In order to get a giant honking bailout from Congress, AIG pledged it would give up executives annual bonuses, but guess what? They found a way to give them anyway.

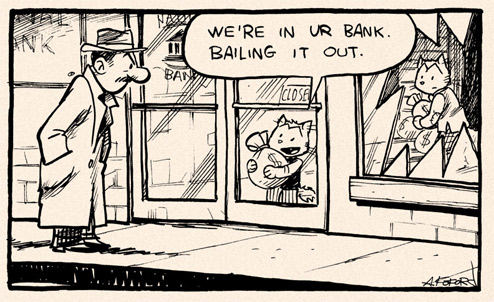

bailouts

US Bails Out Citigroup

Federal regulators took extreme steps to prop up Citigroup, backing $306 billion of mainly real estate loans and securities and directly injecting money by buying $20 billion of preferred stock. The $20 billion of stock will pay an 8% dividend. Regulators will also get an additional $7 billion of preferred stock. Citigroup will basically halt dividend payments for 3 years and limit some executive pay. It will also implement the FDIC’s loan modification plan, which is close to the one it had already announced for itself.

AIG's CEO Issues Statement About $343,000 Phoenix Seminar

Bothered by news reports about another high-priced junket, AIG’s CEO Edward M. Liddy issued a public statement to correct the innacuracies he saw. AIG Media Relations emailed it to us and wanted to make sure we shared it with our readers, and since we’re all about sharing at The Consumerist, here it is:

AIG Spends $343,000 On Secret Seminar

AIG is hurting so bad that we just gave them another $40 billion, while execs live it up at another luxury junket, this one costing $343,000. KNVX uncovered another high-priced conference taking place at the Pointe Hilton Squaw Peak Resort in Phoenix, AZ. They reported that AIG made efforts to disguise its presence, making sure no AIG iconography was out in the open. One hotel employee said that staff was forbidden from even saying the word AIG. AIG said seminars like this, which was for independent financial advisers who steer customers to AIG, are essential to its business. They also said that most of the seminar’s costs would be picked up by other corporate sponsors. AIG said in a statement, “We take very seriously our commitment to aggressively manage meeting costs.”

Banks Using $700 Billion Bailout To Buy Other Banks, Not Make More Loans

Washington told taxpayers a major rationale for us to fork over $700 billion to banks was to save the American economy by making loans more accessible, but it looks like at least at Chase they rather use it to buy other banks, NYT reports.

AIG Has Already Used Up 3/4 Of $123 Billion Bailiout

It’s only been a month, but AIG has already gone through 75% of its $123 billion government bailout. Those golf trips and sea-side hotels sure add up, don’t they? [Washington Post] (Photo: ChristophrHiestr)

Backlash: Outrage Forces AIG To Cancel Second Pricey Hotel Party

AIG has decided to cancel a second pricey hotel party for their brokers after receiving another loan from the Federal Reserve for $37.8 billion dollars. AIG defended throwing a $400,000 week long bash for its top independent insurance agents and some AIG employees immediately after the bailout — claiming that these events were “standard industry practice” and that they must continue. They announced that they would go ahead with another event at the Half Moon Bay Ritz-Carlton in northern California. 50 AIG employees were expected to attend.

../../../..//2008/10/03/the-house-is-entering-its/

The House is entering its final votes on the bailout bill. [NYT]

Bailout Bill Includes Wooden Arrow Tax Break

A repeal of a tax on wooden arrows is but one of the many pork provisions getting tacked onto the bailout bill in order to win support from recalcitrant Congress Critters. So while the world watches and waits for us to rescue the financial system, our elected representatives are holding things up until they can grab their piece of the action. Awesome. This one is even better than the $0.10 Michigan recycling refund. I’ve been trying to crunch the numbers on my wooden arrow business for ages. Finally the margins will work. Full text of the passage, inside. What other fun special-interest pork projects can you find tacked onto this bill? Let us know in the comments.

WaMu And Wachovia Weren't On Texas-Ratio Deathwatch List

Back in July, after IndyMac went under, we posted a list of ten banks that could be “the next to go under.” Interestingly enough, as reader Irene noticed, neither Washington Mutual or Wachovia, two major, sub-prime mortgage saddled, banks that got taken over recently, made the list. The list was based on analyzing the banks’ “Texas-Ratio,” basically the ratio of loans they’ve made to capital they had on hand. None of the banks on the Texas-Ratio watch list, like “The State Bank of Lebo” of Lebo, KS, or “First Priority Bank” of Bradenton, FL, can be found on another list either: the list of banks you’ve heard talked about in the news. Well here’s a newsflash that the media elite passed over while buffing their loafers with their fancy college degrees: The State Bank of Lebo now has an ATM. It’s inside Casey’s General Store. Put that in your pipe and smoke it!

What Else Can $700 Billion Buy?

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

Bush Signs Massive Mortgage Relief Bill

President Bush signed a massive mortgage relief bill that will help hundreds of thousands of homeowners refinance their unaffordable mortgages into fixed rate government backed loans rather than lose their homes to foreclosure. The bill also put tighter reigns on Freddie and Fannie, says the Associated Press.

Countrywide Gets Another $12 Billion In Bailout Money Financing

Reuters is reporting that Countrywide has announced that it has secured an additional $12 billion in financing to help it hang on through the housing slowdown.