that consumers pay more than $32 billion annually in overdraft fees alone, a new report found that the amount of money banks make off customer-account fees declined for the first time in seven decades. [More]

5 Reasons Why People Still Buy Stuff From Companies They Hate

In an ideal world, there would be ample, healthy competition in every industry and consumers everywhere would have access to these numerous options. Additionally, every company would behave ethically and efficiently, respecting consumers and the law. But from what I’ve been told from people familiar with the situation, our world is slightly imperfect and sometimes we end up doing business with companies we’d rather avoid. [More]

3 Things Your ATM Could Soon Be Doing Besides Dispensing Cash

Almost all of the more than 400,000 ATMs in the U.S. are used for the most basic of banking purposes — withdrawing cash and making deposits. But fewer people are using cash and it’s now often easier to deposit a check (in those rare instances when you receive one) via smartphone than it is to trek to the ATM. In order for the machines to survive (and someday play their part in the inevitable robot uprising), they must diversify. [More]

More Consumers Open To Banking Without Traditional Banks

Is the future of banking not at banks? That might not seem too unrealistic, what with the rise in prepaid debit cards and the high number of consumers who are unable to obtain traditional banking products. [More]

Banks Turning To Interactive ATMs To Reconnect Customers With Tellers

Depositing a check, transferring funds between bank accounts and withdrawing cash used to entail a drive to the bank and sometimes a long wait in line to see a teller. Today, with the advent of mobile banking consumers rarely have to come face-to-face with another human being. But the newest development in banking aims to reconnect consumers with the teller, kind of. [More]

Bank Of GameStop Is The Best Or Worst Idea Ever

When you need a place to stash your money that isn’t a shoebox under the bed, it can be hard to find a good option. Minimum balance requirements, fees for the privilege of having an account…it’s all very complicated, especially if you don’t have a lot of money to deposit. Simplify things by joining the First National Bank of GameStop. [More]

A Whole New Meaning To Mobile Banking: T-Mobile Announces Money Management Service

Don’t like going to the bank? Aren’t interested in fees or maintaining a minimum balance? Not to worry, there’s a new service just for you. That is if you’re a T-Mobile customer. The company just announced it’s heading into the banking industry. [More]

Is Voice-Recognition The Future Of Banking? Wells Fargo Thinks So

Who needs to go to the bank when you have a smartphone. Unless you really want to talk to a living, breathing person, you might not have to trek to the bank in the future. That’s because some banks are looking to add voice-recognition technology to their mobile banking repertoire. [More]

Wells Fargo Employees Say Threat Of Being Fired Leads To Bad Behavior

A few months back, we told you about the 30 Los Angeles-area Wells Fargo employees who became former Wells Fargo employees when it was discovered they were opening bogus accounts to meet the bank’s demanding sales goals. According to a new investigative report on the megabank, Wells workers around the country are feeling pressured into behaving unethically just to avoid being fired. [More]

Will Banks Of The Future Lack Tellers?

How many times have you walked into a bank branch and done business with a teller recently? Between using ATMs to make deposits and withdraw cash and getting direct deposit from your workplace, the answer is probably “not all that many.” The bank PNC looks at customers like you and sees the future. A future without traditional teller windows. [More]

Is A “Cardless” ATM Any Better Or Faster Than What We’re Used To?

The idea sounds kind of neat — you go into an app on your smartphone, pre-order the amount of cash you’ll want to pick up from the ATM at a later point, then it’s waiting for you when you arrive. So-called cardless ATMs are being tested and some are touting the technology as the future of banking, but is it really that much of an improvement over the current system? [More]

Coming Soon: Withdraw Prepaid Debit Cards From The Nearest ATM

The automated teller machine is now ubiquitous and can perform most of the functions you would visit a bank branch for: withdrawing cash, transferring money, making deposits. One thing that has really never changed about ATMs is what they dispense. Cash is cash: untraceable, lightweight, and nobody charges you any fees to use it. How boring and unprofitable. [More]

Capital One Android App Traps My Phone In Infinite Updateless Loop

David’s Android smartphone, a Galaxy S, is still working just fine. It just has one problem: he can’t upgrade it to a newer version of the Android operating system. He’s stuck on 2.2. So what? It doesn’t affect him all that much except for how his bank’s app requires a newer version of Android than that. His phone gets stuck in a loop of being unable to update. [More]

How I Stopped Rationalizing And Left Wells Fargo Behind For A Local Bank

Chris happened to live in Minnesota when he opened his first bank account at age 18, and went with Wells Fargo. They were everywhere, convenient, and the rest of his family were all signing up with them too. Shrug – why not? He stuck with them for more than a decade. He moved around the continent and a lot of things changed through his twenties, but his Wells Fargo account was a constant. Sometimes it was a little inconvenient, but he stuck with them out of habit. Until his balance fell low enough that they began charging him fees for the privilege of being their customer. It took him less than an hour to switch everything over to a local bank that isn’t fee-happy. Why, he wonders, did he stick with Big Stagecoach for so long? [More]

Reforms Needed To Keep Consumers From Being Trapped In Their Old Bank Accounts

It’s been nearly a year since the first Bank Transfer Day, when people around the country ditched fee-laden accounts in favor of more consumer-friendly institutions, and yet many bank customers still find roadblocks that keep them from easily jumping ship from one bank to another. [More]