Hope you’ve got your space car ready or at the very least, your walking shoes laced up because you’ll no longer be able to drive up to many Bank of America drive-through teller lanes. Branches from Georgia to Texas have already closed their drive-up bank teller services, a spokeswoman said, although it’s unclear how many have been shuttered. [More]

bank of america

Bank Of America Closing Some Drive-Up Tellers Because We’ll All Have Space Cars Soon, Anyway

Bank Of America Continues Deducting Fees, Even After Death

Perhaps showing its firm belief in the afterlife, Bank of America has continued to charge fees to the bank account of a man it knows died nearly half a year ago. [More]

DOJ Sues Bank of America For Lying About Sketchy Mortgage-Backed Securities

Even though Bank of America execs appear to have avoided criminal prosecution for their part in the recent economic collapse, BofA continues to be slapped upside its head with civil suits for its bad behavior. The latest comes from the U.S. Dept. of Justice, which sued BofA and a number of its affiliates, alleging the defendants misled investors by telling them that mortgage-backed securities were A-OK, when in fact they were more toxic than a house full of lead paint and asbestos. [More]

Bank Of America Won’t Listen? Name-Drop Consumerist

Kyle was having some problems with Bank of America. He decided that his Alaska Airlines credit card was no longer worth the annual fee, so he decided to cancel it. Bank of America didn’t want to let him go. Instead of shutting down the card immediately, they left it open long enough that he got charged the annual fee. It seemed hopeless…until he name-dropped his favorite consumer affairs blog. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Bank Of America Attempts To Discredit Statements Of Former Employees

Last month, it was revealed that six former Bank of America employees and one ex-contractor for the bank, had given sworn statements in a lawsuit filed against BofA, and that these statements painted a picture of a system that deliberately lost mortgage modification paperwork and rewarded staffers for pushing employees into foreclosure. Now BofA has issued a detailed rebuttal of those allegations and why it believes that these statements misrepresent the truth. [More]

Homeowners Accuse Bank Of America Of Racketeering In Lawsuit Over Mortgage Modifications

Following the recent revelations from former Bank of America employees that the nation’s most-hated financial institution allegedly engaged in deliberate schemes to delay and deny mortgage modifications, a group of three homeowners have sued BofA, alleging violations of federal anti-racketeering laws. [More]

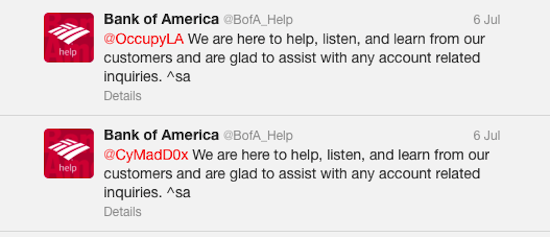

Proof That Bank Of America’s Twitter Account Is Moderated By Robots Or Morons (Or Moronic Robots)

We started the day writing about a Twitter mistake from a company that got all-too-human in its attempt to be funny online. Now comes a story from the other end of the social media idiocy spectrum, with Bank of America’s Twitter ‘bots caught in a loop, confounded that someone would be Tweeting about BofA without actually being a BofA customer. [More]

Jury Finds Bank Of America Protester Not Guilty Of Vandalism For Chalk Drawings Outside BofA Branches

Last week, a San Diego man made headlines when he went on trial to face 13 counts of vandalism related to chalk drawings he’d made on sidewalks outside of Bank of America branches in the area. On Monday afternoon, the jury returned after only a few hours of deliberation with “Not Guilty” verdicts on each count. [More]

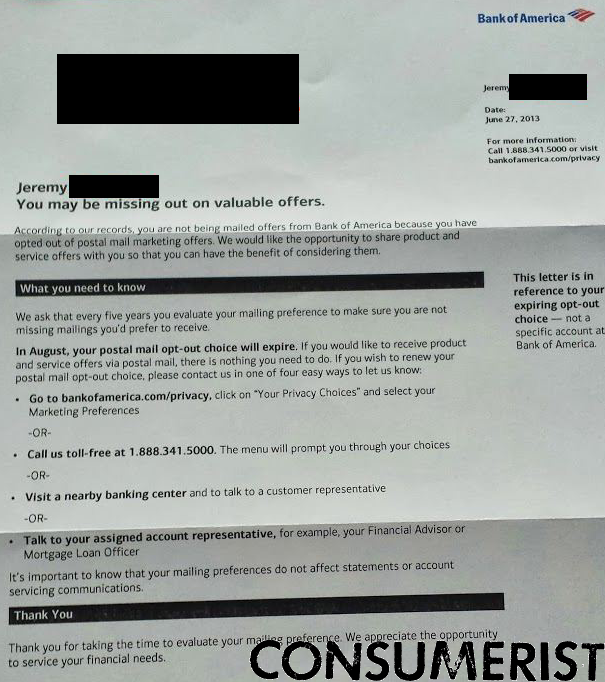

Bank Of America Makes You Opt Out Of Junk Mail Every 5 Years, Even If You Don’t Have An Account

When you opt out of receiving junk mail from a company, you might think that this is the last time your mailbox will be filled with that particular business’s unsolicited offers. But no, as some companies put time limits on how long you can stop them from wasting time, paper, and money to send you things that go straight into the shredder. [More]

Judge Issues Gag Order In Trial Of Man Accused Of Writing Chalk Messages Outside BofA Branches

As you may have heard, a California man alleged to be a serial graffiti artist faces prison time for scribbling anti-bank messages on the sidewalks outside of three Bank of America branches. The trial began earlier this week and yesterday the judge issued a gag order banning any of the involved parties from speaking to the media — and admonishing San Diego Mayor Bob Filner for chiming in on the topic. [More]

BofA’s Customers Don’t Hate Bank As Much As Non-Customers (But They Aren’t Happy)

It’s no secret that Bank of America is the most-reviled of the nation’s large banks, mostly for its handling of the mortgage mess, including the most recent allegations that it deliberately deceived troubled borrowers in order to nudge them toward foreclosure. But even though BofA’s customers gave it the lowest marks in a new survey of banks’ reputations, those customers don’t hate the bank anywhere near as much as people who have no financial ties to it. [More]

The Bank Of America Account That Refuses To Die

Reader David wants to close his Bank of America account and move on. He was in no hurry: he began the process last spring, and slowly moved regular payments over to an account at a local bank and stopped making deposits in his Bank of America account. He wanted to bring his relationship with the bank to a graceful, amicable close. BoA isn’t interested in an amicable breakup, though. This account simply refuses to close. [More]

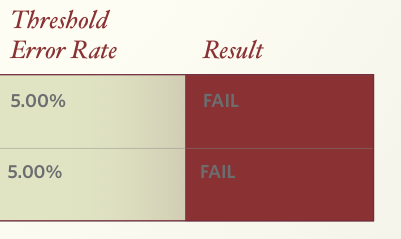

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Former Staffers: Bank Of America Rewarded Us For Lying To Homeowners, Losing Paperwork, Denying Modifications

In sworn statements provided for a lawsuit by homeowners against Bank of America, a half-dozen people who reviewed loan modification applications for BofA say the company encouraged staffers to lose applicants paperwork so that it could later be denied, putting homeowners at further risk of losing their homes. And if these people are to be believed, some folks out there may have lost their homes so that a BofA employee could get a Target gift card. [More]

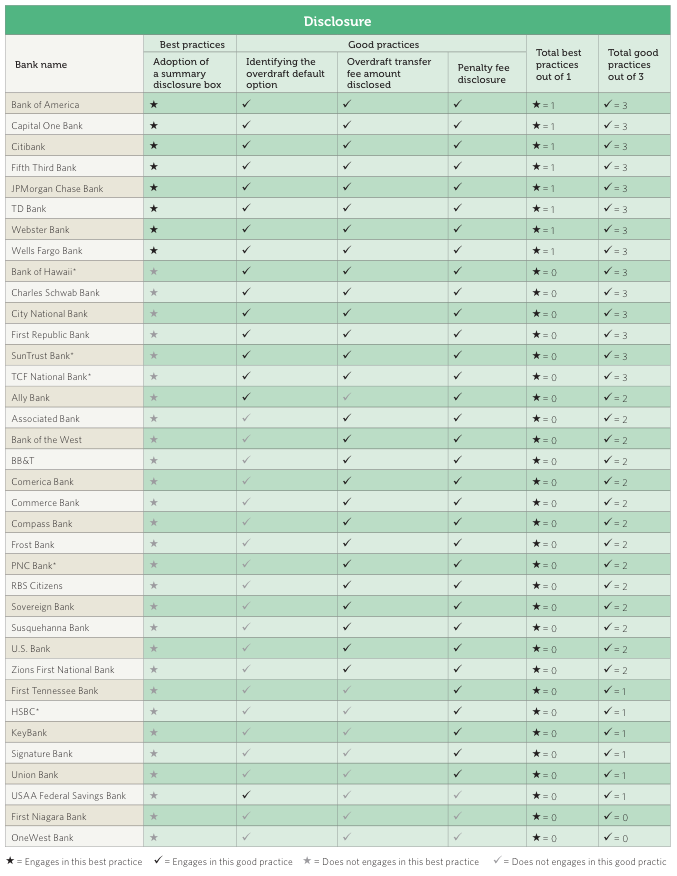

Consumer-Friendly Checking Account Practices Vary Wildly From Bank To Bank

Unless you’ve been hiding under a bed for the last six years, you probably know that the banking industry isn’t exactly beloved by many American consumers. As a reaction to public sentiment (and threats of regulation), a number of banks have begun phasing in some more consumer-friendly practices, but a new study shows these changes are not industry-wide and that several banks are still years behind. [More]

Bank Of America Gives Existing Customers Yet Another Reason To Flee

Many banks offer benefits to account-holders who also have their home loan serviced by the institution. Bank of America has been doing that for years, cutting fees for people with both checking accounts and mortgages. But now BofA has gone and sold off millions of these mortgages to another servicer, starting a countdown clock for account-holders to go elsewhere or likely face new fees. [More]

New York AG To Sue Bank Of America, Wells Fargo Over Alleged Violations Of National Mortgage Settlement

If the big mortgage servicers thought they’d put a pile of legal troubles behind them when they reached the $25 billion dollar National Mortgage Settlement with almost every state in 2012, they were wrong. Today, New York Attorney General Eric Schneiderman announced his intention to sue Bank of America and Wells Fargo for what he alleges is a ” persistent pattern of non-compliance” by the two banks. [More]